Money

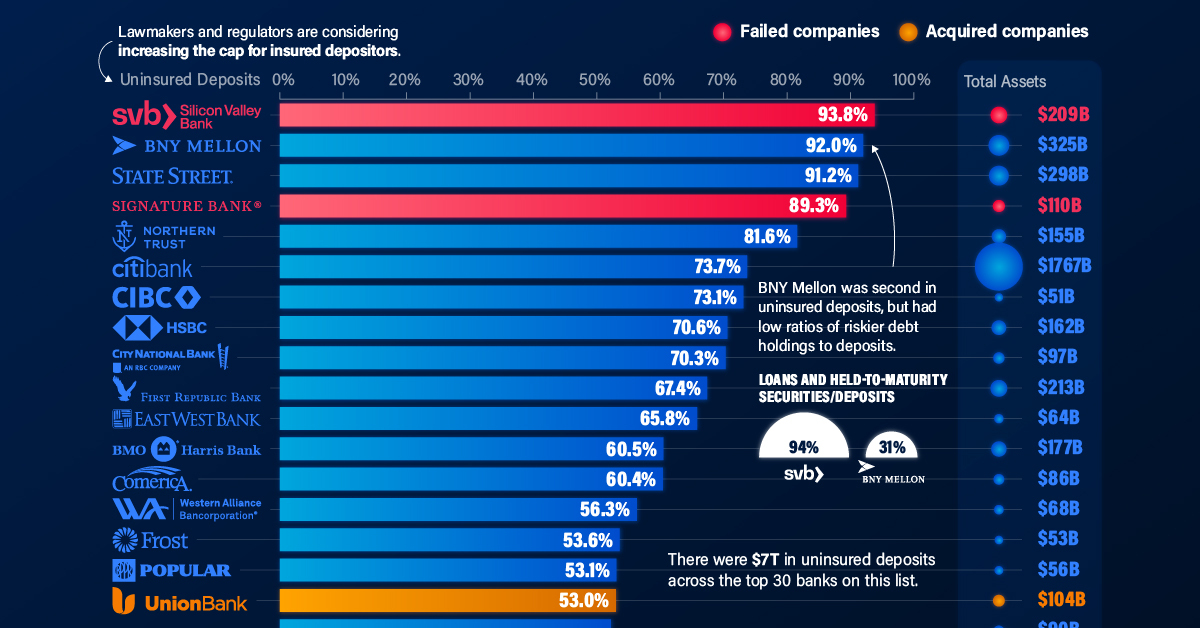

Ranked: The U.S. Banks With the Most Uninsured Deposits

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

The U.S. Top Banks by Uninsured Deposits

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

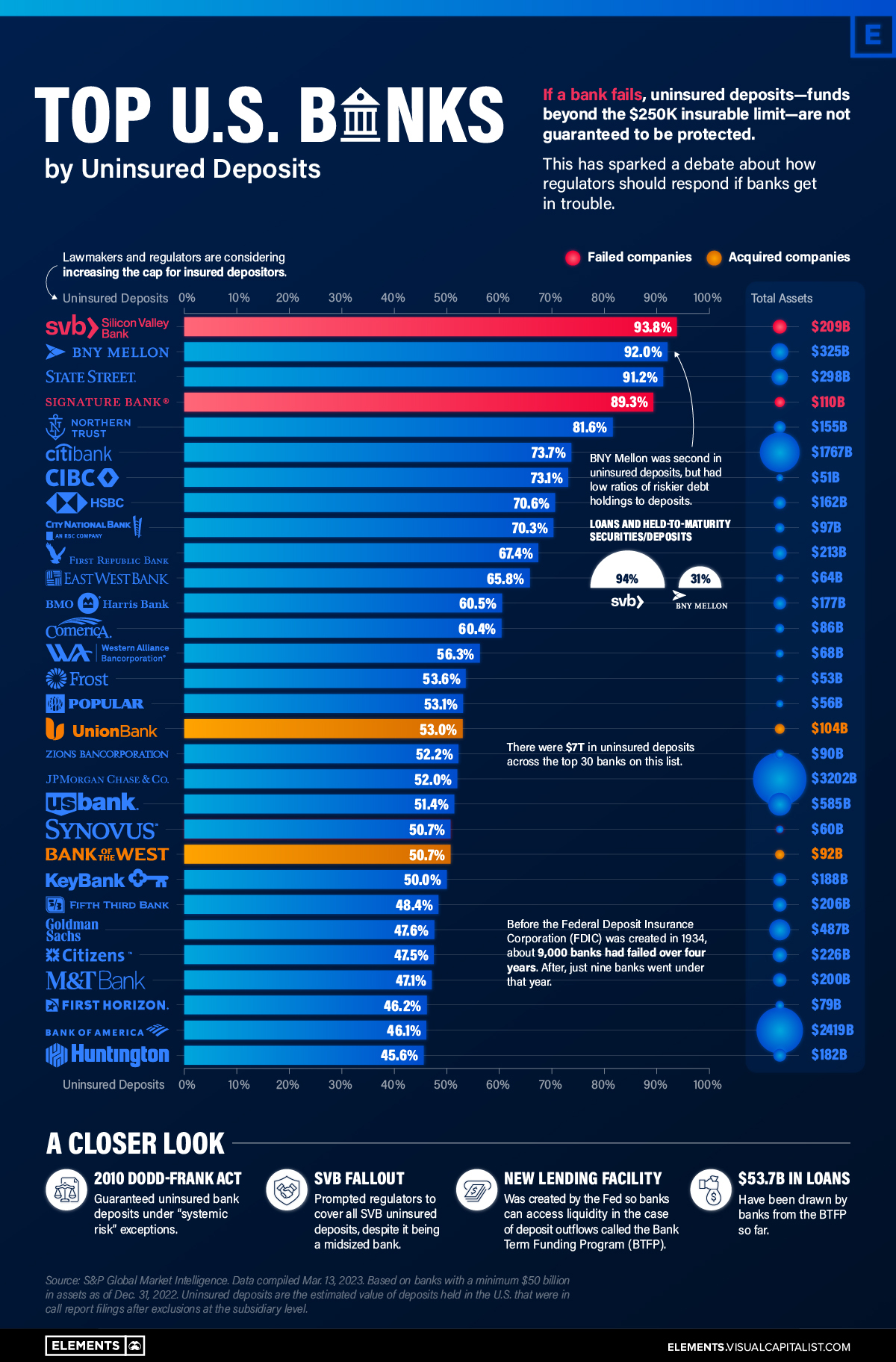

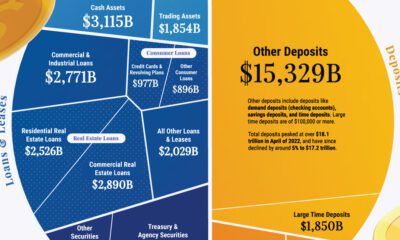

Today, there is at least $7 trillion in uninsured bank deposits in America.

This dollar value is roughly three times that of Apple’s market capitalization, or about equal to 30% of U.S. GDP. Uninsured deposits are ones that exceed the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC), which was actually increased from $100,000 after the Global Financial Crisis. They account for roughly 40% of all bank deposits.

In the wake of the Silicon Valley Bank (SVB) fallout, we look at the 30 U.S. banks with the highest percentage of uninsured deposits, using data from S&P Global.

Which Banks Have the Most Uninsured Deposits?

Over the last month, SVB and Signature Bank went under at lightning speed.

Below, we show how their level of uninsured deposits compare to other banks. The dataset includes U.S. banks with at least $50 billion in assets at the end of 2022.

| Top 30 Rank | Bank | Uninsured Deposits (%) | Total Assets (B) |

|---|---|---|---|

