Technology

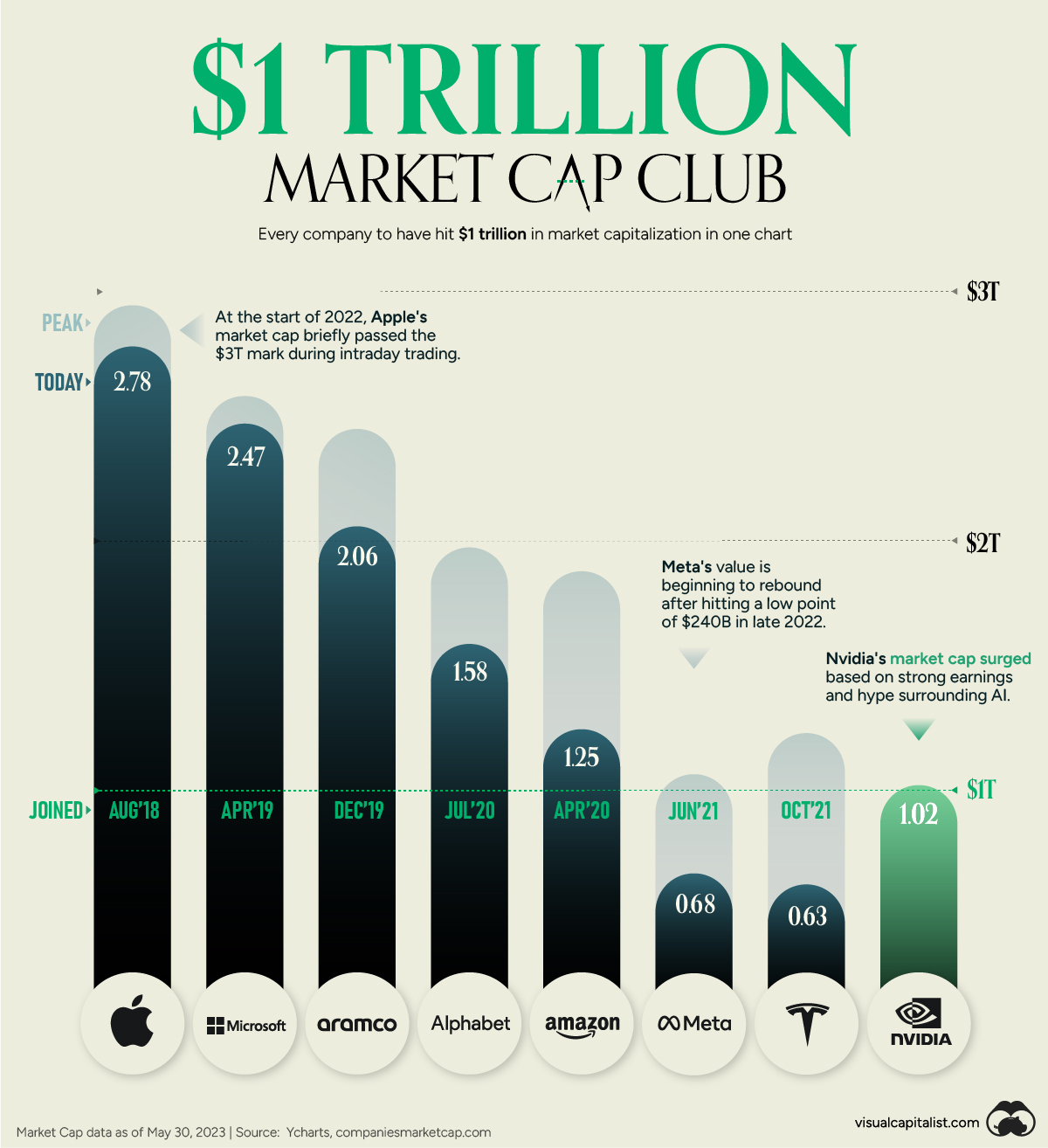

Nvidia Joins the Trillion Dollar Club

Nvidia Joins the Trillion Dollar Club

Chipmaker Nvidia is now worth nearly as much as Amazon.

