Batteries

How EV Adoption Will Impact Oil Consumption (2015-2025P)

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

The EV Impact on Oil Consumption

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on real assets and resource megatrends each week.

As the world moves towards the electrification of the transportation sector, demand for oil will be replaced by demand for electricity.

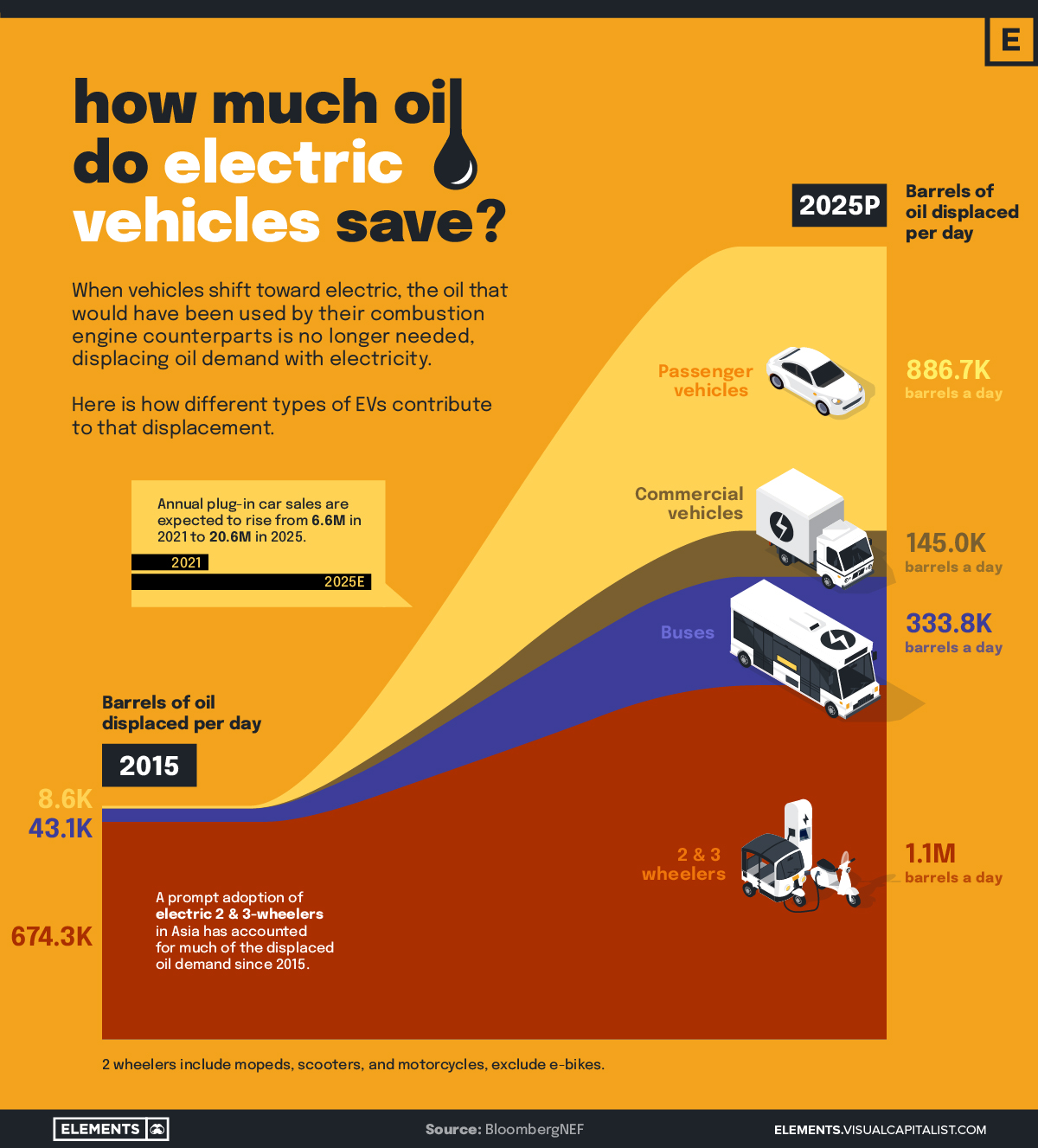

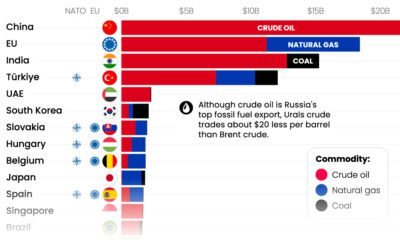

To highlight the EV impact on oil consumption, the above infographic shows how much oil has been and will be saved every day between 2015 and 2025 by various types of electric vehicles, according to BloombergNEF.

How Much Oil Do Electric Vehicles Save?

