Energy

How Does U.S. Electricity Generation Change Over One Week?

Subscribe to the Decarbonization Channel’s free mailing list for more like this

How Does U.S. Electricity Generation Change in a Week?

This was originally posted on the Decarbonization Channel. Subscribe to the free mailing list to be the first to see graphics related to decarbonization with a focus on the U.S. energy sector.

The U.S. has a dynamic electricity mix, with a range of energy sources generating electricity at different times of the day.

At all times, the amount of electricity generated must match demand in order to keep the power grid in balance, which leads to cyclical patterns in daily and weekly electricity generation.

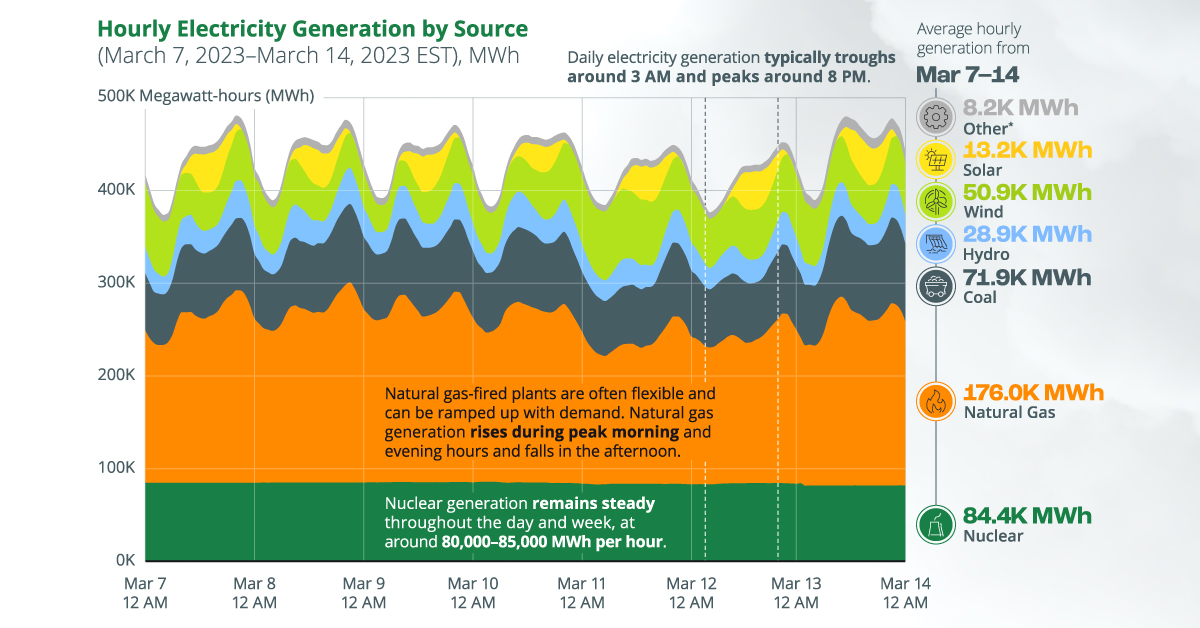

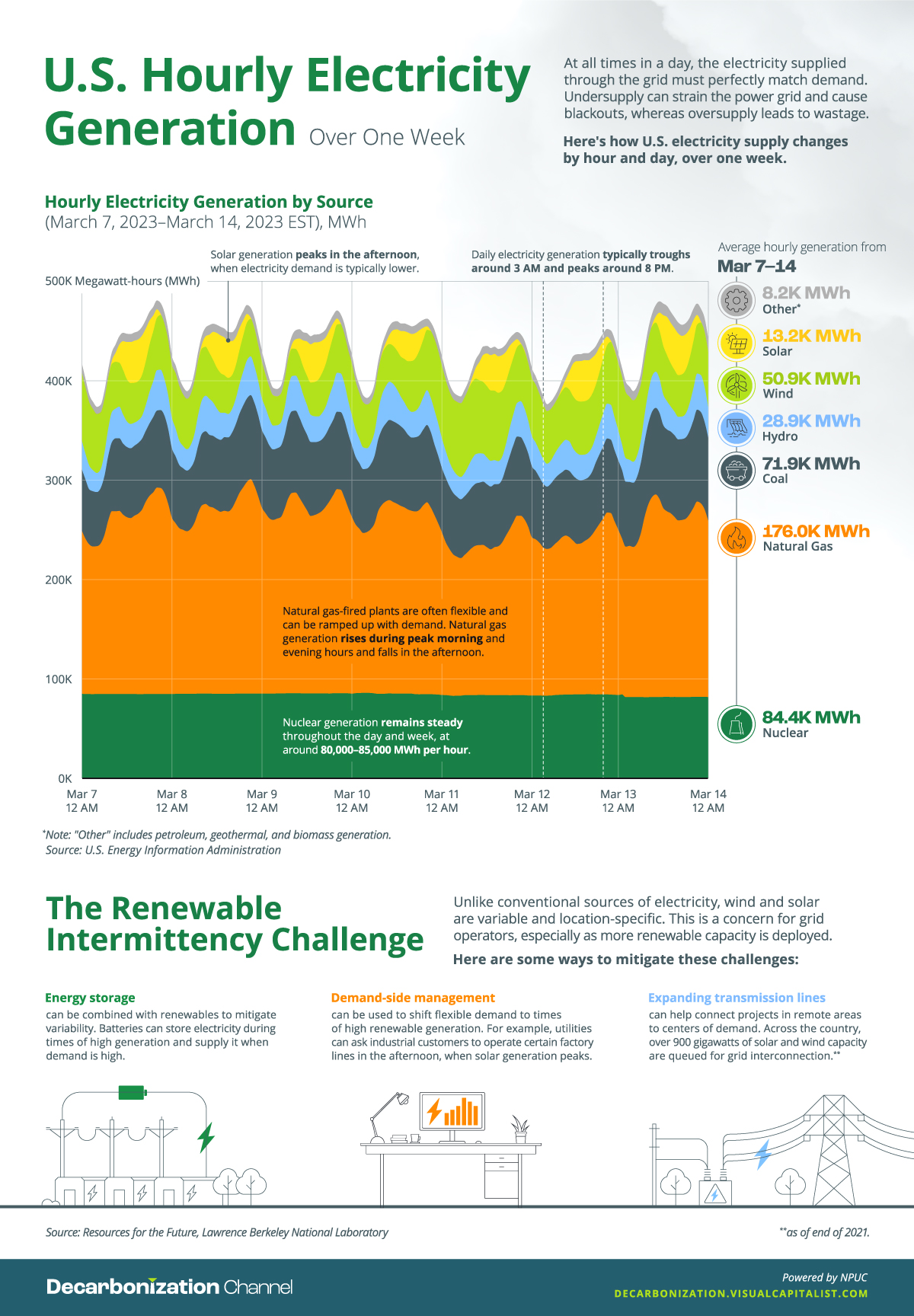

The above graphic tracks hourly changes in U.S. electricity generation over one week, based on data from the U.S. Energy Information Administration (EIA).

The Three Types of Power Plants

Before diving in, it’s important to distinguish between the three main types of power plants in the U.S. electricity mix:

- Base load plants generally run at full or near-full capacity and are used to meet the base load or the minimum amount of electricity demanded at all times. These are typically coal-fired or nuclear power plants. If regionally available, geothermal and hydropower plants can also be used as baseload sources.

- Peak load or peaking power plants are typically dispatchable and can be ramped up quickly during periods of high demand. These plants usually operate at maximum capacity only for a few hours a day and include gas-fired and pumped-storage hydropower plants.