America’s largest semiconductor company has vaulted past the $1 trillion market capitalization mark, a milestone reached by just a handful of companies including Apple, Amazon, and Microsoft. While many of these are household names, Nvidia has only recently gained widespread attention amid the AI boom.

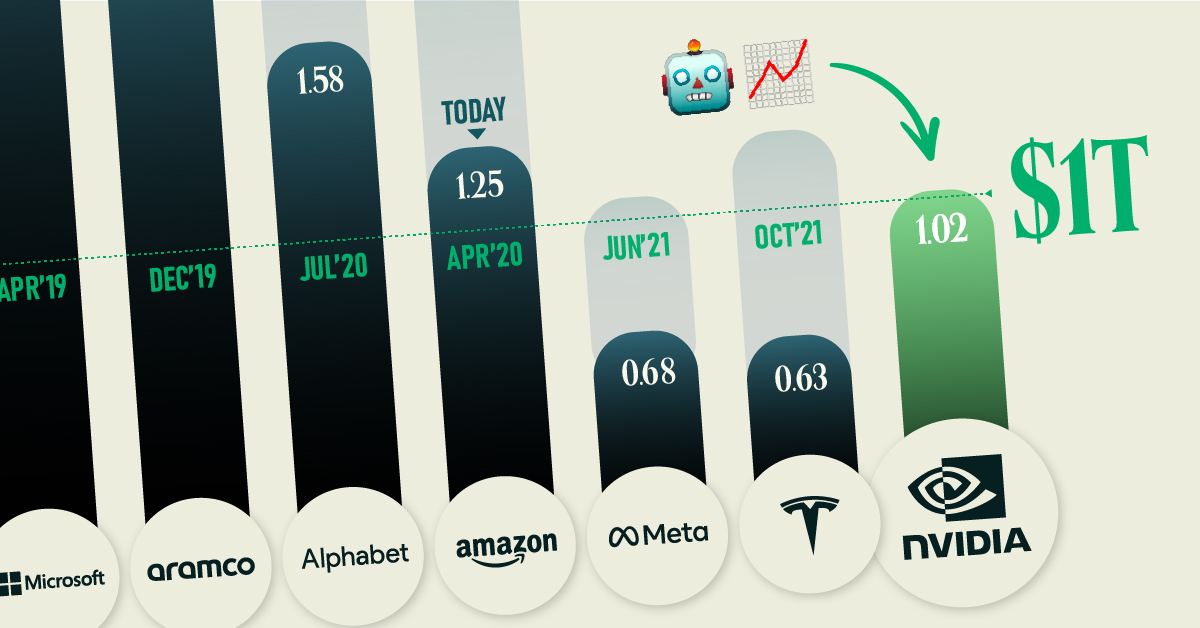

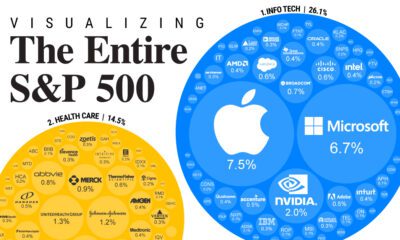

The above graphic compares Nvidia to the seven companies that have reached the trillion dollar club.

Riding the AI Wave

Nvidia’s market cap has more than doubled in 2023 to over $1 trillion.

The company designs semiconductor chips that are made of silicon slices that contain specific patterns. Just like you flip an electrical switch by turning on a light at home, these chips have billions of switches that process complex information simultaneously.

Today, they are integral to many AI functions—from OpenAI’s ChatGPT to image generation. Here’s how Nvidia stands up against companies that have achieved the trillion dollar milestone:

| Joined Club | Market Cap in trillions | Peak Market Cap in trillions |

|

|---|---|---|---|

| Apple | Aug 2018 | $2.78 | $2.94 |

| Microsoft | Apr 2019 | $2.47 | $2.58 |

| Aramco | Dec 2019 | $2.06 | $2.45 |

| Alphabet | Jul 2020 | $1.58 | $1.98 |

| Amazon | Apr 2020 | $1.25 | $1.88 |

| Meta | Jun 2021 | $0.68 | $1.07 |

| Tesla | Oct 2021 | $0.63 | $1.23 |

| Nvidia | May 2023 | $1.02 | $1.02 |

Note: Market caps as of May 30th, 2023

After posting record sales, the company added $184 billion to its market value in one day. Only two other companies have exceeded this number: Amazon ($191 billion), and Apple ($191 billion).