| 1 | Silicon Valley Bank* | 93.8 | $209 |

| 2 | Bank of New York Mellon | 92.0 | $325 |

| 3 | State Street Bank and Trust Co. | 91.2 | $298 |

| 4 | Signature Bank* | 89.3 | $110 |

| 5 | Northern Trust Co. | 81.6 | $155 |

| 6 | Citibank NA | 73.7 | $1,767 |

| 7 | CIBC Bank USA | 73.1 | $51 |

| 8 | HSBC Bank USA NA | 70.6 | $162 |

| 9 | City National Bank | 70.3 | $97 |

| 10 | First Republic Bank | 67.4 | $213 |

| 11 | East West Bank | 65.8 | $64 |

| 12 | BMO Harris Bank NA | 60.5 | $177 |

| 13 | Comerica Bank | 60.4 | $86 |

| 14 | Western Alliance Bank | 56.3 | $68 |

| 15 | Frost Bank | 53.6 | $53 |

| 16 | Banco Popular de Puerto Rico | 53.1 | $56 |

| 17 | MUFG Union Bank NA** | 53.0 | $104 |

| 18 | Zions Bancorp. NA | 52.2 | $90 |

| 19 | JPMorgan Chase Bank NA | 52 | $3,202 |

| 20 | U.S. Bank NA | 51.4 | $585 |

| 21 | Synovus Bank | 50.7 | $60 |

| 22 | Bank of the West** | 50.7 | $92 |

| 23 | KeyBank NA | 50.0 | $188 |

| 24 | Fifth Third Bank NA | 48.4 | $206 |

| 25 | Goldman Sachs Bank USA | 47.6 | $487 |

| 26 | Citizens Bank NA | 47.5 | $226 |

| 27 | Manufacturers and Traders Trust Co. | 47.1 | $200 |

| 28 | First Horizon Bank | 46.2 | $79 |

| 29 | Bank of America NA | 46.1 | $2,419 |

| 30 | Huntington National Bank | 45.6 | $182 |

*Failed banks. **Acquired banks.

