Economy

Visualizing the Link Between Unemployment and Recessions

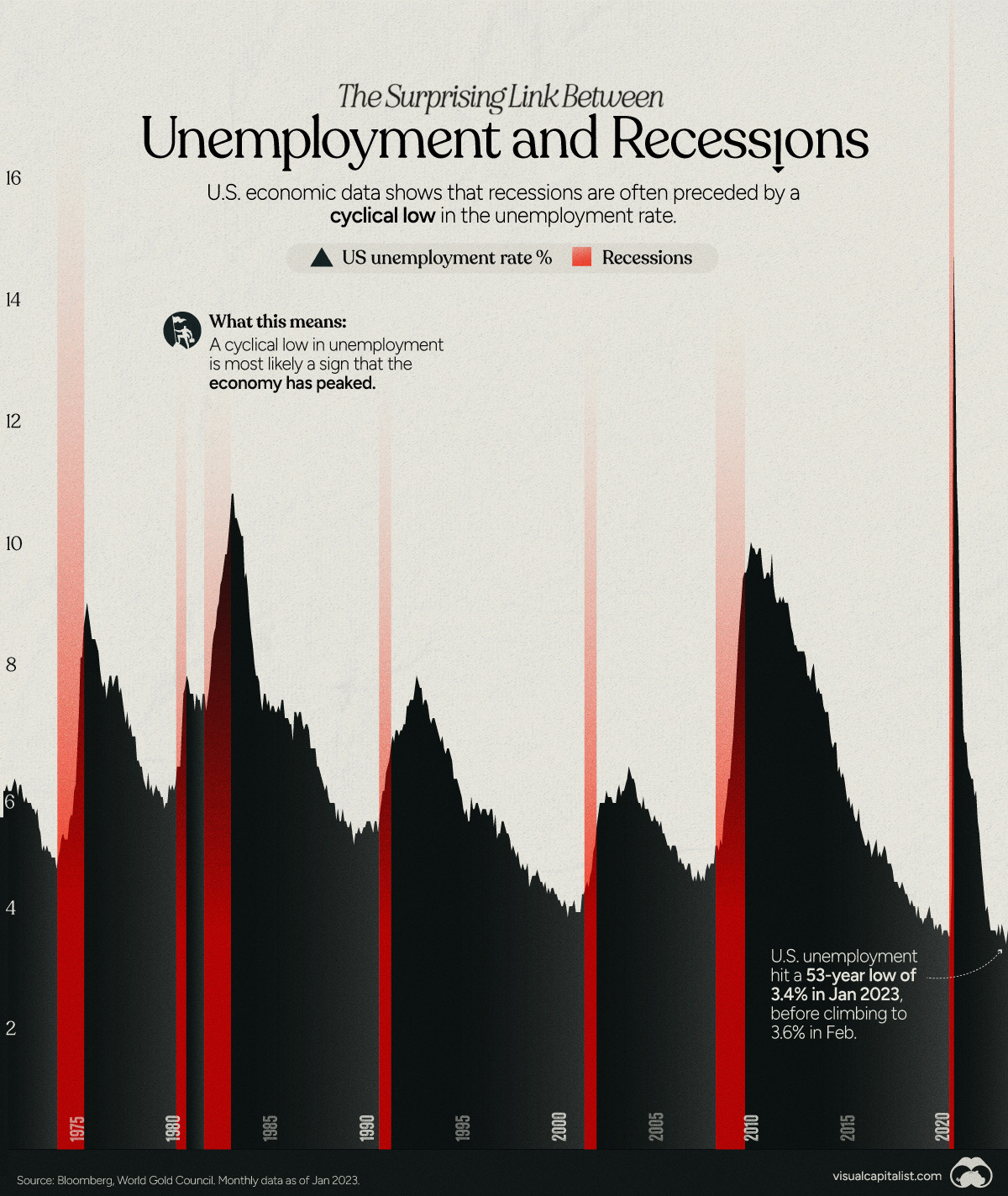

The Surprising Link Between Unemployment and Recessions

The U.S. labor market is having a strong start to 2023, adding 504,000 nonfarm payrolls in January, and 311,000 in February.

Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%.

A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement:

You don’t have a recession when you have 500,000 jobs and the lowest unemployment rate in more than 50 years

While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession.

This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter).

With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation.

For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022.

The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make.

Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation.

More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession.

According to the Fed’s own report, if you continue raising interest rates as you plan, unemployment will be 4.6% by the end of the year.

– Elizabeth Warren

Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes.

Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.

