Banks

The World’s Most Powerful Reserve Currencies

The World’s Most Powerful Reserve Currencies

When we think of network effects, we’re usually thinking of them in the context of technology and Metcalfe’s Law.

Metcalfe’s Law states that the more users that a network has, the more valuable it is to those users. It’s a powerful idea that is exploited by companies like LinkedIn, Airbnb, or Uber — all companies that provide a more beneficial service as their networks gain more nodes.

But network effects don’t apply just to technology and related fields.

In the financial sector, for example, stock exchanges grow in utility when they have more buyers, sellers, and volume. Likewise, in international finance, a currency can become increasingly entrenched when it’s accepted, used, and trusted all over the world.

What’s a Reserve Currency?

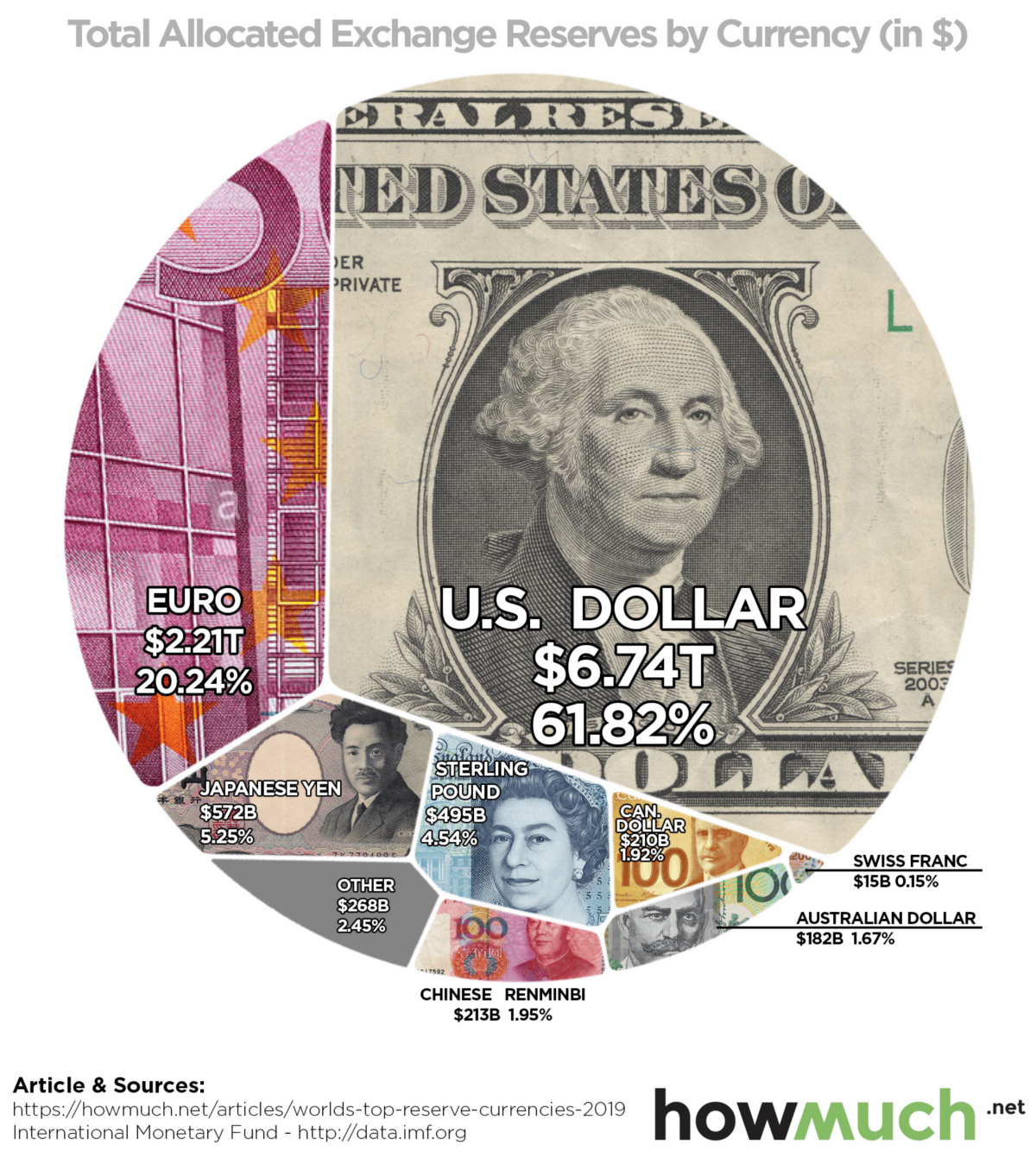

Today’s visualization comes to us from HowMuch.net, and it breaks down foreign reserves held by countries — but what is a reserve currency, anyways?

