Healthcare

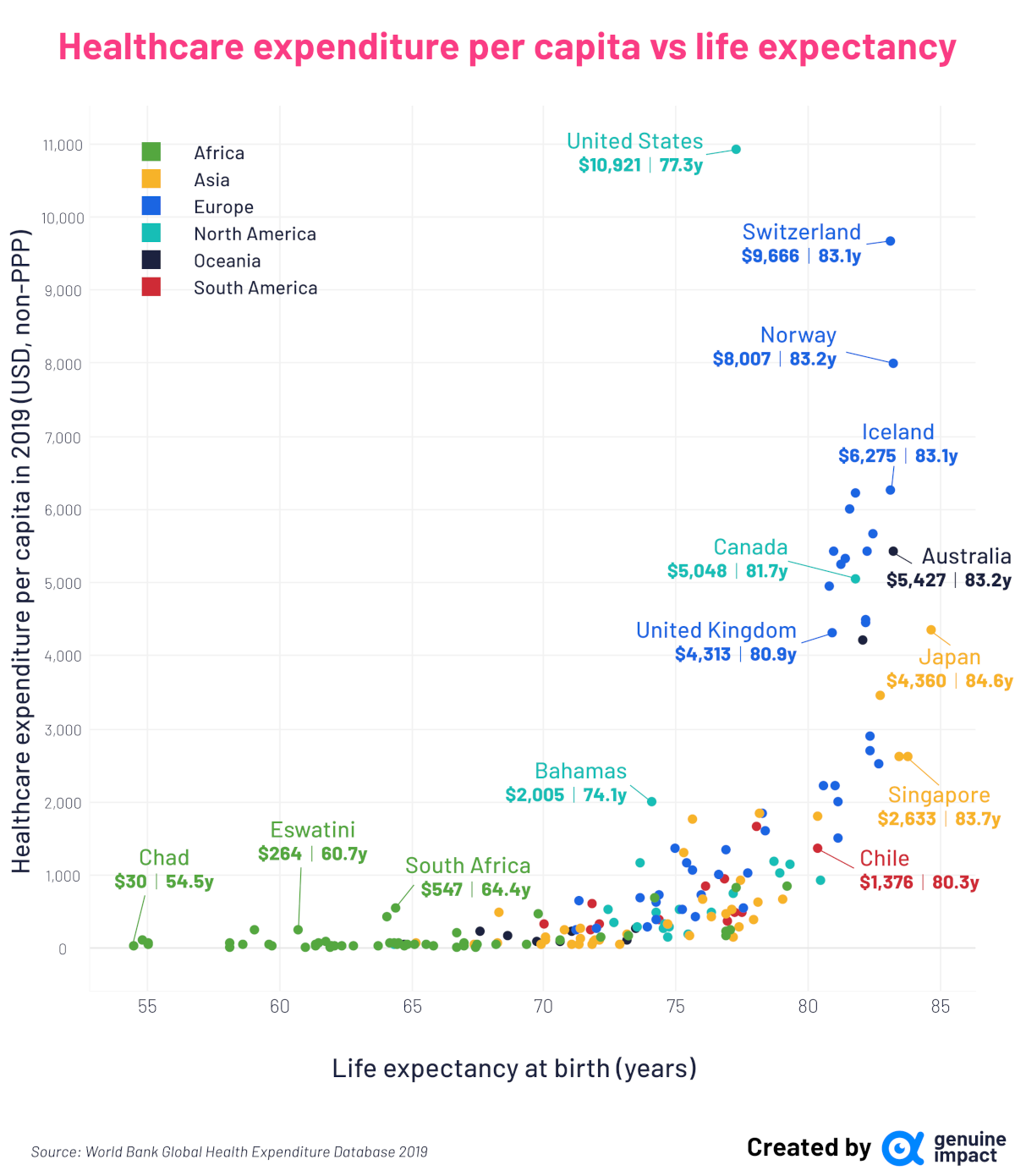

Charted: Healthcare Spending and Life Expectancy, by Country

Charted: Healthcare Spending and Life Expectancy, by Country

Over the last century, life expectancy at birth has more than doubled across the globe, largely thanks to innovations and discoveries in various medical fields around sanitation, vaccines, and preventative healthcare.