- Intermediate load plants are used during the transitory hours between base load and peak load demand. Intermittent renewable sources like wind and solar (without battery storage) are suitable for intermediate use, along with other sources.

Zooming In: The U.S. Hourly Electricity Mix

With that context, the table below provides an overview of average hourly electricity generation by source for the week of March 7–March 14, 2023, in the Eastern Time Zone.

It’s worth noting that while this is representative of a typical week of electricity generation, these patterns can change with seasons. For example, in the month of June, electricity demand usually peaks around 5 PM, when solar generation is still high, unlike in March.

| Energy Source | Type | Avg. Hourly Electricity Generation, MWh (Mar 07–14, 2023, EST) |

|---|---|---|

| Natural Gas | Fossil fuel | 175,967 |

| Nuclear | Non-renewable | 84,391 |

| Coal | Fossil fuel | 71,922 |

| Wind | Renewable | 50,942 |

| Hydro | Renewable | 28,889 |

| Solar | Renewable | 13,213 |

| Other | Mixed | 8,192 |

Natural gas is the country’s largest source of electricity, with gas-fired plants generating an average of 176,000 MWh of electricity per hour throughout the week outlined above. The dispatchable nature of natural gas is evident in the chart, with gas-fired generation falling in the wee hours and rising during business hours.

Meanwhile, nuclear electricity generation remains steady throughout the given days and week, ranging between 80,000–85,000 MWh per hour. Nuclear plants are designed to operate for long durations (1.5 to 2 years) before refueling and require less maintenance, allowing them to provide reliable baseload energy.

