UK Only

Charting the Rise of Cross-Border Money Transfers (2015-2023)

The following content is sponsored by Scottish Mortgage Investment Trust

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

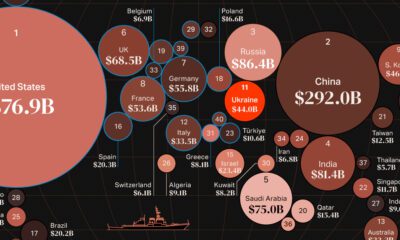

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $447B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

Markets4 weeks ago

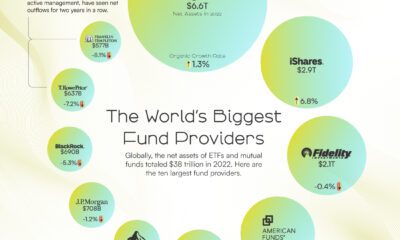

Markets4 weeks agoThe World’s Biggest Mutual Fund and ETF Providers

-

Brands2 weeks ago

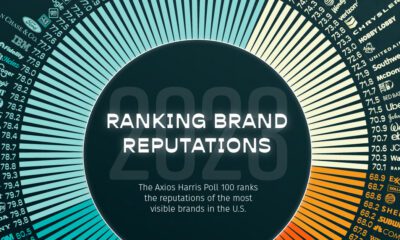

Brands2 weeks agoBrand Reputations: Ranking the Best and Worst in 2023

-

Environment5 days ago

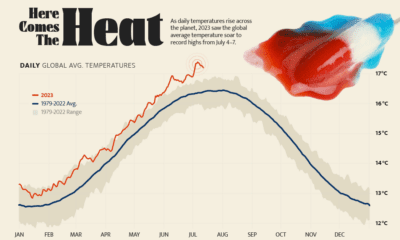

Environment5 days agoHotter Than Ever: 2023 Sets New Global Temperature Records

-

Datastream4 weeks ago

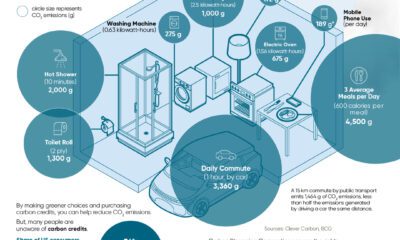

Datastream4 weeks agoCan You Calculate Your Daily Carbon Footprint?

-

Energy2 weeks ago

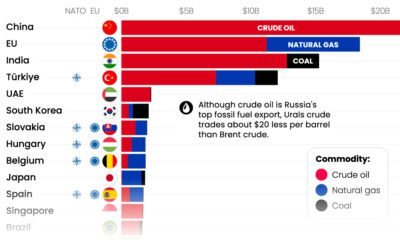

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+4 days ago

VC+4 days agoWhat’s New on VC+ in July

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

Technology2 weeks ago

Technology2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share