Bank of New York (BNY) Mellon and State Street Bank are the active banks with the highest levels of uninsured deposits. They are the two largest custodian banks in the U.S., followed by JP Morgan. Custodian banks provide critical infrastructure in the financial system, holding assets for safe-keeping for investment managers and transferring assets, among other duties.

Both BNY Mellon and State Street are considered “systemically important” banks.

Where these banks differ from SVB is that their loans and held-to-maturity securities as a percentage of total deposits are much lower. While these loans made up over 94% of SVB’s deposits, they made up 31% of BNY Mellon’s and 40% of State Street Bank’s deposits, respectively.

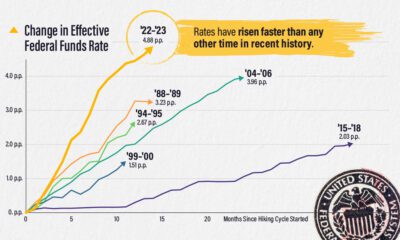

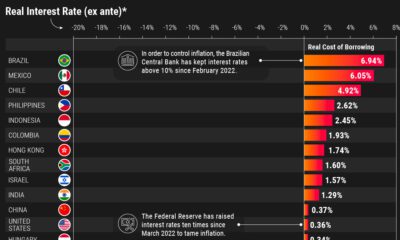

Held-to-maturity securities pose a greater risk to banks. Many of these holdings have lost value since interest rates have risen at a sharp clip. This presents interest-rate risks to banks. Consider how the value of long-term U.S. Treasurys declined about 30% in 2022. In this way, if a bank sells these assets before they mature, they take on a steep loss.

Overall, 11 banks on this list have loans and held-to-maturity assets that are over 90% of their total value of deposits.

Backstop Measures

To prevent wider ramifications, regulators implemented emergency actions. This was done by protecting all deposits of SVB and Signature Bank days after they announced failure.

The Fed also set up an emergency lending facility for banks. This Bank Term Funding Program (BTFP) was created to provide additional funding for banks if depositors pulled their money. It was also set up to prevent banks from interest-rate risk.

So far, more than $50 billion in loans have been withdrawn from the BTFP, up from $11.9 billion in its first week. (The Federal Reserve updates these numbers on a weekly basis.) This has led the Fed’s balance sheet to once again tick higher after slowly declining with the introduction of quantitative tightening in 2022.

Between a Rock and a Hard Place

What does this mean for the U.S. banking system, and what are the implications for depositors and the broader financial system?

On the one hand, the Fed may have had no other option than to save the banks.

“The way the world is, the government had no alternative but to back all deposits. Or we would have had the biggest goddamn bunch of bank runs you ever saw.”

-Charles Munger

The bigger problem is that it introduces new risk into the system. If market participants expect the Fed to always come to the rescue, they will likely make less prudent decisions. Beyond this, the ultra-low interest rate environment not only made banks more sensitive to interest-rate risk as rates went up, but it also lowered the cost of risk-taking.

Now, the Fed has said that they could take necessary actions to protect uninsured deposits. How quickly BTFP loans increase in the next few months will be anyone’s guess as clients from smaller banks withdraw funds and send to larger ones or invest in money market funds.

Editor’s note: Not all types of uninsured deposits are created equal. For custodian banks, retail deposits can make up a smaller portion of total deposits while operational deposits comprise a larger share. These types of deposits hold large amounts of funds for other banks for the purposes of custody or clearing and cash management, among other functions. For this reason, they are often considered more stable forms of deposits.