Yet, while the average life expectancy for humans has increased significantly on a global scale, there’s still a noticeable gap in average life expectancies between different countries.

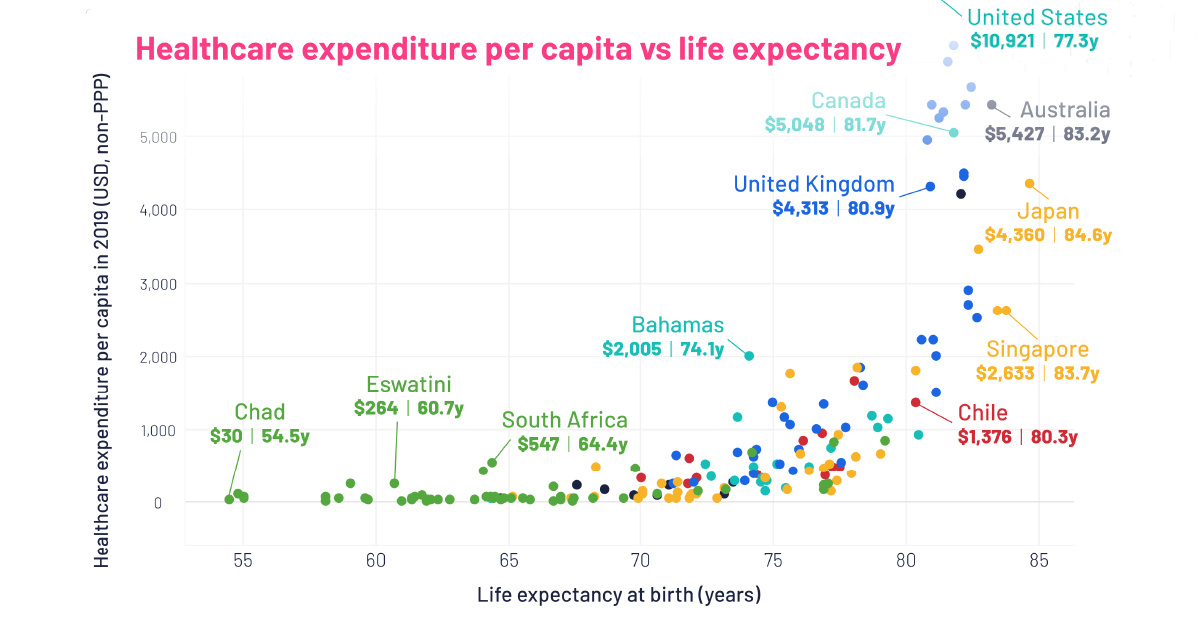

What’s the explanation for this divide? According to World Bank data compiled by Truman Du, it may be partially related to the amount of money a country spends on its healthcare.

More Spending Generally Means More Years

The latest available data from the World Bank includes both the healthcare spending per capita of 178 different countries and their average life expectancy.

Perhaps unsurprisingly, the analysis found that countries that spent more on healthcare tended to have higher average life expectancies up until reaching the 80-year mark.

| Country | Health expenditure per capita (USD, 2019) | Life expectancy at birth, total (years, 2020) |