On the other hand, wind and solar generation tend to see large fluctuations throughout the week. For example, during the week of March 07–14, wind generation ranged between 26,875 MWh and 77,185 MWh per hour, based on wind speeds. Solar generation had stronger extremes, often reaching zero or net-negative at night and rising to over 40,000 MWh in the afternoon.

Because wind and solar are often variable and location-specific, integrating them into the grid can pose challenges for grid operators, who rely on forecasts to keep electricity supply and demand in balance. So, what are some ways to solve these problems?

Solving the Renewable Intermittency Challenge

As more renewable capacity is deployed, here are three ways to make the transition smoother.

- Energy storage systems can be combined with renewables to mitigate variability. Batteries can store electricity during times of high generation (for example, in the afternoon for solar), and supply it during periods of peak demand.

- Demand-side management can be used to shift flexible demand to times of high renewable generation. For instance, utilities can collaborate with their industrial customers to ensure that certain factory lines only run in the afternoon, when solar generation peaks.

- Expanding transmission lines can help connect high-quality solar and wind resources in remote regions to centers of demand. In fact, as of the end of 2021, over 900 gigawatts of solar and wind capacity (notably more than the country’s current renewable capacity) were queued for grid interconnection.

Batteries

Visualized: The Rise of the LFP Battery

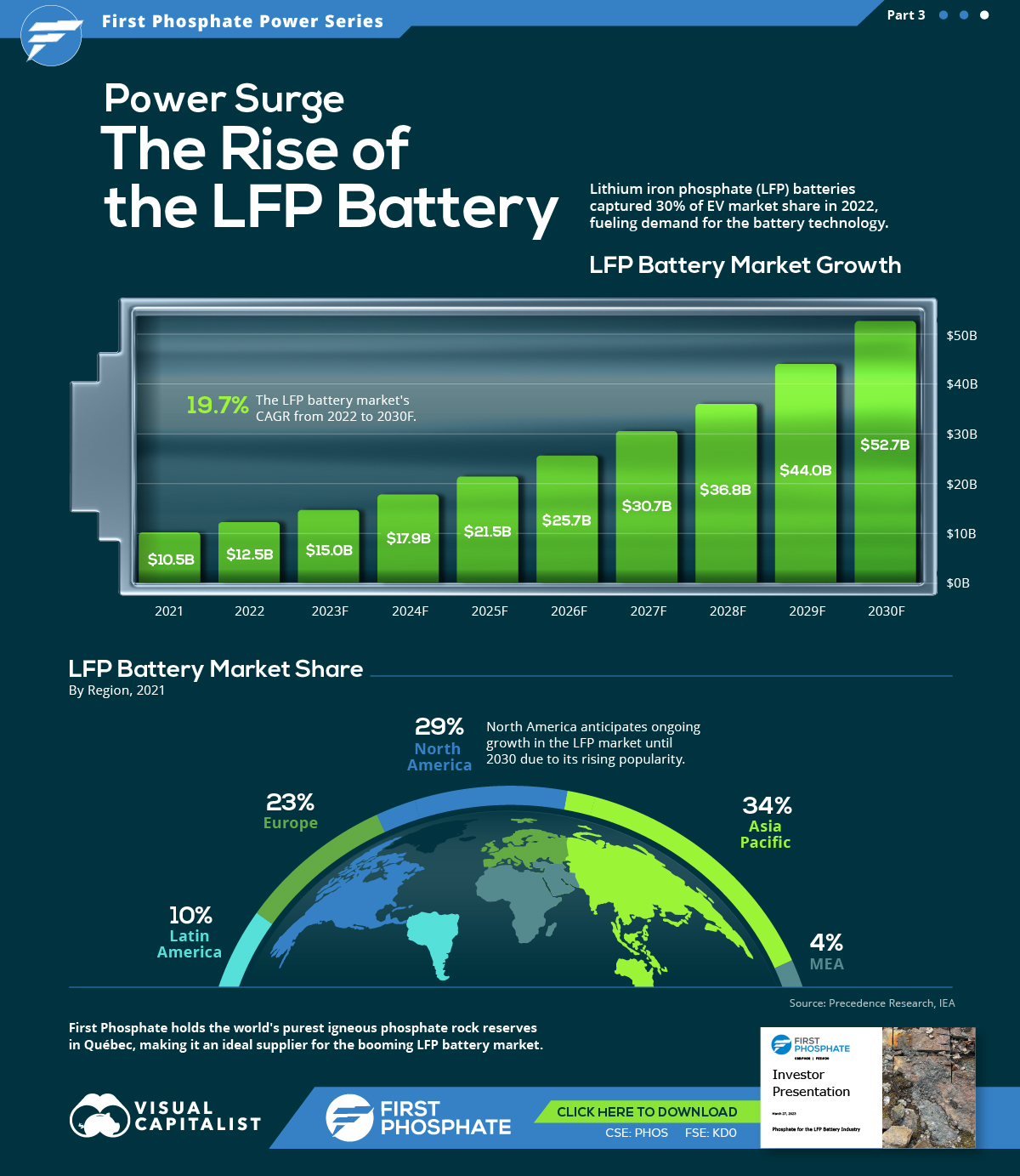