Politics

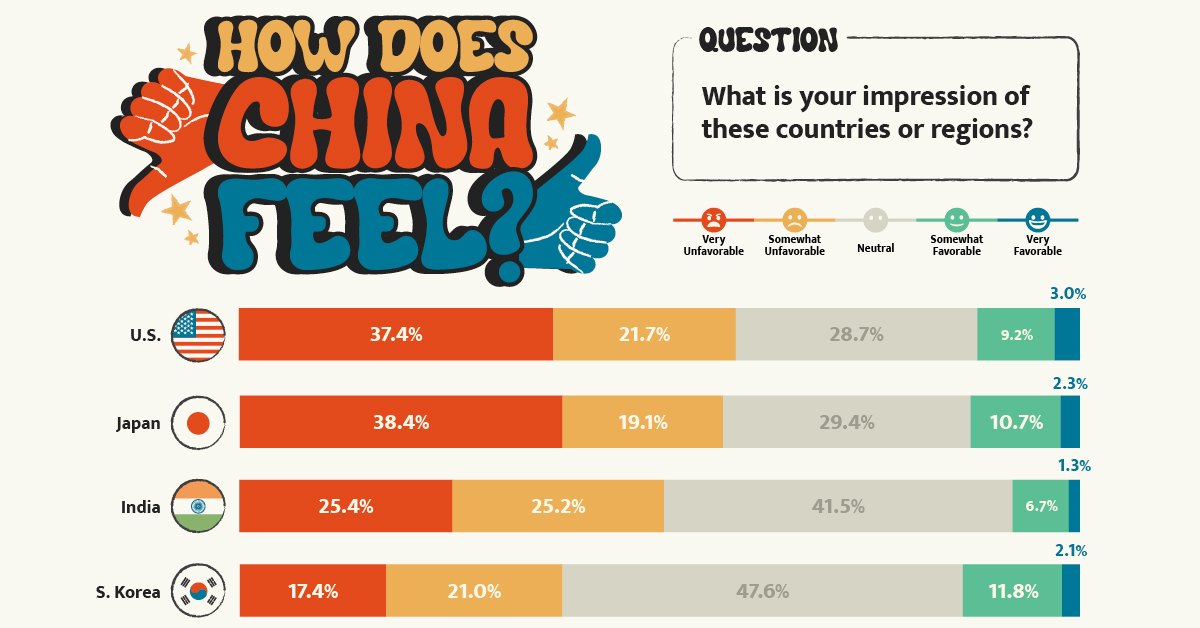

How Do Chinese Citizens Feel About Other Countries?

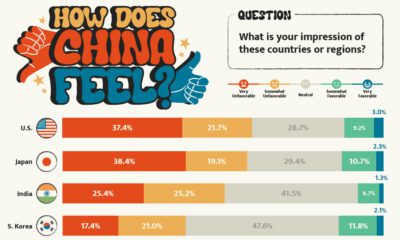

What is the Chinese public’s view of world powers? This visual breaks down Chinese sentiment towards other countries.

Public Opinion: How Chinese Citizens Feel About Other Countries

Tensions over Taiwan, the COVID-19 pandemic, trade, and the war in Ukraine have impacted Chinese sentiment towards other countries.

This visualization uses data from the Center for International Security and Strategy (CISS) at Tsinghua University to rank survey responses from the Chinese public on their attitudes towards countries and regions around the world.

Chinese Sentiment Towards Other Countries in 2023

In the Center’s opinion polls, which surveyed a random sample of more than 2,500 Chinese mainland adults in November 2022, Russia came out significantly ahead.

Just under 60% of respondents held Russia in a favorable view, with 19% seeing the country as “very favorable.” Contrast that to the mere 12% that viewed the U.S. in a positive light.

Here’s a closer look at the data. The percentages refer to the share of respondents that voted for said category.

| Country/Region | Very Unfavorable | Somewhat Unfavorable | Neutral | Somewhat Favorable | Very Favorable |

|---|---|---|---|---|---|

| 🇺🇸 United States | 37.4% | 21.7% | 28.7% | 9.2% | 3.0% |

| 🇯🇵 Japan | 38.4% | 19.1% | 29.4% | 10.7% | 2.3% |

| 🇮🇳 India | 25.4% | 25.2% | 41.5% | 6.7% | 1.3% |

| 🇰🇷 South Korea | 17.4% | 21.0% | 47.6% | 11.8% | 2.1% |

| 🇪🇺 European Union | 9.3% | 15.6% | 57.6% | 14.1% | 3.3% |

| Southeast Asia | 7.1% | 13.1% | 59.5% | 16.8% | 3.5% |

| 🇷🇺 Russia | 3.0% | 4.8% | 33.7% | 39.4% | 19.0% |

Japan ranked just below the U.S. in terms of overall unfavorability, though a slightly higher share of respondents saw Japan as “very unfavorable” compared to America. This is likely due to both modern tensions in the East China Sea over mutually claimed islands and historical tensions over the Sino-Japanese Wars.

Chinese sentiment towards India was also unfavorable at just over 50%, though notably the country also received the lowest favorability rating at just 8%.

Additional Survey Findings

The survey also found that 39% of Chinese people get their information on international security from Chinese state-run media (mainly through TV), with an additional 19% getting information from government websites and official social accounts. Conversely, only 1.7% get their news from foreign websites and foreign social media, partially due to the Great Firewall.

When asked about different international security issues, the biggest shares of Chinese citizens ranked the following as their top three:

- Pandemics (12.9%)

- Disputes over territory and territorial waters (12.9%)

- China-U.S. relations (12.0%)

The pandemic’s high score reflects the harsher impact COVID-19 had on China. Chinese borders were shut for years and the public faced intense measures to reduce spread.

In terms of other world events, the majority of Chinese people align with a more “Eastern” viewpoint. For example, in regards to the war in Ukraine, the report found that:

“About 80 percent of the respondents believe the U.S. and Western countries should be held most accountable [for the war], while less than ten percent of the respondents argue that Russia is mainly responsible.”– Center for International Security and Strategy, Tsinghua University

Overall, the views of the Chinese public reflect the opposite of those found in many Western countries. They provide an important insight that it is not just the Chinese government holding particular views about the world, but the Chinese public as well.

-

Green5 days ago

Green5 days agoHotter Than Ever: 2023 Sets New Global Temperature Records

-

Datastream4 weeks ago

Datastream4 weeks agoCan You Calculate Your Daily Carbon Footprint?

-

Energy2 weeks ago

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+4 days ago

VC+4 days agoWhat’s New on VC+ in July

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

Technology2 weeks ago

Technology2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

Politics15 hours ago

Politics15 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

Markets4 weeks ago

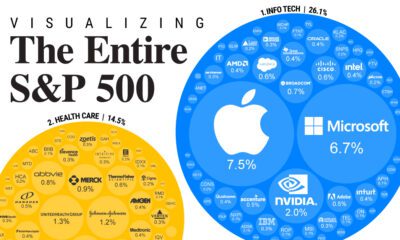

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index