Technology

Charted: Companies in the Nasdaq 100, by Weight

Charted: Companies in the Nasdaq 100, by Weight

Launched in 1985, the Nasdaq 100 index tracks the performance of the largest, and most actively-traded, non-financial companies listed on the Nasdaq stock exchange.

The index is capitalization-weighted, meaning that stock weights in the index are based on each company’s market cap (with some rules to rebalance if companies have an oversized influence). For example, leaders Apple and Microsoft amounted to more than one-fourth of the Nasdaq 100’s total market capitalization alone as of April 2023.

One of the most well-known trackers of the index, Invesco QQQ’s ETF, is the data source for today’s visualization by Truman Du.

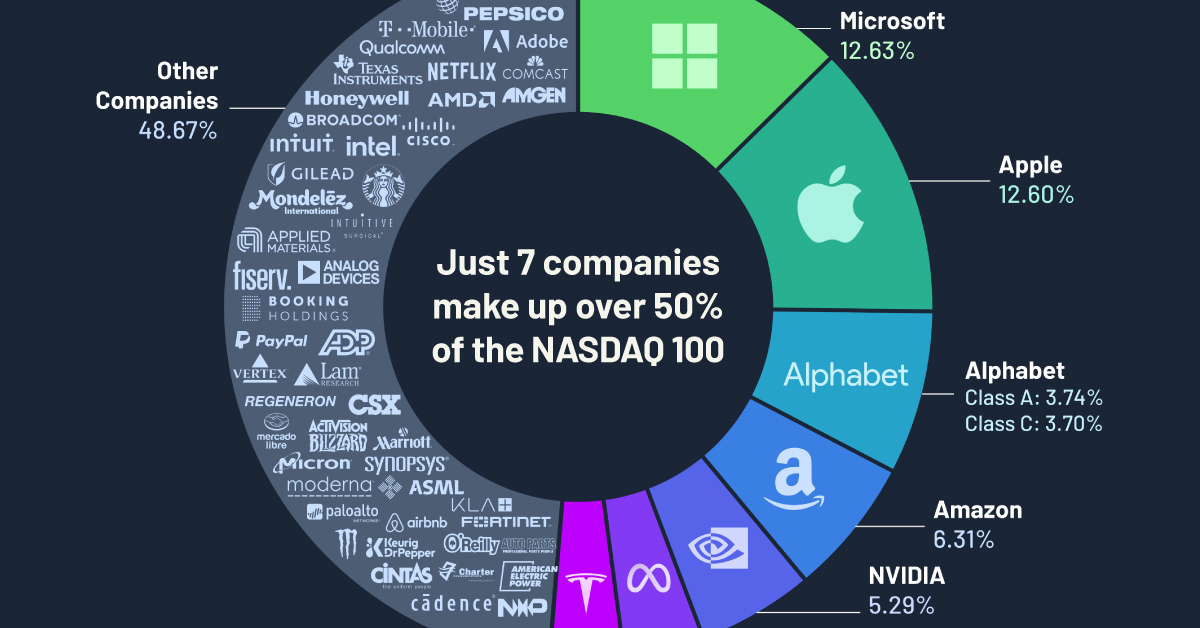

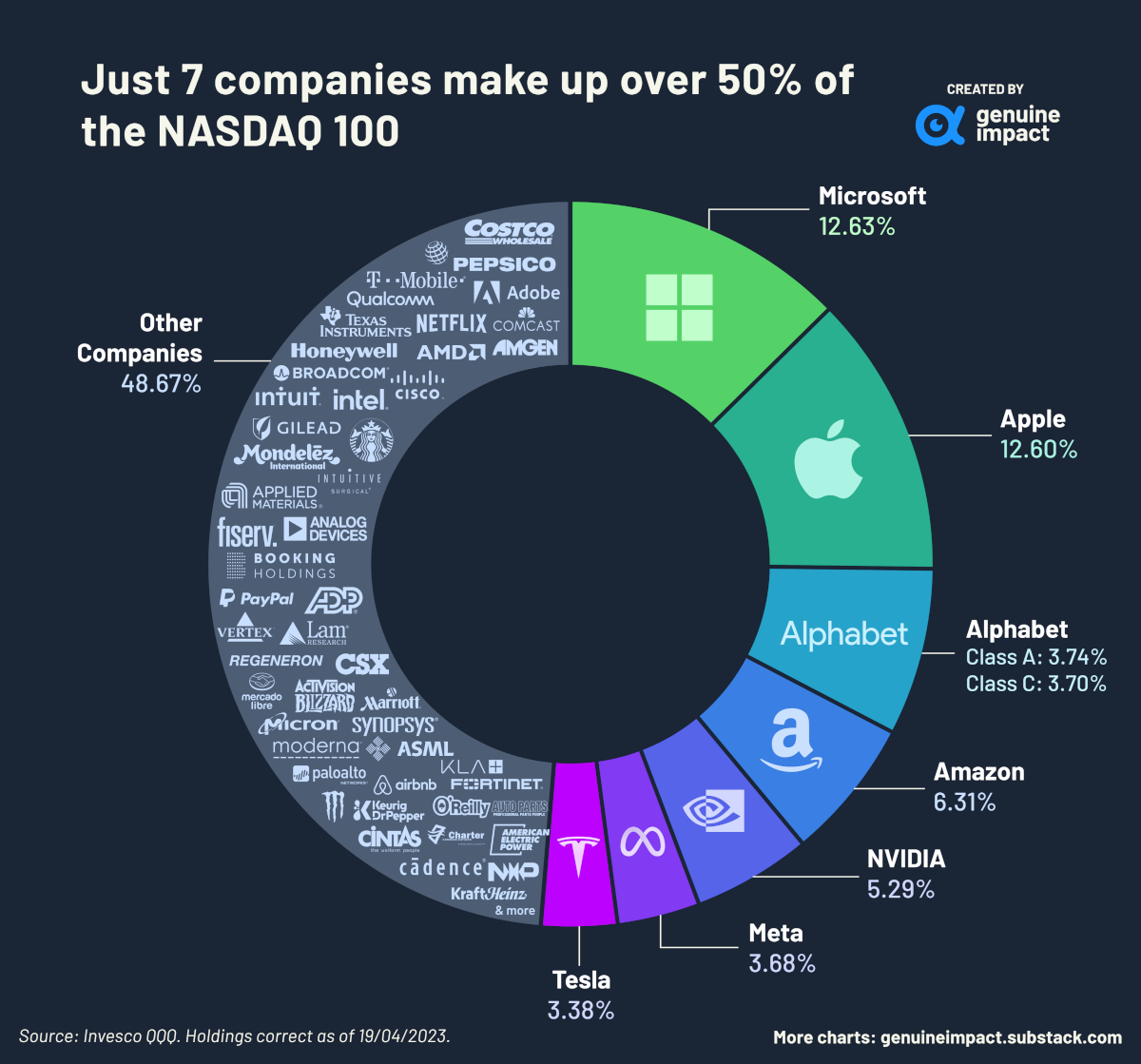

Just 7 Companies Dominate the Nasdaq 100

Microsoft and Apple, together with the next five ranked companies, made up over 50% of the total weight of the index in April. These companies are: Alphabet (Google), Amazon, NVIDIA, Meta, and Tesla, with Alphabet’s class A and class C shares occupying two spots.