In essence, reserve currencies (i.e. U.S. dollar, pound sterling, euro, etc.) are held on to by central banks for the following major reasons:

- To maintain a stable exchange rate for the domestic currency

- To ensure liquidity in the case of an economic or political crisis

- To provide confidence to international buyers and foreign investors

- To fulfill international obligations, such as paying down debt

- To diversify central bank portfolios, reducing overall risk

Not surprisingly, central banks benefit the most from stockpiling widely-held reserve currencies such as the U.S. dollar or the euro.

Because these currencies are accepted almost everywhere, they provide third-parties with extra confidence and perceived liquidity. This is a network effect that snowballs from the growing use of a particular reserve currency over others.

Reserve Currencies Over Time

Here is how the usage of reserve currencies has evolved over the last 15 years:

| 🇺🇸 U.S. Dollar | 🇪🇺 Euro | 🇯🇵 Japanese Yen | 🇬🇧 Pound Sterling | 🌐 Other | |

| 2004 | 65.5% | 24.7% | 4.3% | 3.5% | 2.0% |

| 2009 | 62.1% | 27.7% | 2.9% | 4.3% | 3.0% |

| 2014 | 65.1% | 21.2% | 3.5% | 3.7% | 6.5% |

| 2019 | 61.8% | 20.2% | 5.3% | 4.5% | 8.2% |

Over this timeframe, there have been small ups and downs in most reserve currencies.

Today, the U.S. dollar is the world’s most powerful reserve currency, making up over 61% of foreign reserves. The dollar gets an extensive network effect from its use abroad, and this translates into several advantages for the multi-trillion dollar U.S. economy.

The euro, yen, and pound sterling are the other mainstay reserve currencies, adding up to roughly 30% of foreign reserves.

Finally, the most peculiar data series above is “Other”, which grew from 2.0% to 8.4% of worldwide foreign reserves over the last 15 years. This bucket includes the Canadian dollar, the Australian dollar, the Swiss franc, and the Chinese renminbi.

Accepted Everywhere?

There have been rumblings in the media for decades now about the rise of the Chinese renminbi as a potential new challenger on the reserve currency front.

While there are still big structural problems that will prevent this from happening as fast as some may expect, the currency is still on the rise internationally.

What will the composition of global foreign reserves look like in another 15 years?

Banks

Visualized: Real Interest Rates by Country

What countries have the highest real interest rates? We look at 40 economies to analyze nominal and real rates after projected inflation.

Visualized: Real Interest Rates of Major World Economies

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on real assets and resource megatrends each week.

Interest rates play a crucial role in the economy because they affect consumers, businesses, and investors alike.

They can have significant implications for people’s ability to access credit, manage debts, and buy more expensive goods such as cars and houses.