|---|---|---|

| Japan | $4,360 | 85 |

| Singapore | $2,633 | 84 |

| Korea, Rep. | $2,625 | 83 |

| Norway | $8,007 | 83 |

| Australia | $5,427 | 83 |

| Switzerland | $9,666 | 83 |

| Iceland | $6,275 | 83 |

| Israel | $3,456 | 83 |

| Malta | $2,532 | 83 |

| Sweden | $5,671 | 82 |

| Italy | $2,906 | 82 |

| Spain | $2,711 | 82 |

| Ireland | $5,429 | 82 |

| France | $4,492 | 82 |

| Finland | $4,450 | 82 |

| New Zealand | $4,211 | 82 |

| Canada | $5,048 | 82 |

| Luxembourg | $6,221 | 82 |

| Denmark | $6,003 | 82 |

| Netherlands | $5,335 | 81 |

| Austria | $5,242 | 81 |

| Cyprus | $1,996 | 81 |

| Greece | $1,501 | 81 |

| Portugal | $2,221 | 81 |

| Germany | $5,440 | 81 |

| United Kingdom | $4,313 | 81 |

| Belgium | $4,960 | 81 |

| Slovenia | $2,219 | 81 |

| Costa Rica | $922 | 80 |

| Qatar | $1,807 | 80 |

| Chile | $1,376 | 80 |

| Barbados | $1,143 | 79 |

| Maldives | $854 | 79 |

| Lebanon | $663 | 79 |

| Cuba | $1,032 | 79 |

| Panama | $1,193 | 79 |

| Estonia | $1,599 | 78 |

| Czech Republic | $1,844 | 78 |

| United Arab Emirates | $1,843 | 78 |

| Oman | $625 | 78 |

| Uruguay | $1,661 | 78 |

| Turkiye | $396 | 78 |

| Croatia | $1,040 | 78 |

| Bosnia and Herzegovina | $554 | 78 |

| Colombia | $495 | 77 |

| Bahrain | $940 | 77 |

| Thailand | $296 | 77 |

| United States | $10,921 | 77 |

| Seychelles | $840 | 77 |

| Ecuador | $486 | 77 |

| Antigua and Barbuda | $760 | 77 |

| Sri Lanka | $161 | 77 |

| China | $535 | 77 |

| Algeria | $248 | 77 |

| Peru | $370 | 77 |

| Morocco | $174 | 77 |

| Tunisia | $233 | 77 |

| Iran, Islamic Rep. | $470 | 77 |

| Slovak Republic | $1,342 | 77 |

| Argentina | $946 | 77 |

| Poland | $1,014 | 77 |

| St. Lucia | $502 | 76 |

| Malaysia | $437 | 76 |

| Brazil | $853 | 76 |

| Brunei Darussalam | $672 | 76 |

| Montenegro | $735 | 76 |

| North Macedonia | $437 | 76 |

| Hungary | $1,062 | 76 |

| Kuwait | $1,759 | 76 |

| Vietnam | $181 | 75 |

| Honduras | $188 | 75 |

| Latvia | $1,167 | 75 |

| Saudi Arabia | $1,316 | 75 |

| Armenia | $524 | 75 |

| Mexico | $540 | 75 |

| Lithuania | $1,370 | 75 |

| Belize | $293 | 75 |

| Nicaragua | $161 | 75 |

| Jordan | $334 | 75 |

| Jamaica | $327 | 75 |

| Guatemala | $271 | 75 |

| Paraguay | $388 | 74 |

| Romania | $739 | 74 |

| Dominican Republic | $491 | 74 |

| Serbia | $641 | 74 |

| Belarus | $399 | 74 |

| Mauritius | $686 | 74 |

| Bahamas | $2,005 | 74 |

| Georgia | $291 | 74 |

| Trinidad and Tobago | $1,168 | 74 |

| Bulgaria | $698 | 74 |

| El Salvador | $300 | 74 |

| Samoa | $272 | 73 |

| Cabo Verde | $178 | 73 |

| Solomon Islands | $112 | 73 |

| Azerbaijan | $193 | 73 |

| Bangladesh | $46 | 73 |