Here’s a breakdown of all 100 companies on the Nasdaq 100, by percentage weight in the index on April 19, 2023.

| Company | Allocation |

|---|---|

| Microsoft | 12.63% |

| Apple | 12.60% |

| Amazon | 6.31% |

| NVIDIA | 5.29% |

| Alphabet (Class A) | 3.74% |

| Alphabet (Class C) | 3.70% |

| Meta (Class A) | 3.68% |

| Tesla | 3.38% |

| Broadcom | 2.03% |

| PepsiCo | 1.95% |

| Costco | 1.69% |

| Cisco | 1.51% |

| T-Mobile | 1.39% |

| Adobe | 1.33% |

| Comcast (Class A) | 1.23% |

| Texas Instruments | 1.23% |

| AMD | 1.11% |

| Netflix | 1.10% |

| Qualcomm | 1.01% |

| Honeywell International | 1.01% |

| Amgen | 1.01% |

| Intel | 0.99% |

| Intuit | 0.96% |

| Starbucks | 0.94% |

| Gilead Sciences | 0.80% |

| Intuitive Surgical | 0.80% |

| Booking Holdings | 0.77% |

| Mondelez International (Class A) | 0.74% |

| Analog Devices | 0.73% |

| Applied Materials | 0.71% |

| Automatic Data Processing | 0.69% |

| Regeneron Pharmaceuticals | 0.67% |

| PayPal Holdings | 0.65% |

| Vertex Pharmaceuticals | 0.65% |

| Fiserv | 0.56% |

| Activision Blizzard | 0.51% |

| Lam Research | 0.51% |

| Micron Technology | 0.51% |

| MercadoLibre | 0.50% |

| CSX Corp | 0.48% |

| Palo Alto Networks | 0.45% |

| Cadence Design | 0.45% |

| Synopsys | 0.44% |

| O'Reilly Automotive | 0.43% |

| Moderna | 0.42% |

| ASML Holding NV ADR | 0.42% |

| Monster Beverage | 0.42% |

| Marriott (Class A) | 0.41% |

| Fortinet | 0.40% |

| Charter Communications (Class A) | 0.40% |

| KLA Corp | 0.38% |

| Keurig Dr Pepper | 0.38% |

| Airbnb (Class A) | 0.38% |

| Kraft Heinz | 0.37% |

| American Electric Power | 0.37% |

| DexCom | 0.37% |

| Cintas Corp | 0.35% |

| Lululemon | 0.35% |

| AstraZeneca PLC ADR | 0.35% |

| NXP Semiconductors NV | 0.34% |

| Microchip Technology | 0.33% |

| Exelon Corp | 0.33% |

| Autodesk | 0.33% |

| Biogen | 0.32% |

| PDD Holdings Inc ADR | 0.32% |

| IDEXX Laboratories | 0.31% |

| Paychex | 0.30% |

| Workday (Class A) | 0.30% |

| Xcel Energy | 0.30% |

| Seagen | 0.29% |

| PACCAR | 0.29% |

| ODFL | 0.29% |

| Copart | 0.29% |

| Illumina | 0.28% |

| Ross Stores | 0.28% |

| EA | 0.27% |

| Marvell Technology | 0.27% |

| Global Foundries | 0.27% |

| Warner Bros. Discovery (Class A) | 0.27% |

| Dollar Tree | 0.25% |

| Baker Hughes (Class A) | 0.24% |

| Fastenal | 0.24% |

| Cognizant (Class A) | 0.24% |

| Enphase Energy | 0.23% |

| Walgreens Boots | 0.23% |

| Verisk Analytics | 0.23% |

| CrowdStrike Holdings (Class A) | 0.22% |

| CoStar Group | 0.22% |

| Ansys | 0.22% |

| Align Technology | 0.21% |

| Diamondback Energy | 0.20% |

| Constellation Energy | 0.19% |

| Atlassian Corp A | 0.19% |

| eBay | 0.18% |

| Datadog (Class A) | 0.16% |

| JD.com ADR | 0.13% |

| Zoom | 0.13% |

| Sirius XM Holdings | 0.12% |

| Zscaler | 0.11% |

| Lucid Group | 0.11% |

| Rivian (Class A) | 0.09% |

The dominance of these seven companies within the NASDAQ 100 is a reflection of how central they are to large parts of the wider consumer economy. The economic output and influence of the tech giants speaks for themselves, and Tesla still leads the (rapidly crowding) electric vehicle market.