As Nvidia’s market cap reaches new heights, many are wondering if its explosive growth will continue—or if the AI craze is merely temporary. There are cases to be made on both sides.

Bull Case Scenario

Big tech companies are racing to develop capabilities like OpenAI. These types of generative AI require vastly higher amounts of computing power, especially as they become more sophisticated.

Many tech giants, including Google and Microsoft use Nvidia chips to power their AI operations. Consider how Google plans to use generative AI in six products in the future. Each of these have over 2 billion users.

Nvidia has also launched new products days since its stratospheric rise, spanning from robotics to gaming. Leading the way is the A100, a powerful graphics processing unit (GPU) well-suited for machine learning. Additionally, it announced a new supercomputer platform that Google, Microsoft, and Meta are first in line for. Overall, 65,000 companies globally use the company’s chips for a wide range of functions.

Bear Case Scenario

While extreme investor optimism has launched Nvidia to record highs, how do some of its fundamental valuations stack up to other giants?

As the table below shows, its price to earnings (P/E) ratio is second-only to Amazon, at 214.4. This shows how much a shareholder pays compared to the earnings of a company. Here, the company’s share price is over 200 times its earnings on a per share basis.

| P/E Ratio | Net Profit Margin (Annual) | |

|---|---|---|

| Apple | 30.2 | 25.3% |

| Microsoft | 36.1 | 36.7% |

| Aramco | 13.5 | 26.4% |

| Alphabet | 28.2 | 21.2% |

| Amazon | 294.2 | -0.5% |

| Meta | 33.9 | 19.9% |

| Tesla | 59.0 | 15.4% |

| Nvidia | 214.4 | 16.19% |

Consider how this looks for revenue of Nvidia compared to other big tech names:

$NVDA $963 billion market cap, 38x Revenue

$MSFT $2.5 trillion market cap, 12x Revenue$TSLA $612 billion market cap, 7.8x Revenue$AAPL $2.75 trillion market cap, 7.3x Revenue$GOOG $1.6 trillion market cap, 6.1x Revenue$META $672 billion market cap, 6x Revenue pic.twitter.com/VgkKAfiydx— Martin Pelletier (@MPelletierCIO) May 29, 2023

For some, Nvidia’s valuation seems unrealistic even in spite of the prospects of AI. While Nvidia has $11 billion in projected revenue for the next quarter, it would still mean significantly higher multiples than its big tech peers. This suggests the company is overvalued at current prices.

Nvidia’s Growth: Will it Last?

This is not the first time Nvidia’s market cap has rocketed up.

During the crypto rally of 2021, its share price skyrocketed over 100% as demand for its GPUs increased. These specialist chips help mine cryptocurrency, and a jump in demand led to a shortage of chips at the time.

As cryptocurrencies lost their lustre, Nvidia’s share price sank over 46% the following year.

By comparison, AI advancements could have more transformative power. Big tech is rushing to partner with Nvidia, potentially reshaping everything from search to advertising.

Technology

How Long it Took for Popular Apps to Reach 100 Million Users

Threads reached 100 million users in just five days. Here is a timeline of how long other popular platforms took to reach the milestone.

How Long it Took for Popular Apps to Reach 100 Million Users

Of Twitter’s many new rivals, Meta’s newest social media platform Threads has established its presence with a bang.

According to Meta founder Mark Zuckerberg, Threads took only 5 days to reach the key threshold of 100 million users. It achieved this milestone through organic demand—and no paid promotions required—smashing all previous records.

But how long have other popular platforms—TikTok, Instagram, and YouTube to name a few—taken to build their user base? Pulling data from PwC and Yahoo, we rank how long it took popular platforms to get to 100 million users.

Ranking Every Apps Journey to 100 Million Users

In first place, Threads has a significant lead over the rest of the pack with its five day achievement, and may have built a significant moat in holding on to this record.

Firstly, its launch coincided with Twitter’s viewing limit decision, and rode the wave of dissatisfaction aimed at Twitter’s current owner, Elon Musk.

Secondly, new users on Threads need an Instagram account to register, thus eliminating sign-up barriers and leveraging Instagram’s 1.2 billion-strong user base.

