Datastream

Ranked: The World’s Least Affordable Cities to Buy a Home

The Briefing

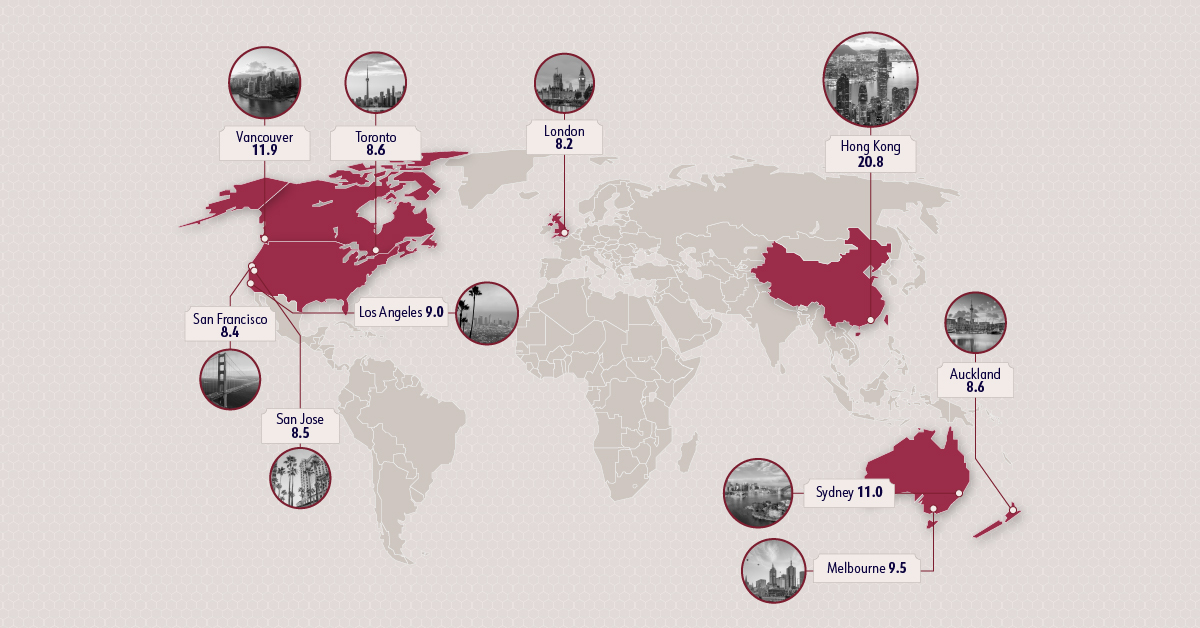

- For the 10th year in a row, Hong Kong is the world’s least affordable housing market