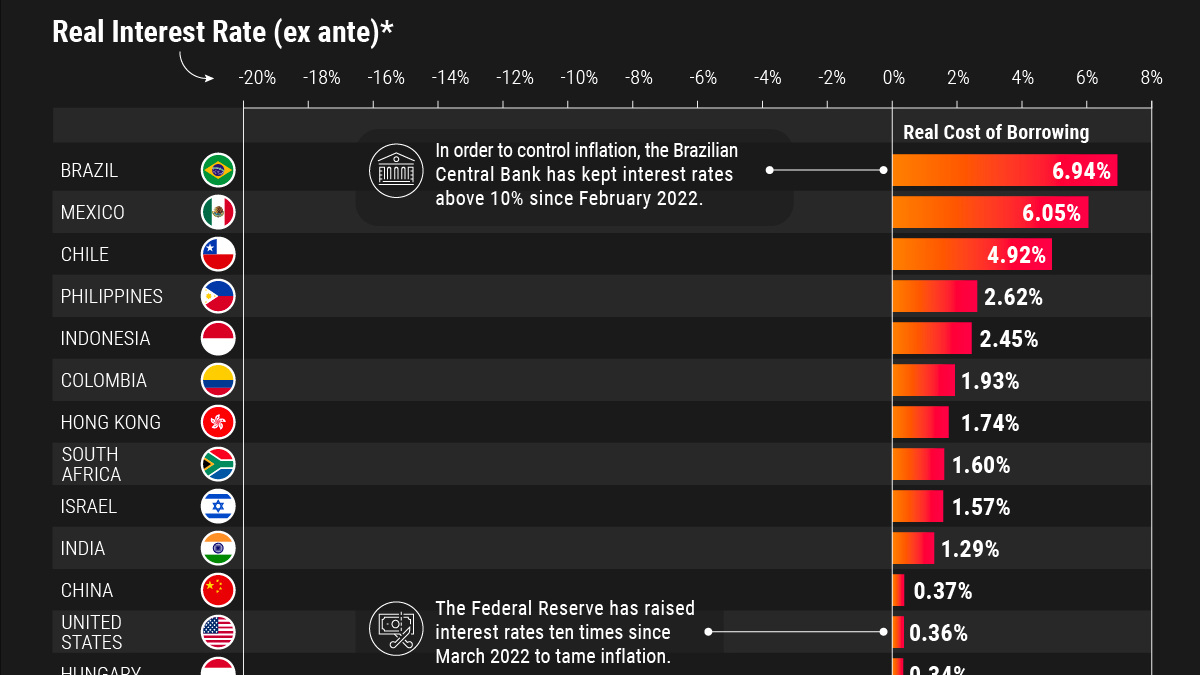

This graphic uses data from Infinity Asset Management to visualize the real interest rates (ex ante) of 40 major world economies, by subtracting projected inflation over the next 12 months from current nominal rates.

Nominal Interest Rates vs. Real Interest Rates

Nominal interest rates refer to the rate at which money can be borrowed or lent at face value, without considering any other factors like inflation.

Meanwhile, the real interest rate is the nominal interest rate after taking into account inflation, reflecting the true cost of borrowing or lending. Real interest rates can fluctuate over time and are influenced by various factors such as inflation, central bank policies, and economic growth. They can also influence economic growth by affecting investment and consumption decisions.

