Energy

The Top 10 EV Battery Manufacturers in 2022

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

The Top 10 EV Battery Manufacturers in 2022

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

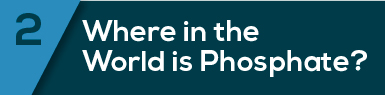

The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028.

With increasing demand to decarbonize the transportation sector, companies producing the batteries that power EVs have seen substantial momentum.

Here we update our previous graphic of the top 10 EV battery manufacturers, bringing you the world’s biggest battery manufacturers in 2022.

Chinese Dominance

Despite efforts from the United States and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

The top 10 producers are all Asian companies.

Currently, Chinese companies make up 56% of the EV battery market, followed by Korean companies (26%) and Japanese manufacturers (10%).

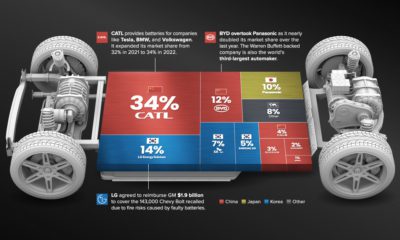

The leading battery supplier, CATL, expanded its market share from 32% in 2021 to 34% in 2022. One-third of the world’s EV batteries come from the Chinese company. CATL provides lithium-ion batteries to Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo.

| Rank | Company | 2022 Market Share | Country |

|---|---|---|---|

| #1 | CATL | 34% | China 🇨🇳 |

| #2 | LG Energy Solution | 14% | Korea 🇰🇷 |

| #3 | BYD | 12% | China 🇨🇳 |

| #4 | Panasonic | 10% | Japan 🇯🇵 |

| #5 | SK On | 7% | Korea 🇰🇷 |

| #6 | Samsung SDI | 5% | Korea 🇰🇷 |

| #7 | CALB | 4% | China 🇨🇳 |

| #8 | Guoxuan | 3% | China 🇨🇳 |

| #9 | Sunwoda | 2% | China 🇨🇳 |

| #10 | SVOLT | 1% | China 🇨🇳 |

| Other | 8% | ROW 🌐 |

Despite facing strict scrutiny after EV battery-fire recalls in the United States, LG Energy Solution remains the second-biggest battery manufacturer. In 2021, the South Korean supplier agreed to reimburse General Motors $1.9 billion to cover the 143,000 Chevy Bolt EVs recalled due to fire risks from faulty batteries.

BYD took the third spot from Panasonic as it nearly doubled its market share over the last year. The Warren Buffett-backed company is the world’s third-largest automaker by market cap, but it also produces batteries sold in markets around the world. Recent sales figures point to BYD overtaking LG Energy Solution in market share the coming months or years.

The Age of Battery Power

Electric vehicles are here to stay, while internal combustion engine (ICE) vehicles are set to fade away in the coming decades. Recently, General Motors announced that it aims to stop selling ICE vehicles by 2035, while Audi plans to stop producing such models by 2033.

Besides EVs, battery technology is essential for the energy transition, providing storage capacity for intermittent solar and wind generation.

As battery makers work to supply the EV transition’s increasing demand and improve energy density in their products, we can expect more interesting developments within this industry.