| St. Vincent and the Grenadines | $355 | 73 |

| Grenada | $534 | 72 |

| Egypt, Arab Rep. | $150 | 72 |

| Bhutan | $116 | 72 |

| Venezuela, RB | $339 | 72 |

| Moldova | $284 | 72 |

| Indonesia | $120 | 72 |

| Uzbekistan | $99 | 72 |

| Suriname | $619 | 72 |

| Kyrgyz Republic | $62 | 72 |

| Bolivia | $246 | 72 |

| Kazakhstan | $273 | 71 |

| Philippines | $142 | 71 |

| Russian Federation | $653 | 71 |

| Tajikistan | $62 | 71 |

| Ukraine | $248 | 71 |

| Nepal | $53 | 71 |

| Tonga | $242 | 71 |

| Iraq | $253 | 71 |

| Vanuatu | $104 | 71 |

| Sao Tome and Principe | $108 | 71 |

| Mongolia | $163 | 70 |

| Cambodia | $113 | 70 |

| Guyana | $326 | 70 |

| India | $64 | 70 |

| Botswana | $482 | 70 |

| Timor-Leste | $93 | 70 |

| Rwanda | $51 | 69 |

| Kiribati | $172 | 69 |

| Turkmenistan | $500 | 68 |

| Lao PDR | $68 | 68 |

| Senegal | $59 | 68 |

| Fiji | $236 | 68 |

| Djibouti | $62 | 67 |

| Pakistan | $39 | 67 |

| Madagascar | $20 | 67 |

| Myanmar | $60 | 67 |

| Kenya | $83 | 67 |

| Ethiopia | $27 | 67 |

| Gabon | $215 | 67 |

| Eritrea | $25 | 67 |

| Tanzania | $40 | 66 |

| Sudan | $47 | 66 |

| Afghanistan | $66 | 65 |

| Mauritania | $58 | 65 |

| Congo, Rep. | $49 | 65 |

| Papua New Guinea | $65 | 65 |

| Malawi | $30 | 65 |

| Comoros | $72 | 65 |

| Liberia | $53 | 64 |

| South Africa | $547 | 64 |

| Ghana | $75 | 64 |

| Haiti | $57 | 64 |

| Zambia | $69 | 64 |

| Namibia | $427 | 64 |

| Uganda | $32 | 64 |

| Niger | $31 | 63 |

| Gambia, The | $30 | 62 |

| Benin | $29 | 62 |

| Burkina Faso | $42 | 62 |

| Guinea | $43 | 62 |

| Burundi | $21 | 62 |

| Zimbabwe | $103 | 62 |

| Angola | $71 | 61 |

| Mozambique | $39 | 61 |

| Togo | $51 | 61 |

| Congo, Dem. Rep. | $21 | 61 |

| Eswatini | $264 | 61 |

| Mali | $34 | 60 |

| Cameroon | $54 | 60 |

| Equatorial Guinea | $255 | 59 |

| Guinea-Bissau | $63 | 59 |

| Cote d'Ivoire | $75 | 58 |

| South Sudan | $23 | 58 |

| Sierra Leone | $46 | 55 |

| Nigeria | $71 | 55 |

| Lesotho | $124 | 55 |

| Chad | $30 | 55 |

However, there were a few slight exceptions. For instance, while the United States has the largest spending of any country included in the dataset, its average life expectancy of 77 years is lower than many other countries that spend far less per capita.

What’s going on in the United States? While there are several intermingling factors at play, some researchers believe a big contributor is the country’s higher infant mortality rate, along with its higher relative rate of violence among young adults.

On the other end of the spectrum, Japan, Singapore, and South Korea have the highest life expectancies on the list despite their relatively low spending per capita.