In 2022, the EV sector’s market share of the LFP battery rose from just 6% in 2020 to 30%, highlighting its growing popularity.

The Rise of the LFP Battery

Primarily a key component in fertilizers, phosphate is also essential to lithium iron phosphate (LFP) battery technology.

LFP is an emerging favorite in the expanding EV market, particularly in standard-range EVs. Factors driving this popularity include superior safety, longevity, cost-effectiveness, and environmental sustainability.

In this graphic, our sponsor First Phosphate looks at the growing LFP market, highlighting forecasted growth and current market share.

Market Growth

In 2022, the global LFP battery market stood at $12.5 billion. By 2030, this figure is expected to catapult to nearly $52.7 billion, signifying a CAGR of 19.7%.

| Year | USD (Billion) |

|---|---|

| 2021 | $10.5B |

| 2022 | $12.5B |

| 2023F | $15.0B |

| 2024F | $17.9B |

| 2025F | $21.5B |

| 2026F | $25.7B |

| 2027F | $30.7B |

| 2028F | $36.8B |

| 2029F | $44.0B |

| 2030F | $52.7B |

In 2022, LFP batteries cornered a sizable 30% of the EV market share from just 6% in 2020, demonstrating the growing appeal of this type of lithium-ion battery in the electric vehicle sector.

Market Share

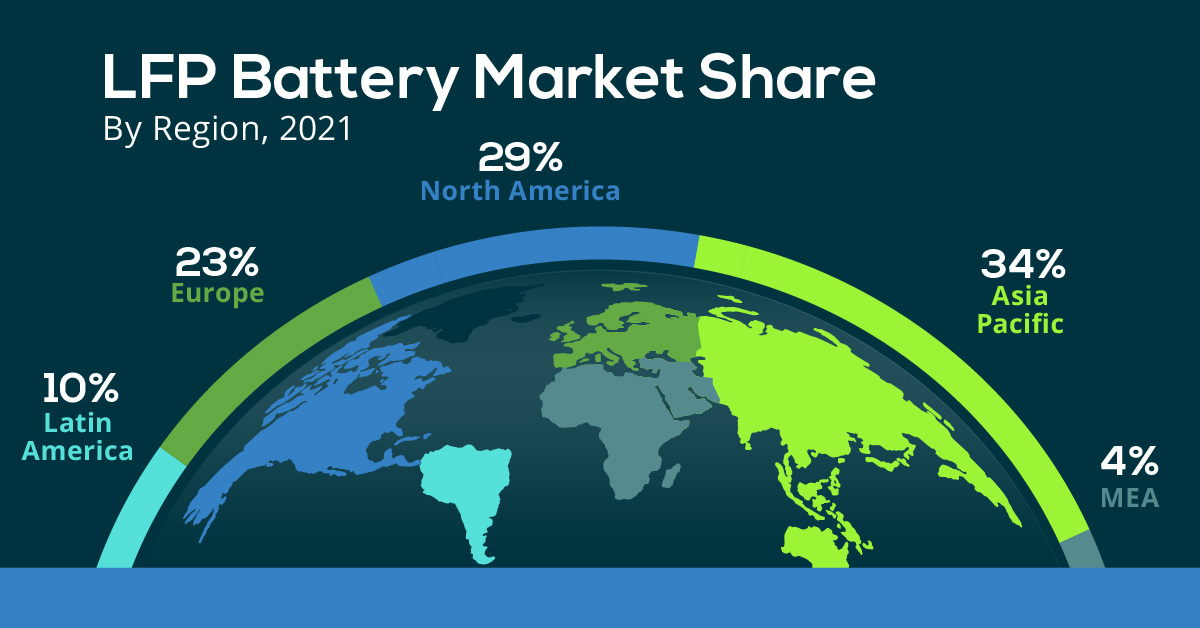

The Asia Pacific region dominated the LFP battery market in 2021, accounting for over 34% of the global share.

| Regions | Revenue Share (%) |

|---|---|

| Asia Pacific | 34% |

| North America | 29% |

| Europe | 23% |

| Latin America | 10% |

| MEA | 4% |

Meanwhile, North America, with the second largest share, is projected to witness ongoing growth through 2030.