War

Animated: Change in Russian Billionaires’ Wealth Since 2022

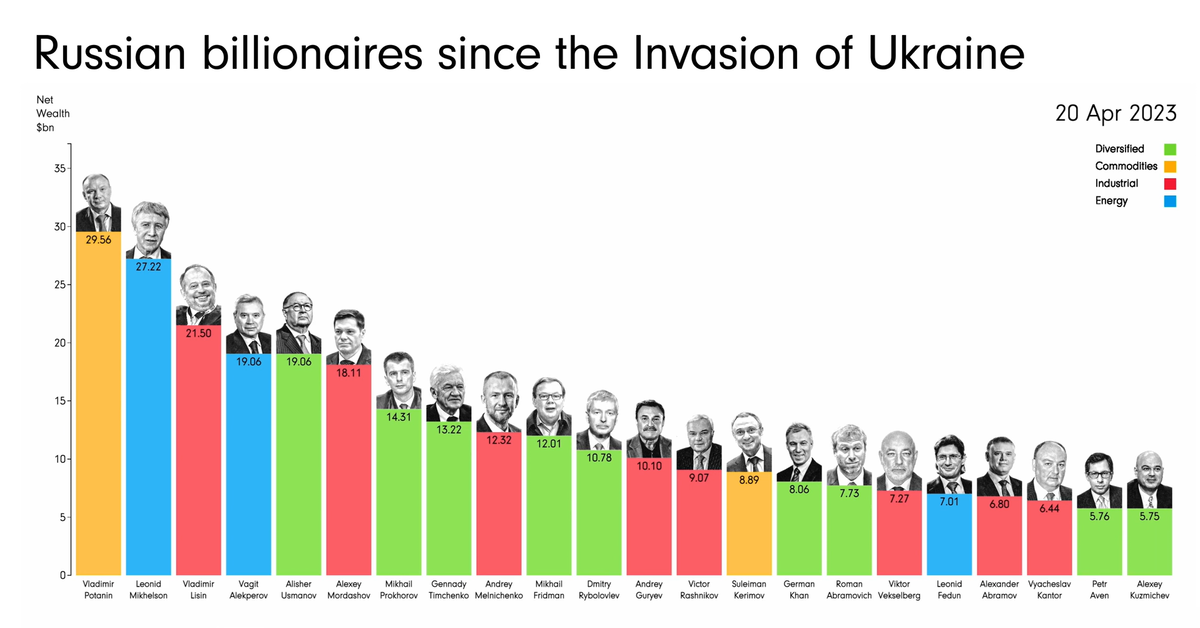

How have Russian billionaires fared since Russia’s invasion of Ukraine? This animation tracks the wealth of 22 Russian billionaires.

Animated: Change in Russian Billionaires’ Wealth Since 2022

When Russia invaded Ukraine in February 2022, many countries retaliated with sanctions targeting Russian billionaires—the oligarchs—and politicians directly.

And as the war has progressed, those sanctions have intensified, with even the relatives and shell companies of these billionaires being targeted over time. The reason? These oligarchs are interconnected to Russia’s government, lending vocal and fiscal support in exchange for sweetheart deals or beneficial government oversight.

This animation from James Eagle shows how the estimated net wealth of the 22 wealthiest Russian billionaires on the Bloomberg Billionaires Index in April 2023 has changed since January 2022, prior to the start of the conflict.

Net Wealth of Top Russian Billionaires

The 22 wealthiest Russian billionaires in April 20, 2023 lost a collective $90.4 billion in net worth since January 5, 2022.

| Rank | Name | Main Industry | Net Wealth (Apr 20, 2023) | Net Wealth (Jan 5, 2022) | % Change |