Here’s the journey length of popular platforms to attaining 100 million users:

| Rank | Platform | Launch | Time to 100M Users |

|---|---|---|---|

| 1 | Threads | 2023 | 5 days |

| 2 | ChatGPT | 2022 | 2 months |

| 3 | TikTok | 2017 | 9 months |

| 4 | 2011 | 1 year, 2 months | |

| 5 | 2010 | 2 years, 6 months | |

| 6 | Myspace | 2003 | 3 years |

| 7 | 2009 | 3 years, 6 months | |

| 8 | Snapchat | 2011 | 3 years, 8 months |

| 9 | YouTube | 2005 | 4 years, 1 month |

| 10 | 2004 | 4 years, 6 months | |

| 11 | Spotify | 2006 | 4 years, 7 months |

| 12 | Telegram | 2013 | 5 years, 1 month |

| 13 | 2006 | 5 years, 5 months | |

| 14 | Uber | 2011 | 5 years, 10 months |

| 15 | 2010 | 5 years, 11 months | |

| 16 | Google Translate | 2006 | 6 years, 6 months |

| 17 | World Wide Web | 1991 | 7 years |

| 18 | 2003 | 7 years, 11 months |

Ranked second, Open AI’s ChatGPT launched in November 2022 and hit 100 million users by the start of the new year. ChatGPT introduced the incredible capabilities of large language models to the masses, prompting a rush of sign-ups, and reviving old conversations around the potential consequences of AI.

Coming in at third place, ByteDance’s TikTok took just 9 months to reach 100 million users after its launch in 2017. Like Threads, TikTok benefited from another app, accessing popular lip syncing app Musical.ly’s existing user base after it was acquired and folded into TikTok.

WeChat and Instagram round out the top-five, also with interesting advantages. WeChat, an instant messaging platform similar to WhatsApp, benefited from its unique access to China’s notoriously closed internet market of 500 million users in 2012.

Meanwhile, Meta acquired Instagram when the photo-sharing platform had 30 million users, and more than tripled that number past 100 million in just one year.

And while Facebook ranks solidly middle-of-the-pack for fastest to 100 million users, it remains the platform with the most monthly active accounts, at nearly 3 billion. In fact, Meta’s lessons learned from Facebook have been well-leveraged, and the company owns 4 of the fastest apps to register 100 million users.

So What Does Threads Success Mean for Twitter?

Coming back to Threads’ incredible feat, however, it’s still early days whether an en-masse switch from Twitter is on the cards for Meta’s newest platform.

For one, Threads has faced significant criticism due to its intensive data collection practices and lack of accessibility features. It also is missing some key features from its rival, including trending topics, hashtags, and direct messages.

Meanwhile Elon Musk has been less than pleased with Threads’ success, deeming it a copy of Twitter and even threatening legal action.

Competition is fine, cheating is not

— Elon Musk (@elonmusk) July 6, 2023

So where does this leave the increasingly-crowded social media space? The next decade will set the stage for either more platform consolidation, or even further audience fragmentation.

-

Energy2 weeks ago

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+4 days ago

VC+4 days agoWhat’s New on VC+ in July

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

apps2 weeks ago

apps2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

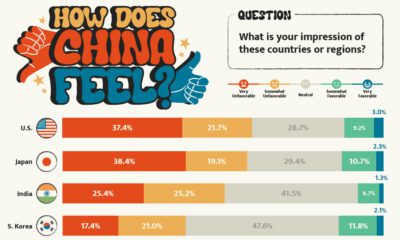

Politics14 hours ago

Politics14 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

Markets4 weeks ago

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index

-

Markets2 weeks ago

Markets2 weeks agoVisualizing 1 Billion Square Feet of Empty Office Space

-

Energy4 weeks ago

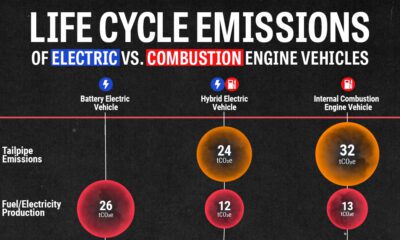

Energy4 weeks agoLife Cycle Emissions: EVs vs. Combustion Engine Vehicles