A standard combustion engine passenger vehicle in the U.S. uses about 10 barrels of oil equivalent (BOE) per year. A motorcycle uses 1, a Class 8 truck about 244, and a bus uses more than 276 BOEs per year.

When these vehicles become electrified, the oil their combustion engine counterparts would have used is no longer needed, displacing oil demand with electricity.

Since 2015, two and three-wheeled vehicles, such as mopeds, scooters, and motorcycles, have accounted for most of the oil saved from EVs on a global scale. With a wide adoption in Asia specifically, these vehicles displaced the demand for almost 675,000 barrels of oil per day in 2015. By 2021, this number had quickly grown to 1 million barrels per day.

Let’s take a look at the daily displacement of oil demand by EV segment.

| Number of barrels saved per day, 2015 | Number of barrels saved per day, 2025P | |

|---|---|---|

| Electric Passenger Vehicles | 8,600 | 886,700 |

| Electric Commercial Vehicles | 0 | 145,000 |

| Electric Buses | 43,100 | 333,800 |

| Electric Two & Three-Wheelers | 674,300 | 1,100,000 |

| Total Oil Barrels Per Day | 726,000 | 2,465,500 |

Today, while work is being done in the commercial vehicle segment, very few large trucks on the road are electric—however, this is expected to change by 2025.

Meanwile, electric passenger vehicles have shown the biggest growth in adoption since 2015.

In 2022, the electric car market experienced exponential growth, with sales exceeding 10 million cars. The market is expected to continue its strong growth throughout 2023 and beyond, eventually coming to save a predicted 886,700 barrels of oil per day in 2025.

From Gas to Electric

While the world shifts from fossil fuels to electricity, BloombergNEF predicts that the decline in oil demand does not necessarily equate to a drop in oil prices.

In the event that investments in new supply capacity decrease more rapidly than demand, oil prices could still remain unstable and high.

The shift toward electrification, however, will likely have other implications.

While most of us associate electric vehicles with lower emissions, it’s good to consider that they are only as sustainable as the electricity used to charge them. The shift toward electrification, then, presents an incredible opportunity to meet the growing demand for electricity with clean energy sources, such as wind, solar and nuclear power.

The shift away from fossil fuels in road transport will also require expanded infrastructure. EV charging stations, expanded transmission capacity, and battery storage will likely all be key to supporting the wide-scale transition from gas to electricity.