Batteries

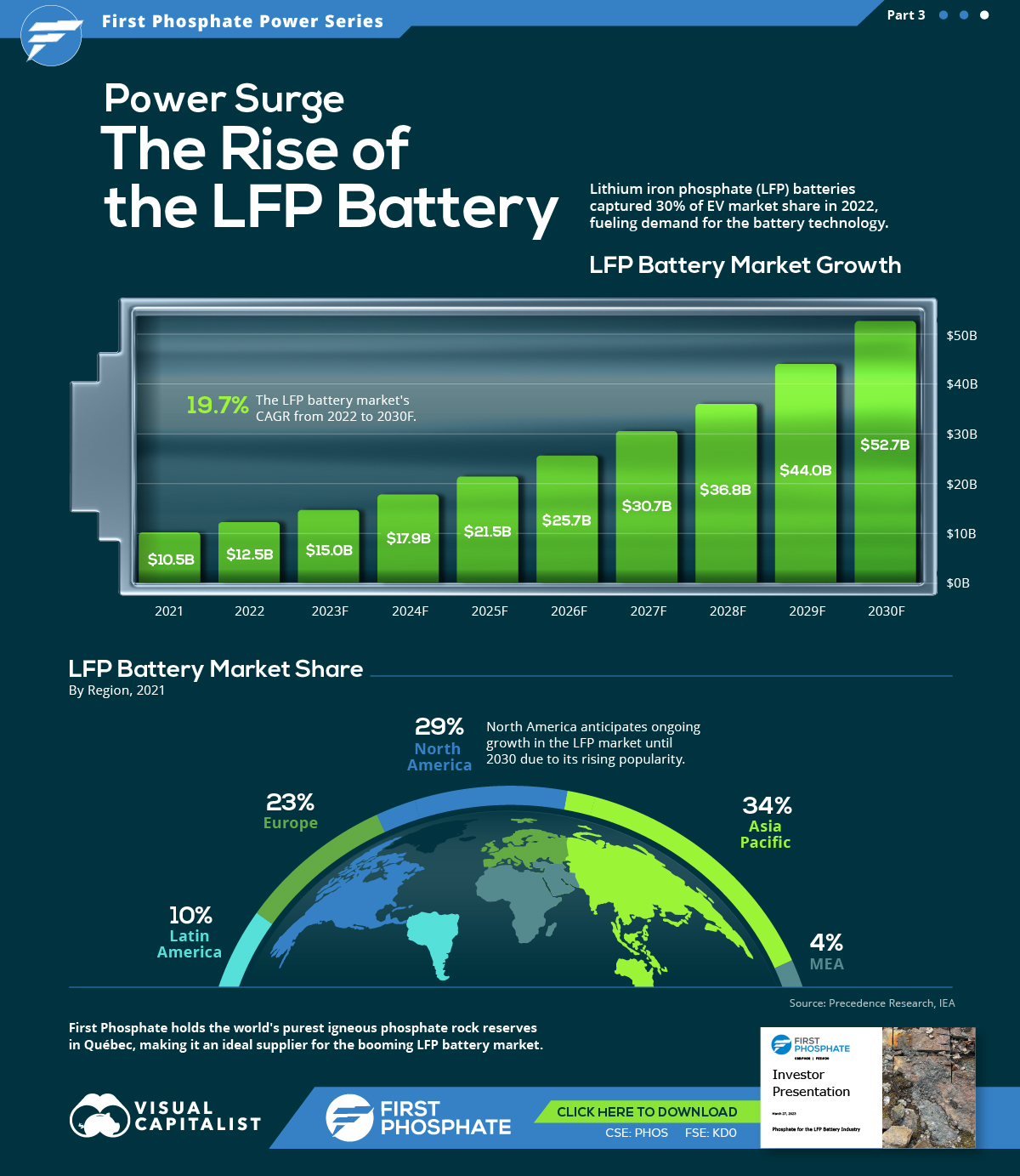

Visualized: The Rise of the LFP Battery

In 2022, the EV sector’s market share of the LFP battery rose from just 6% in 2020 to 30%, highlighting its growing popularity.

The Rise of the LFP Battery

Primarily a key component in fertilizers, phosphate is also essential to lithium iron phosphate (LFP) battery technology.

LFP is an emerging favorite in the expanding EV market, particularly in standard-range EVs. Factors driving this popularity include superior safety, longevity, cost-effectiveness, and environmental sustainability.

In this graphic, our sponsor First Phosphate looks at the growing LFP market, highlighting forecasted growth and current market share.

Market Growth

In 2022, the global LFP battery market stood at $12.5 billion. By 2030, this figure is expected to catapult to nearly $52.7 billion, signifying a CAGR of 19.7%.

| Year | USD (Billion) |

|---|---|

| 2021 | $10.5B |

| 2022 | $12.5B |

| 2023F | $15.0B |

| 2024F | $17.9B |

| 2025F | $21.5B |

| 2026F | $25.7B |

| 2027F | $30.7B |

| 2028F | $36.8B |

| 2029F | $44.0B |

| 2030F | $52.7B |

In 2022, LFP batteries cornered a sizable 30% of the EV market share from just 6% in 2020, demonstrating the growing appeal of this type of lithium-ion battery in the electric vehicle sector.