|---|---|---|---|---|---|

| 1 | Vladimir Potanin | Commodities | $29.6B | $31.1B | -4.8% |

| 2 | Leonid Mikhelson | Energy | $27.2B | $33.2B | -18.1% |

| 3 | Vladimir Lisin | Industrial | $21.5B | $28.0B | -23.2% |

| 4 | Vagit Alekperov | Energy | $19.1B | $22.8B | -16.2% |

| 5 | Alisher Usmanov | Diversified | $19.1B | $21.2B | -9.9% |

| 6 | Alexey Mordashov | Industrial | $18.1B | $29.1B | -37.8% |

| 7 | Mikhail Prokhorov | Diversified | $14.3B | $14.0B | 2.1% |

| 8 | Gennady Timchenko | Diversified | $13.2B | $23.1B | -42.9% |

| 9 | Andrey Melnichenko | Industrial | $12.3B | $17.8B | -30.9% |

| 10 | Mikhail Fridman | Diversified | $12.0B | $14.1B | -14.9% |

| 11 | Dmitry Rybolovlev | Diversified | $10.8B | $11.2B | -3.6% |

| 12 | Andrey Guryev | Industrial | $10.1B | $8.0B | 26.3% |

| 13 | Victor Rashnikov | Industrial | $9.1B | $14.4B | -36.8% |

| 14 | Suleiman Kerimov | Commodities | $8.9B | $15.2B | -41.4% |

| 15 | German Khan | Diversified | $8.1B | $9.6B | -15.6% |

| 16 | Roman Abramovich | Diversified | $7.7B | $18.2B | -57.7% |

| 17 | Viktor Vekselberg | Industrial | $7.3B | $18.6B | -60.8% |

| 18 | Leonid Fedun | Energy | $7.0B | $8.9B | -21.3% |

| 19 | Alexander Abramov | Industrial | $6.8B | $9.1B | -25.3% |

| 20 | Vyacheslav Kantor | Industrial | $6.4B | $9.1B | -29.7% |

| 21 | Petr Aven | Diversified | $5.8B | $6.6B | -12.1% |

| 22 | Alexey Kuzmichev | Diversified | $5.8B | $7.3B | -20.5% |

The heaviest hit include Viktor Vekselberg, who holds a stake in UC Rusal, the world’s third largest aluminum producer. Since the start of the war, he’s lost an estimated $11.3 billion or 61% of his net worth from January 2022.

Roman Abramovich, who got his start in the early oligarchy through oil conglomerates, was also hit hard by the sanctions. He lost $10.5 billion or 58% of his net worth from January 2022, and was forced to sell Chelsea Football Club in one of the biggest sports team sales in history.

Notably, the richest oligarchs haven’t lost as much. Mining giant Norilsk Nickel’s largest shareholder, Vladimir Potanin, saw his net worth only drop by 4.8%. After being hit hard at the onset of the war in Ukraine, he quickly rebounded and at many times had an even higher net worth, reaching $35.6 billion in June 2022.

And a few oligarchs, like former Norilsk Nickel CEO Mikhail Prokhorov and phosphate-based fertilizer baron Andrey Guryev, saw their wealth increase since January 2022. Guryev grew his net worth by $2 billion or 26%, while Prokhorov (who formerly owned the NBA’s Brooklyn Nets) saw his net worth even out at a gain of $0.3 billion or 2%.

Oligarch Support of Russia (or Lack Thereof)

As Russia’s war with Ukraine has dragged on, and sanctions have continued to weigh on Russian billionaires, politicians, and companies, their effects have been uncertain.

Oligarchs have lost net worth, relinquished foreign businesses, and even had prized possessions like mansions and yachts seized. At the same time, though Russia’s economy has weakened under sanctions, bolstered trade with countries like China, India, and Saudi Arabia have kept it stronger than expected.

And though some oligarchs have voiced various concerns over the ongoing war, the wealthiest have been careful to toe the line. Russian billionaires and politicians that did vocalize criticism, including Lukoil chairman Ravil Maganov, have been found dead in apparent suicides, heart attacks, and accidents.

The most serious oligarch rebellion wasn’t due to economic hardships, but military operations. Oligarch and mercenary leader Yevgeny Prigozhin launched an attempted coup in June 2023, reportedly retreating after support from within Russia’s military quickly fizzled.

-

Markets3 weeks ago

Markets3 weeks agoVisualized: The 100 Largest U.S. Banks by Consolidated Assets

-

AI1 week ago

AI1 week agoCharted: Changing Sentiments Towards AI in the Workplace

-

Markets3 weeks ago

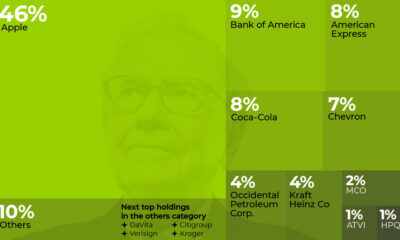

Markets3 weeks agoWhat are Top Investment Managers Holding in Their Portfolios?

-

Markets1 week ago

Markets1 week agoThe 50 Best One-Year Returns on the S&P 500 (1980-2022)

-

United States3 weeks ago

United States3 weeks agoChart: U.S. Home Price Growth Over 50 Years

-

Crime1 week ago

Crime1 week agoMapped: The Most Dangerous Cities in the U.S.

-

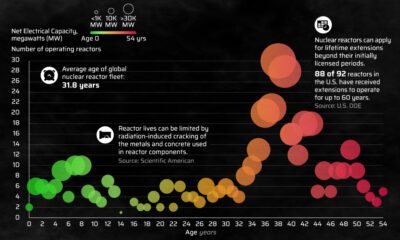

Energy3 weeks ago

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

Countries7 days ago

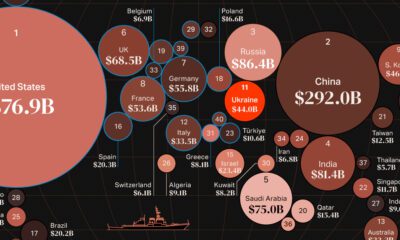

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets

Creator Program

Creator Program