Perhaps the underdog of the bunch is NVIDIA, which produces graphics processing units (GPUs) that power the visuals in many electronic devices and, more recently, artificial intelligence (AI) systems. The latter in particular has made investors incredibly bullish on the company, as NVIDIA’s stock has risen and the company has recently joined the coveted $1 trillion club.

It’s important to note that this snapshot changes drastically over time. For example, Intel and Cisco were massive components of the Nasdaq 100 in the 2000s but have seen their allocations drop, while others like Yahoo! are no longer publicly traded.

The Pros and Cons of Market Consolidation

Such imbalance in the Nasdaq 100 has both benefits and downsides.

The success of the biggest contingents can pull up the entire index, and the Nasdaq 100 has consistently outperformed broader markets. In fact, $10,000 invested in the Nasdaq 100 in 2013 would be worth $50,000 today, while the same investment in the S&P 500 would now be $30,000.

However, if even one of these large companies underperforms, it can have a major impact on the entire index. This outsized influence can also hide general market woes that may be affecting many other components of the index, and the economy.

With the advent of large language models of AI in 2022, the tech sector is on a precipice. Will AI lead to further profitability—and bigger market caps—or will it render entire companies defunct, leading to a big shakeup in the composition of the Nasdaq 100 index?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

apps

How Long it Took for Popular Apps to Reach 100 Million Users

Threads reached 100 million users in just five days. Here is a timeline of how long other popular platforms took to reach the milestone.

How Long it Took for Popular Apps to Reach 100 Million Users

Of Twitter’s many new rivals, Meta’s newest social media platform Threads has established its presence with a bang.

According to Meta founder Mark Zuckerberg, Threads took only 5 days to reach the key threshold of 100 million users. It achieved this milestone through organic demand—and no paid promotions required—smashing all previous records.

But how long have other popular platforms—TikTok, Instagram, and YouTube to name a few—taken to build their user base? Pulling data from PwC and Yahoo, we rank how long it took popular platforms to get to 100 million users.

Ranking Every Apps Journey to 100 Million Users

In first place, Threads has a significant lead over the rest of the pack with its five day achievement, and may have built a significant moat in holding on to this record.

Firstly, its launch coincided with Twitter’s viewing limit decision, and rode the wave of dissatisfaction aimed at Twitter’s current owner, Elon Musk.

Secondly, new users on Threads need an Instagram account to register, thus eliminating sign-up barriers and leveraging Instagram’s 1.2 billion-strong user base.

Here’s the journey length of popular platforms to attaining 100 million users:

| Rank | Platform | Launch | Time to 100M Users |

|---|---|---|---|

| 1 | Threads | 2023 | 5 days |

| 2 | ChatGPT | 2022 | 2 months |

| 3 | TikTok | 2017 | 9 months |

| 4 | 2011 | 1 year, 2 months | |

| 5 | 2010 | 2 years, 6 months | |

| 6 | Myspace | 2003 | 3 years |

| 7 | 2009 | 3 years, 6 months | |

| 8 | Snapchat | 2011 | 3 years, 8 months |

| 9 | YouTube | 2005 | 4 years, 1 month |

| 10 | 2004 | 4 years, 6 months | |

| 11 | Spotify | 2006 | 4 years, 7 months |

| 12 | Telegram | 2013 | 5 years, 1 month |

| 13 | 2006 | 5 years, 5 months | |

| 14 | Uber | 2011 | 5 years, 10 months |

| 15 | 2010 | 5 years, 11 months | |

| 16 | Google Translate | 2006 | 6 years, 6 months |

| 17 | World Wide Web | 1991 | 7 years |

| 18 | 2003 | 7 years, 11 months |

Ranked second, Open AI’s ChatGPT launched in November 2022 and hit 100 million users by the start of the new year. ChatGPT introduced the incredible capabilities of large language models to the masses, prompting a rush of sign-ups, and reviving old conversations around the potential consequences of AI.