First Phosphate holds access to 1% of the world’s purest igneous rock phosphate reserves in Québec, making it an ideal supplier for the growing LFP market.

-

Maps2 months ago

Maps2 months agoMapped: Renewable Energy and Battery Installations in the U.S. in 2023

This graphic describes new U.S. renewable energy installations by state along with nameplate capacity, planned to come online in 2023.

-

Batteries2 months ago

Batteries2 months agoHow EV Adoption Will Impact Oil Consumption (2015-2025P)

How much oil is saved by adding electric vehicles into the mix? We look at data from 2015 to 2025P for different types of EVs.

-

Automotive3 months ago

Automotive3 months agoGlobal EV Production: BYD Surpasses Tesla

This graphic explores the latest EV production data for 2022, which shows BYD taking a massive step forward to surpass Tesla.

-

Batteries6 months ago

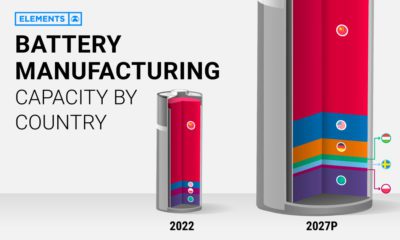

Batteries6 months agoVisualizing China’s Dominance in Battery Manufacturing (2022-2027P)

This infographic breaks down battery manufacturing capacity by country in 2022 and 2027.

-

Batteries7 months ago

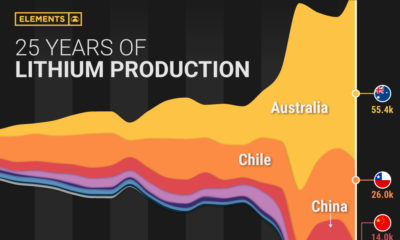

Batteries7 months agoVisualizing 25 Years of Lithium Production, by Country

Lithium production has grown exponentially over the last few decades. Which countries produce the most lithium, and how how has this mix evolved?

-

Energy10 months ago

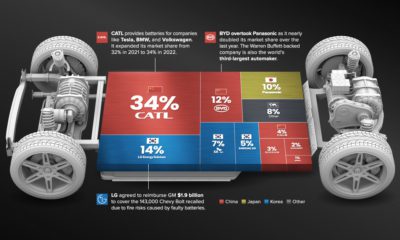

Energy10 months agoThe Top 10 EV Battery Manufacturers in 2022

Despite efforts from the U.S. and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

-

Energy2 weeks ago

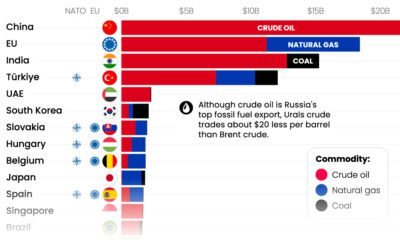

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+4 days ago

VC+4 days agoWhat’s New on VC+ in July

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

Technology2 weeks ago

Technology2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

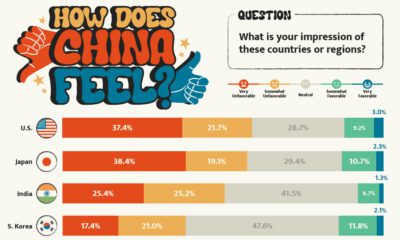

Politics15 hours ago

Politics15 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

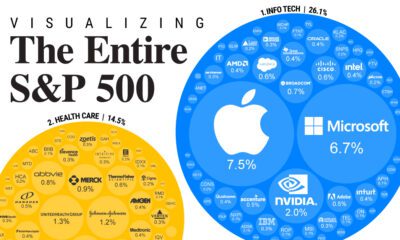

Markets4 weeks ago

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing 1 Billion Square Feet of Empty Office Space

-

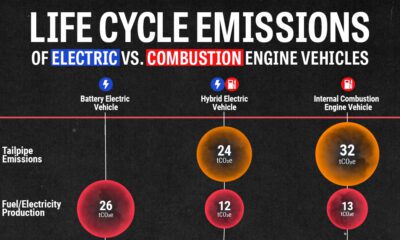

Energy4 weeks ago

Energy4 weeks agoLife Cycle Emissions: EVs vs. Combustion Engine Vehicles