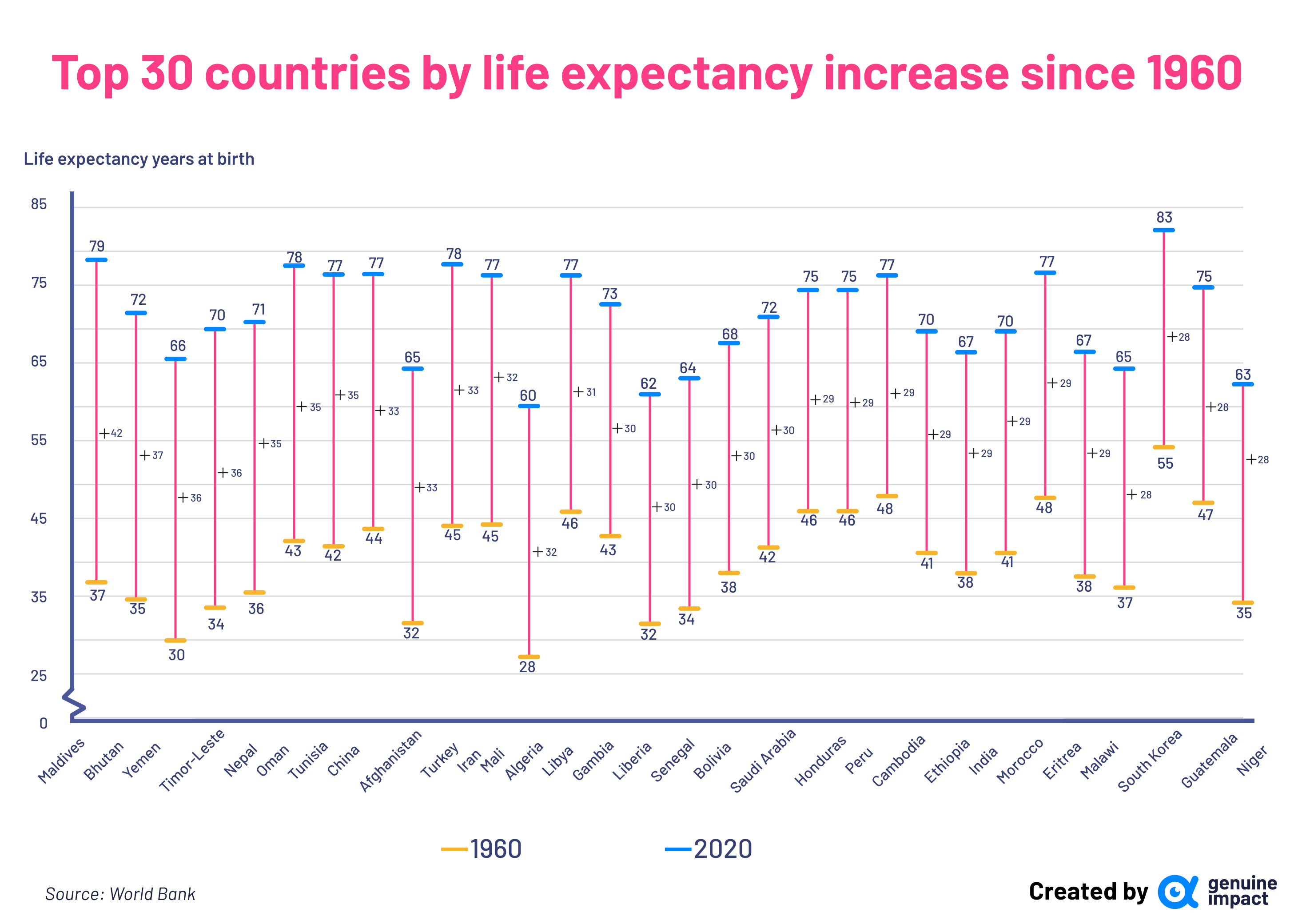

It’s worth mentioning that this wasn’t always the case—in the 1960s, Japan’s life expectancy was actually the lowest among the G7 countries, and South Korea’s was below 60 years, making it one of the top 30 countries by improved life expectancy:

View the full-size infographic

In fact, the last 60 years have seen many countries substantially increase their average life expectancies from the 30-40 year range to 70+ years. But as the header chart shows, there are still many countries lagging behind in Africa, Asia, and Oceania.

How High Can Average Life Expectancy Go?