Batteries

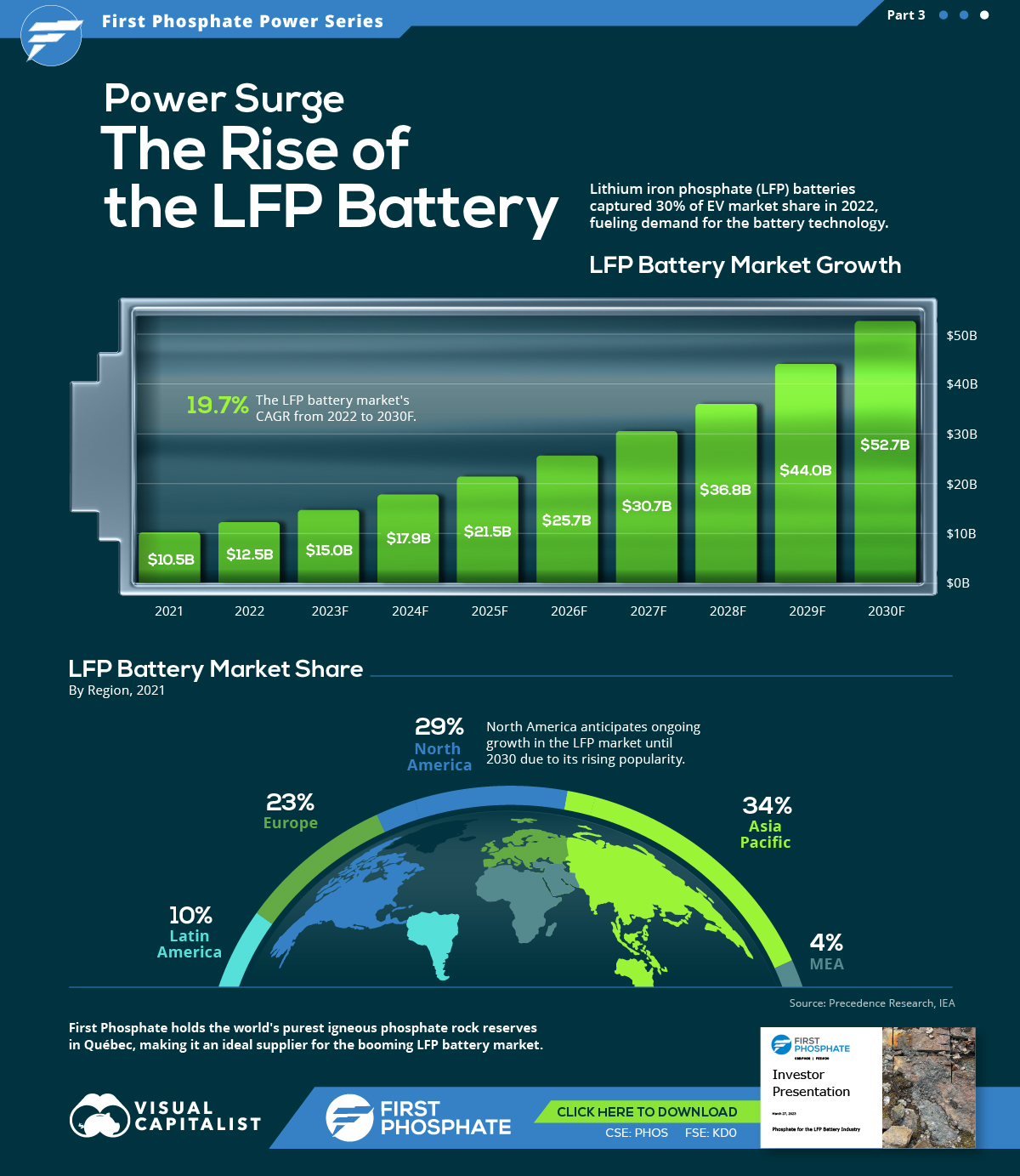

Visualized: The Rise of the LFP Battery

In 2022, the EV sector’s market share of the LFP battery rose from just 6% in 2020 to 30%, highlighting its growing popularity.

The Rise of the LFP Battery

Primarily a key component in fertilizers, phosphate is also essential to lithium iron phosphate (LFP) battery technology.

LFP is an emerging favorite in the expanding EV market, particularly in standard-range EVs. Factors driving this popularity include superior safety, longevity, cost-effectiveness, and environmental sustainability.

In this graphic, our sponsor First Phosphate looks at the growing LFP market, highlighting forecasted growth and current market share.

Market Growth

In 2022, the global LFP battery market stood at $12.5 billion. By 2030, this figure is expected to catapult to nearly $52.7 billion, signifying a CAGR of 19.7%.

| Year | USD (Billion) |

|---|---|

| 2021 | $10.5B |

| 2022 | $12.5B |

| 2023F | $15.0B |

| 2024F | $17.9B |

| 2025F | $21.5B |

| 2026F | $25.7B |

| 2027F | $30.7B |

| 2028F | $36.8B |

| 2029F | $44.0B |

| 2030F | $52.7B |

In 2022, LFP batteries cornered a sizable 30% of the EV market share from just 6% in 2020, demonstrating the growing appeal of this type of lithium-ion battery in the electric vehicle sector.

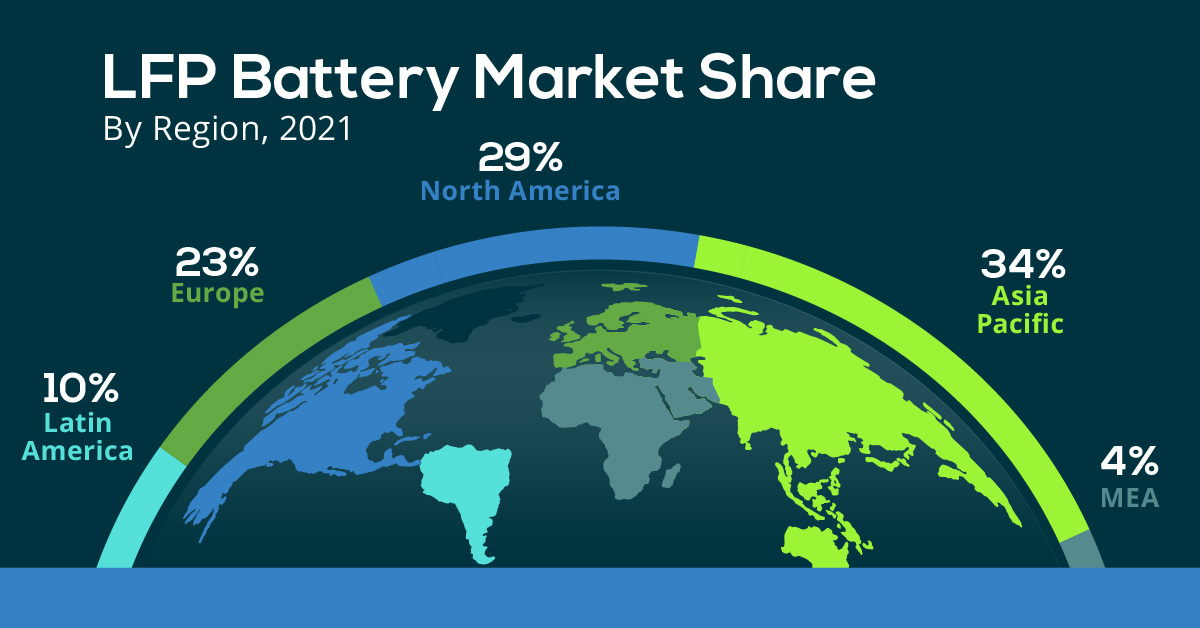

Market Share

The Asia Pacific region dominated the LFP battery market in 2021, accounting for over 34% of the global share.