Coming in at third place, ByteDance’s TikTok took just 9 months to reach 100 million users after its launch in 2017. Like Threads, TikTok benefited from another app, accessing popular lip syncing app Musical.ly’s existing user base after it was acquired and folded into TikTok.

WeChat and Instagram round out the top-five, also with interesting advantages. WeChat, an instant messaging platform similar to WhatsApp, benefited from its unique access to China’s notoriously closed internet market of 500 million users in 2012.

Meanwhile, Meta acquired Instagram when the photo-sharing platform had 30 million users, and more than tripled that number past 100 million in just one year.

And while Facebook ranks solidly middle-of-the-pack for fastest to 100 million users, it remains the platform with the most monthly active accounts, at nearly 3 billion. In fact, Meta’s lessons learned from Facebook have been well-leveraged, and the company owns 4 of the fastest apps to register 100 million users.

So What Does Threads Success Mean for Twitter?

Coming back to Threads’ incredible feat, however, it’s still early days whether an en-masse switch from Twitter is on the cards for Meta’s newest platform.

For one, Threads has faced significant criticism due to its intensive data collection practices and lack of accessibility features. It also is missing some key features from its rival, including trending topics, hashtags, and direct messages.

Meanwhile Elon Musk has been less than pleased with Threads’ success, deeming it a copy of Twitter and even threatening legal action.

Competition is fine, cheating is not

— Elon Musk (@elonmusk) July 6, 2023

So where does this leave the increasingly-crowded social media space? The next decade will set the stage for either more platform consolidation, or even further audience fragmentation.

-

Energy3 weeks ago

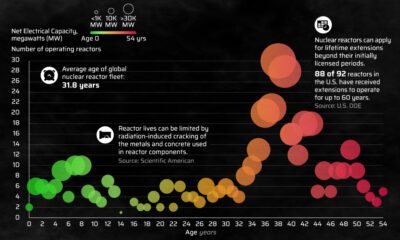

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

Countries7 days ago

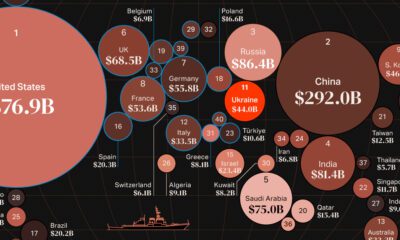

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets

-

Markets3 weeks ago

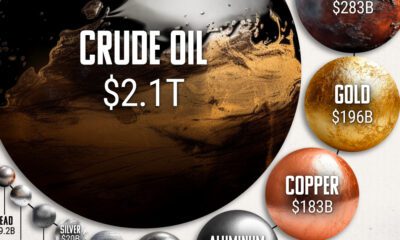

Markets3 weeks agoHow Big is the Market for Crude Oil?

-

Maps6 days ago

Maps6 days agoMapped: The Safest Cities in the U.S.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Profitable U.S. Companies, by Sector

-

apps5 days ago

apps5 days agoHow Long it Took for Popular Apps to Reach 100 Million Users

-

Markets4 weeks ago

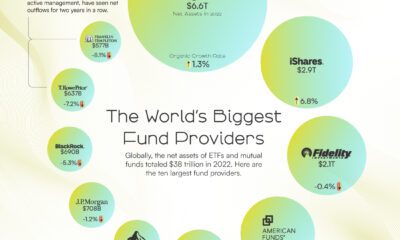

Markets4 weeks agoThe World’s Biggest Mutual Fund and ETF Providers

-

Business2 weeks ago

Business2 weeks agoBrand Reputations: Ranking the Best and Worst in 2023