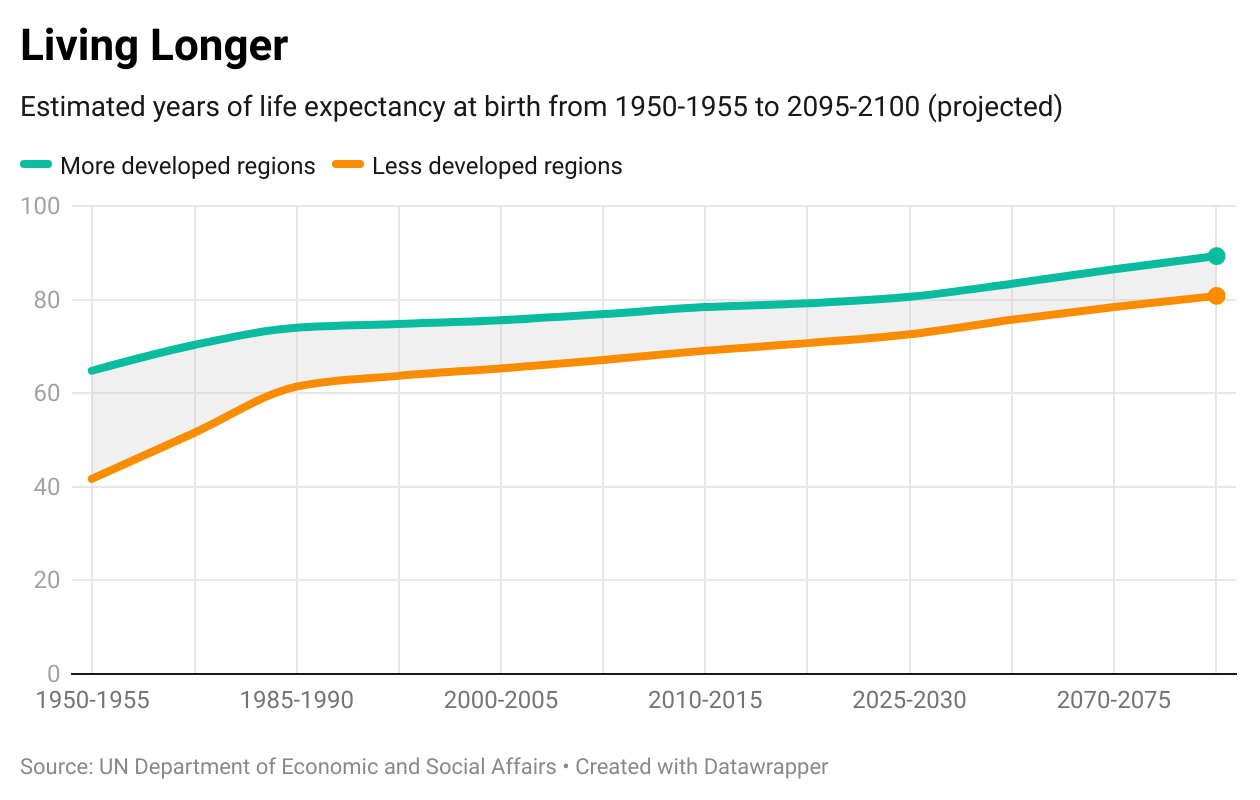

Since people are living longer than they’ve ever lived before, how much higher will average life expectancies be in another 100 years?

Recent research published in Nature Communications suggests that, under the right circumstances, human beings have the potential to live up to 150 years.

Projections from the UN predict that growth will be divided, with developed countries seeing higher life expectancies than developing regions.

However, as seen in the above chart from the World Economic Forum and using UN data, it’s likely the gap between developed and developing countries will narrow over time.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Personal Finance