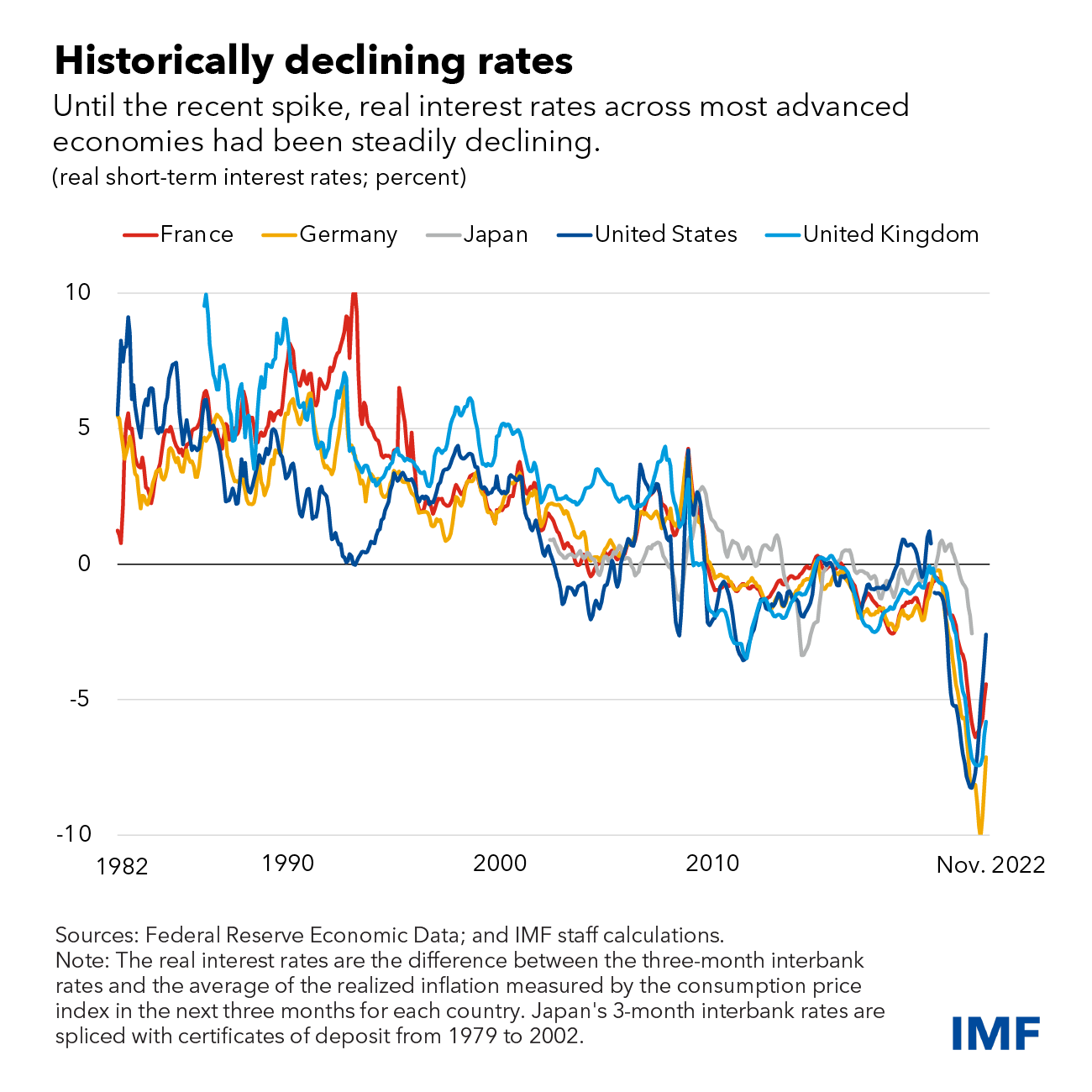

According to the International Monetary Fund (IMF), since the mid-1980s, real interest rates across several advanced economies have declined steadily.

As of March 2023, Brazil has the highest real interest rate among the 40 major economies shown in this dataset.

Below we look at Brazil’s situation, along with the data of the four other major economies with the highest real rates in the dataset:

| Nominal Interest Rate | Real Interest Rate | |

|---|---|---|

| 🇧🇷 Brazil | 13.75% | 6.94% |

| 🇲🇽 Mexico | 11.00% | 6.05% |

| 🇨🇱 Chile | 11.25% | 4.92% |

| 🇵🇭 Philippines | 6.00% | 2.62% |

| 🇮🇩 Indonesia | 5.75% | 2.45% |

In general, countries with high interest rates offer investors higher yields on their investments but also come with higher risks due to volatile economies and political instability.

Below are the five countries in the dataset with the lowest real rates:

| Nominal Interest Rate | Real Interest Rate | |

|---|---|---|

| 🇦🇷 Argentina | 78.00% | -19.61% |

| 🇳🇱 Netherlands | 3.50% | -7.42% |

| 🇨🇿 Czech Republic | 7.00% | -7.17% |

| 🇵🇱 Poland | 6.75% | -6.68% |

| 🇧🇪 Belgium | 3.50% | -6.42% |

Hyperinflation, as seen in Argentina, can lead to anomalies in both real and nominal rates, causing problems for the country’s broader economy and financial system.

As you can see above, with a 78% nominal interest rate, Argentina’s real interest rates remain the lowest on the planet due to a staggering annual inflation rate of over 100%.

Interest Rate Outlook

Increasing inflation and tighter monetary policy have resulted in rapid increases in nominal interest rates recently in many countries.

However, IMF analysis suggests that recent increases could be temporary.

Central banks in advanced economies are likely to ease monetary policy and bring interest rates back to pre-pandemic levels when inflation is brought under control, according to the fund.

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

apps2 weeks ago

apps2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

Politics18 hours ago

Politics18 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

Markets4 weeks ago

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index

-

Markets2 weeks ago

Markets2 weeks agoVisualizing 1 Billion Square Feet of Empty Office Space

-

Environment4 weeks ago

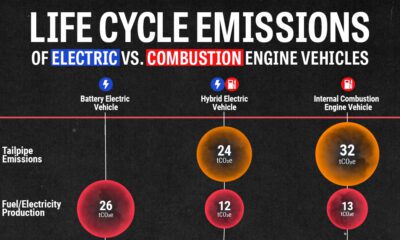

Environment4 weeks agoLife Cycle Emissions: EVs vs. Combustion Engine Vehicles

-

Maps2 weeks ago

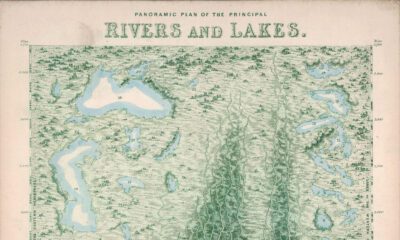

Maps2 weeks agoVintage Viz: The World’s Rivers and Lakes, Organized Neatly

-

Finance3 weeks ago

Finance3 weeks agoVisualized: The 100 Largest U.S. Banks by Consolidated Assets