| Regions | Revenue Share (%) |

|---|---|

| Asia Pacific | 34% |

| North America | 29% |

| Europe | 23% |

| Latin America | 10% |

| MEA | 4% |

Meanwhile, North America, with the second largest share, is projected to witness ongoing growth through 2030.

First Phosphate holds access to 1% of the world’s purest igneous rock phosphate reserves in Québec, making it an ideal supplier for the growing LFP market.

-

Maps2 months ago

Maps2 months agoMapped: Renewable Energy and Battery Installations in the U.S. in 2023

This graphic describes new U.S. renewable energy installations by state along with nameplate capacity, planned to come online in 2023.

-

Batteries2 months ago

Batteries2 months agoHow EV Adoption Will Impact Oil Consumption (2015-2025P)

How much oil is saved by adding electric vehicles into the mix? We look at data from 2015 to 2025P for different types of EVs.

-

Automotive3 months ago

Automotive3 months agoGlobal EV Production: BYD Surpasses Tesla

This graphic explores the latest EV production data for 2022, which shows BYD taking a massive step forward to surpass Tesla.

-

Batteries6 months ago

Batteries6 months agoVisualizing China’s Dominance in Battery Manufacturing (2022-2027P)

This infographic breaks down battery manufacturing capacity by country in 2022 and 2027.

-

Batteries7 months ago

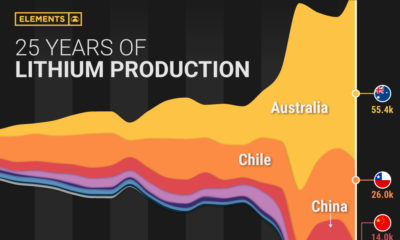

Batteries7 months agoVisualizing 25 Years of Lithium Production, by Country

Lithium production has grown exponentially over the last few decades. Which countries produce the most lithium, and how how has this mix evolved?

-

Batteries10 months ago

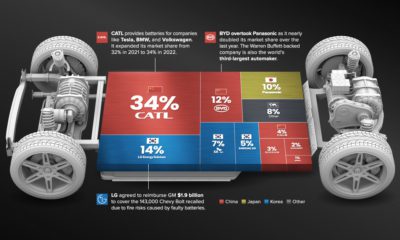

Batteries10 months agoThe Top 10 EV Battery Manufacturers in 2022

Despite efforts from the U.S. and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

-

Environment5 days ago

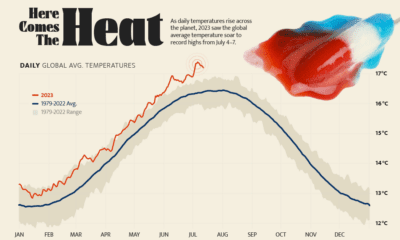

Environment5 days agoHotter Than Ever: 2023 Sets New Global Temperature Records

-

Datastream4 weeks ago

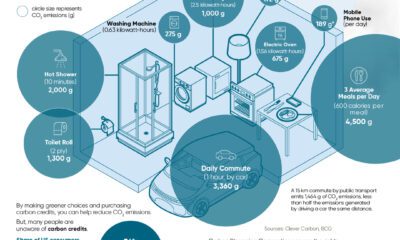

Datastream4 weeks agoCan You Calculate Your Daily Carbon Footprint?

-

Energy2 weeks ago

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+4 days ago

VC+4 days agoWhat’s New on VC+ in July

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

Technology2 weeks ago

Technology2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

Politics15 hours ago

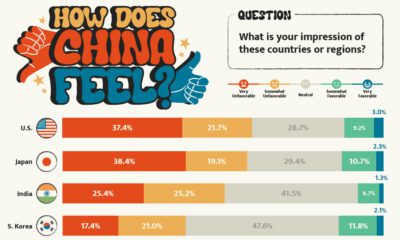

Politics15 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

Markets4 weeks ago

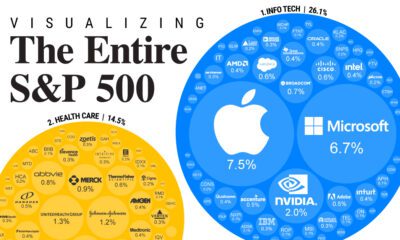

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index