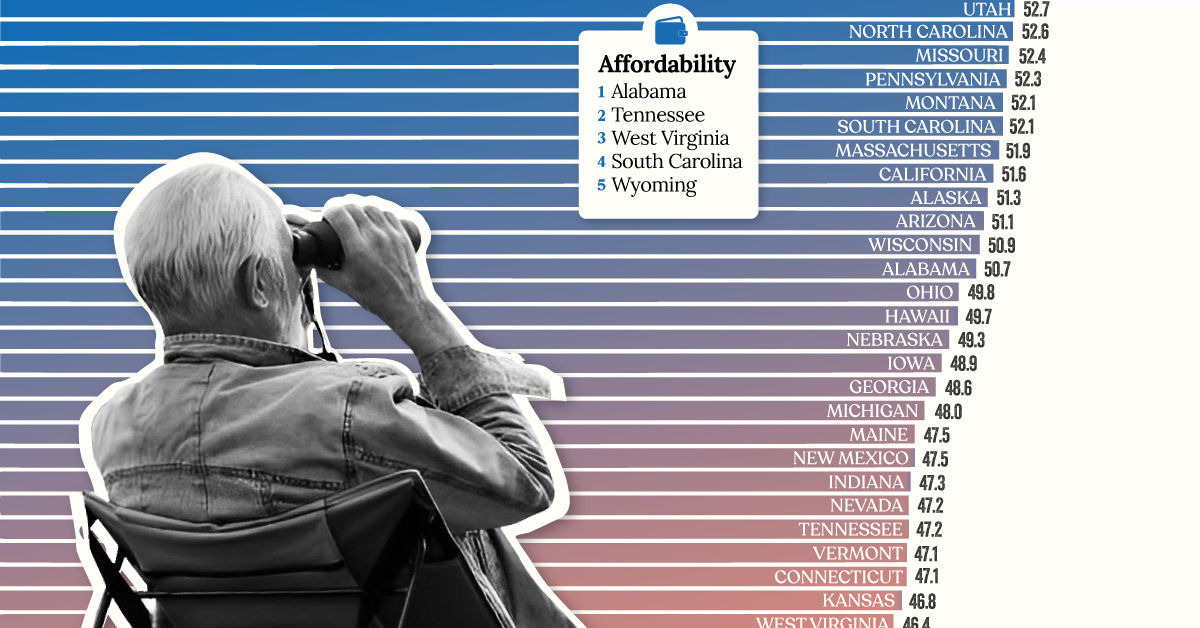

Ranked: The Best U.S. States for Retirement

Getting ready for retirement? See which states score the highest in terms of affordability, quality of life, and health care.

Ranked: The Best U.S. States for Retirement

What is the most important aspect of retirement planning?

If you said finances, you’re probably right. But have you ever thought about where the best place is to retire? Being strategic about location can make a big impact on your quality of life, and perhaps help your savings go just a bit further.

To help break it down, we’ve visualized data from personal finance platform, WalletHub, which ranked the best U.S. states for retirement as of 2023.

Data and Methodology

WalletHub ranked each state using 47 metrics across three dimensions.

- Affordability (7 metrics worth 40 points)

- Quality of Life (22 metrics worth 30 points)

- Health Care (18 metrics worth 30 points)

Here are some examples of what each dimension measures:

- Affordability: Cost of living and taxation

- Quality of Life: Quality of elder-abuse protections and crime rates

- Health Care: Number of health professionals per capita and life expectancy

Visit the source for the full list of metrics.

The final scores (visualized as the bars in the infographic above) represent each state’s weighted average across all metrics. See below for more comprehensive results.

| Rank | State | Score | Affordability (rank) | Quality of Life (rank) | Health Care (rank) |