Market Share

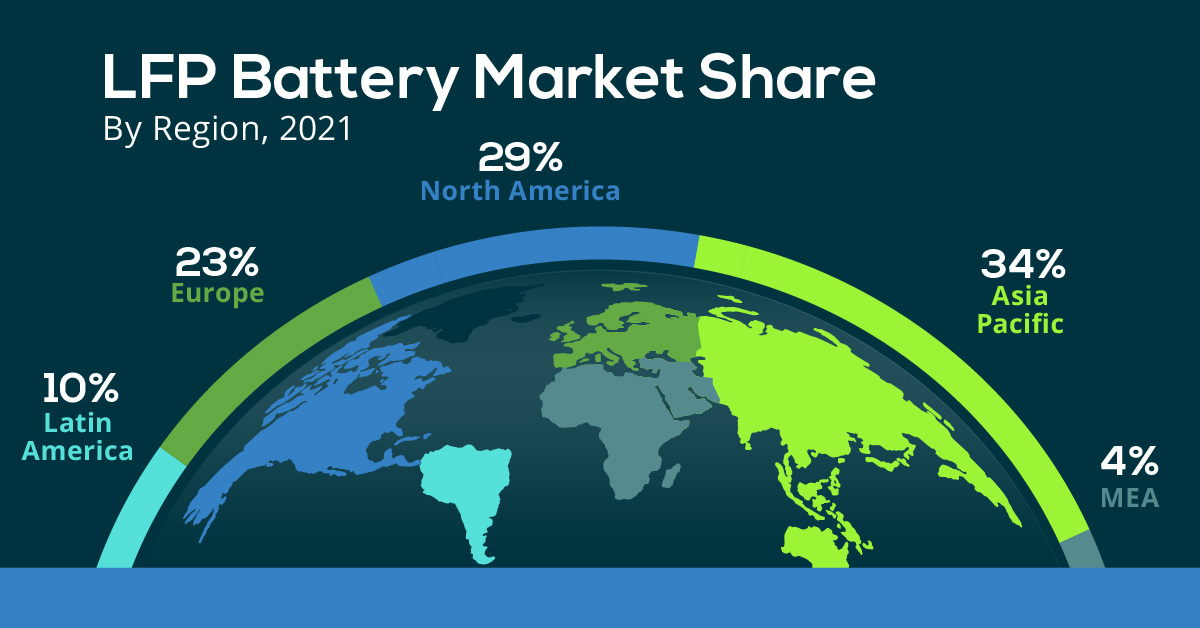

The Asia Pacific region dominated the LFP battery market in 2021, accounting for over 34% of the global share.

| Regions | Revenue Share (%) |

|---|---|

| Asia Pacific | 34% |

| North America | 29% |

| Europe | 23% |

| Latin America | 10% |

| MEA | 4% |

Meanwhile, North America, with the second largest share, is projected to witness ongoing growth through 2030.

First Phosphate holds access to 1% of the world’s purest igneous rock phosphate reserves in Québec, making it an ideal supplier for the growing LFP market.

-

Maps2 months ago

Maps2 months agoMapped: Renewable Energy and Battery Installations in the U.S. in 2023

This graphic describes new U.S. renewable energy installations by state along with nameplate capacity, planned to come online in 2023.

-

Batteries2 months ago

Batteries2 months agoHow EV Adoption Will Impact Oil Consumption (2015-2025P)

How much oil is saved by adding electric vehicles into the mix? We look at data from 2015 to 2025P for different types of EVs.

-

Automotive3 months ago

Automotive3 months agoGlobal EV Production: BYD Surpasses Tesla

This graphic explores the latest EV production data for 2022, which shows BYD taking a massive step forward to surpass Tesla.

-

Energy6 months ago

Energy6 months agoVisualizing China’s Dominance in Battery Manufacturing (2022-2027P)

This infographic breaks down battery manufacturing capacity by country in 2022 and 2027.

-

Energy7 months ago

Energy7 months agoVisualizing 25 Years of Lithium Production, by Country

Lithium production has grown exponentially over the last few decades. Which countries produce the most lithium, and how how has this mix evolved?

-

Energy10 months ago

Energy10 months agoThe Top 10 EV Battery Manufacturers in 2022

Despite efforts from the U.S. and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

-

Brands2 weeks ago

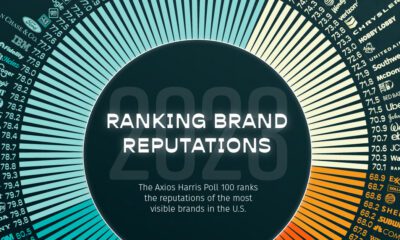

Brands2 weeks agoBrand Reputations: Ranking the Best and Worst in 2023

-

Environment5 days ago

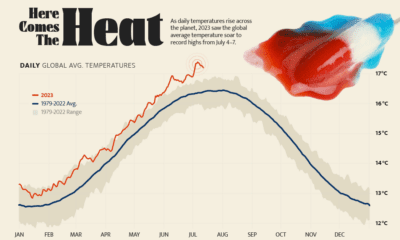

Environment5 days agoHotter Than Ever: 2023 Sets New Global Temperature Records

-

Markets4 weeks ago

Markets4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

Energy2 weeks ago

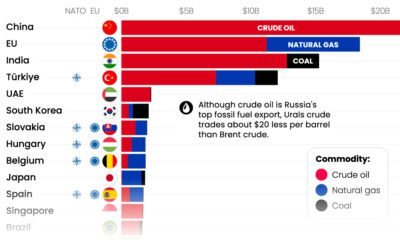

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+5 days ago

VC+5 days agoWhat’s New on VC+ in July

-

Datastream4 weeks ago

Datastream4 weeks agoCharting the Rise of Cross-Border Money Transfers (2015-2023)

-

apps2 weeks ago

apps2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

Politics17 hours ago

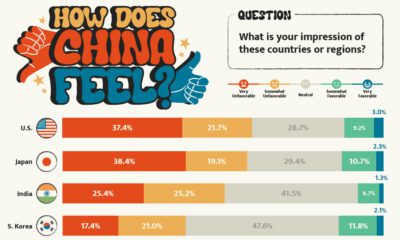

Politics17 hours agoHow Do Chinese Citizens Feel About Other Countries?