|---|---|---|---|---|---|

| 1 | Virginia | 57.6 | 16 | 11 | 11 |

| 2T | Florida | 57.4 | 9 | 4 | 28 |

| 2T | Colorado | 57.4 | 14 | 27 | 5 |

| 4 | Wyoming | 55.6 | 5 | 9 | 38 |

| 5 | Delaware | 55.5 | 6 | 33 | 18 |

| 6 | New Hampshire | 55.0 | 31 | 5 | 7 |

| 7 | South Dakota | 53.6 | 25 | 30 | 9 |

| 8 | Minnesota | 53.5 | 40 | 2 | 1 |

| 9 | Idaho | 53.2 | 15 | 17 | 31 |

| 10 | North Dakota | 53.0 | 22 | 25 | 20 |

| 11 | Utah | 52.7 | 20 | 24 | 26 |

| 12 | North Carolina | 52.6 | 12 | 23 | 35 |

| 13 | Missouri | 52.4 | 17 | 28 | 32 |

| 14 | Pennsylvania | 52.3 | 36 | 3 | 12 |

| 15T | Montana | 52.1 | 24 | 15 | 29 |

| 15T | South Carolina | 52.1 | 4 | 38 | 39 |

| 17 | Massachusetts | 51.9 | 47 | 1 | 2 |

| 18 | California | 51.6 | 32 | 19 | 10 |

| 19 | Alaska | 51.3 | 26 | 36 | 8 |

| 20 | Arizona | 51.1 | 18 | 35 | 25 |

| 21 | Wisconsin | 50.9 | 34 | 14 | 17 |

| 22 | Alabama | 50.7 | 1 | 44 | 50 |

| 23 | Ohio | 49.8 | 27 | 8 | 37 |

| 24 | Hawaii | 49.7 | 38 | 29 | 4 |

| 25 | Nebraska | 49.3 | 37 | 16 | 15 |

| 26 | Iowa | 48.9 | 35 | 12 | 24 |

| 27 | Georgia | 48.6 | 7 | 40 | 42 |

| 28 | Michigan | 48.0 | 29 | 18 | 36 |

| 29T | Maine | 47.5 | 43 | 6 | 13 |

| 29T | New Mexico | 47.5 | 21 | 46 | 30 |

| 31 | Indiana | 47.3 | 23 | 31 | 40 |

| 32T | Nevada | 47.2 | 11 | 42 | 41 |

| 32T | Tennessee | 47.2 | 2 | 48 | 45 |

| 34T | Vermont | 47.1 | 48 | 7 | 6 |

| 34T | Connecticut | 47.1 | 44 | 26 | 3 |

| 36 | Kansas | 46.8 | 30 | 32 | 33 |

| 37 | West Virginia | 46.4 | 3 | 43 | 49 |

| 38 | Oregon | 46.1 | 41 | 21 | 21 |

| 39 | Texas | 45.9 | 28 | 37 | 34 |

| 40 | Rhode Island | 45.0 | 39 | 39 | 14 |

| 41 | Arkansas | 44.7 | 8 | 49 | 44 |

| 42 | Maryland | 44.6 | 46 | 20 | 19 |

| 43 | Washington | 44.5 | 45 | 13 | 23 |

| 44 | Illinois | 44.3 | 42 | 22 | 27 |

| 45 | Louisiana | 43.9 | 13 | 45 | 47 |

| 46 | New York | 43.7 | 50 | 10 | 16 |

| 47 | Oklahoma | 43.6 | 19 | 47 | 43 |

| 48 | Mississippi | 40.8 | 10 | 50 | 48 |

| 49 | New Jersey | 40.2 | 49 | 34 | 22 |

| 50 | Kentucky | 38.8 | 33 | 41 | 46 |

According to this methodology, Virginia is currently the best state for retirement. Although the Southeastern state does not excel in any one dimension, it scores consistently well across all three to create a very balanced retirement profile.

This gives it a slight advantage over second place Florida, which excels in quality of life and affordability, but falls further behind in terms of health care. Third-placed Colorado is a mirror of Florida, offering excellent health care but a lower quality of life in comparison.

How to Interpret These Results

It’s important to remember that this ranking is purely based on data and the methodology above, and may not be tailored to your individual preferences.

For example, if you believe that health services will be very important during retirement, you may rank Minnesota (#1 in terms of health care) much higher than eighth place.

You may notice that prioritizing one dimension will often come at a trade-off in others. Looking at Minnesota once more, we can see that the state is also one of America’s most expensive.

Looking to retire outside of the U.S.? Check out this graphic on the top 25 countries to retire in.

-

Cities1 week ago

Cities1 week agoMapped: The Most Dangerous Cities in the U.S.

-

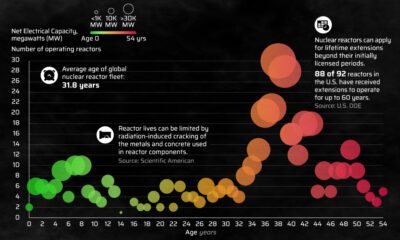

Energy3 weeks ago

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

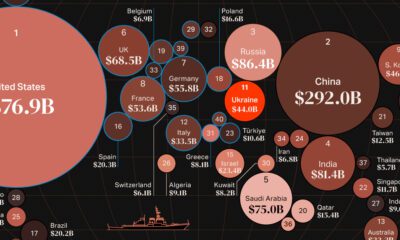

Countries7 days ago

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets

-

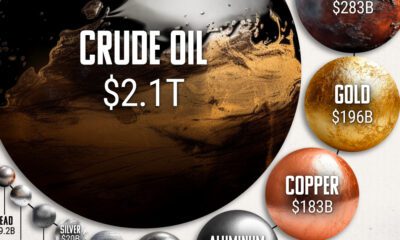

Energy3 weeks ago

Energy3 weeks agoHow Big is the Market for Crude Oil?

-

United States6 days ago

United States6 days agoMapped: The Safest Cities in the U.S.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Profitable U.S. Companies, by Sector

-

apps5 days ago

apps5 days agoHow Long it Took for Popular Apps to Reach 100 Million Users

-

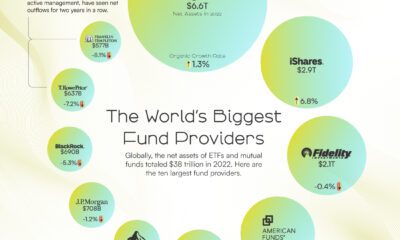

Markets4 weeks ago

Markets4 weeks agoThe World’s Biggest Mutual Fund and ETF Providers