- The U.S. is home to a mixture of the most and least affordable housing markets

Ranked: The World’s Least Affordable Cities to Buy a Home

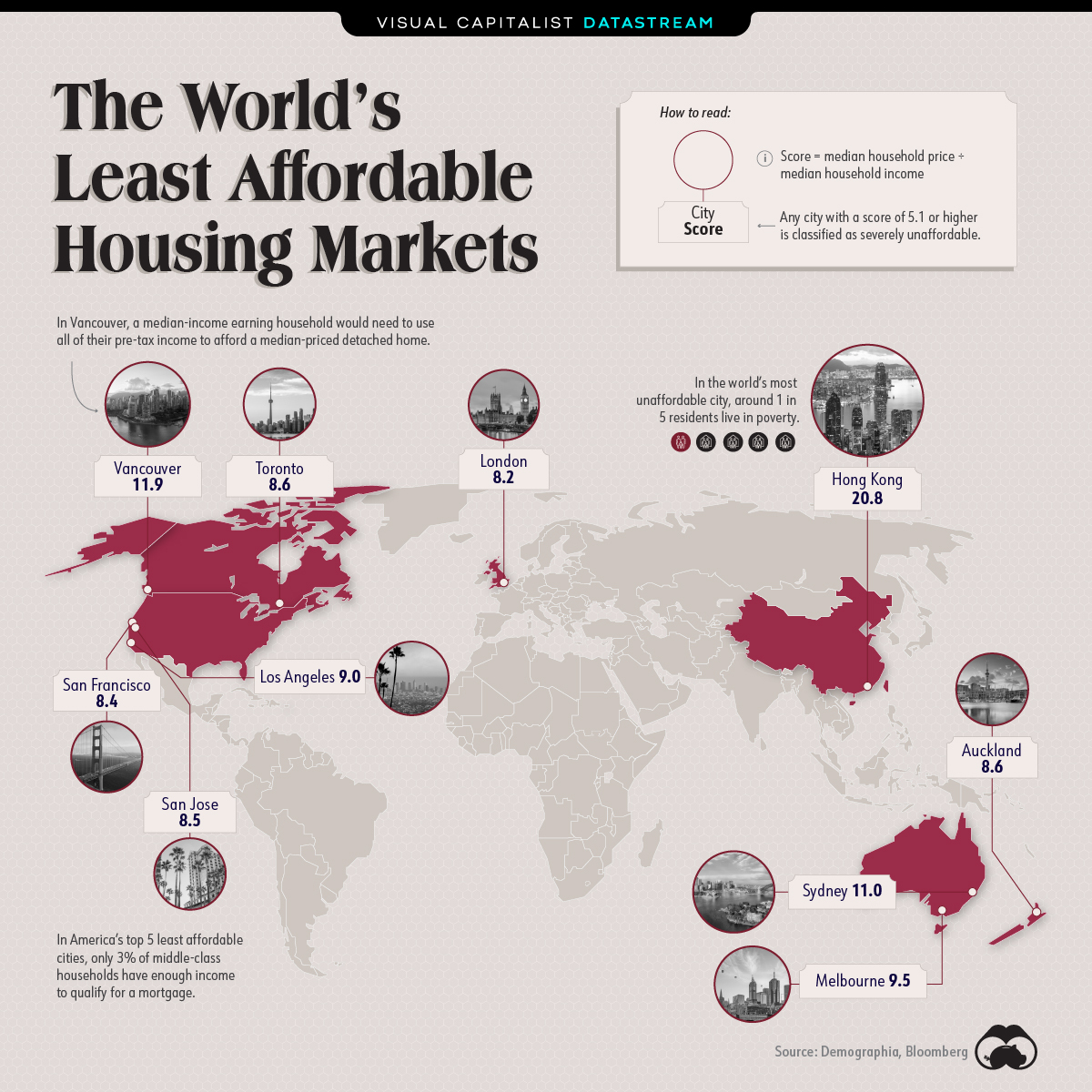

In certain parts of the world, housing prices have risen much faster than household incomes, making home ownership increasingly more difficult for the average Joe.

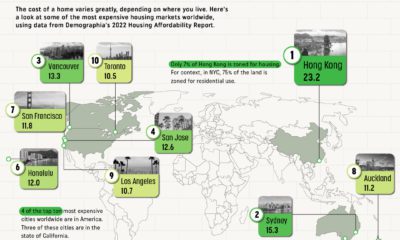

Using data from Demographia published in 2020, this graphic looks at some of the world’s most expensive housing markets.

The Least Affordable Housing Markets

It’s worth noting that this data looks at housing affordability specifically for middle-income earners. While it’s far from globally exhaustive, it measures affordability in 309 major metropolitan areas across Australia, Canada, Hong Kong, Ireland, New Zealand, Singapore, the U.S., and the UK.

In this study, a city’s affordability is calculated by taking its median housing price and dividing it by the median household income.

- Moderately Unaffordable: 3.1 to 4.0

- Seriously Unaffordable: 4.1 to 5.0

- Severely Unaffordable: 5.1+

All the cities on this graphic classify as severely unaffordable. Perhaps unsurprisingly, Hong Kong is the most unaffordable housing market—scoring 20.8 to take the top spot.

| Housing Market | Country | Score |

|---|---|---|

| Hong Kong | 🇨🇳 China (SAR) | 20.8 |

| Vancouver, BC | 🇨🇦 Canada | 11.9 |

| Sydney, NSW | 🇦🇺 Australia | 11.0 |

| Melbourne, VIC | 🇦🇺 Australia | 9.5 |

| Los Angeles, CA | 🇺🇸 United States | 9.0 |

| Auckland | 🇳🇿 New Zealand | 8.6 |

| Toronto, ON | 🇨🇦 Canada | 8.6 |

| San Jose, CA | 🇺🇸 United States | 8.5 |

| San Francisco, CA | 🇺🇸 United States | 8.4 |

| London (Greater London Authority) | 🇬🇧 United Kingdom | 8.2 |

| Honolulu, HI | 🇺🇸 United States | 8.0 |

| San Diego, CA | 🇺🇸 United States | 7.3 |

| Adelaide, SA | 🇦🇺 Australia | 6.9 |

| Bournemouth & Dorset | 🇬🇧 United Kingdom | 6.9 |

Home to 7.5 million people, Hong Kong has ranked as the world’s least affordable city for 10 consecutive years. Because of its steep housing prices, nano apartments have risen in popularity over the last decade.

The Most Affordable Housing Markets

Three of the most expensive housing markets are in America, but at the same time, the country also contains some of the most affordable markets in the eight-country study, too.

In fact, the top 10 most affordable cities are all in America:

| City | Country | Score |

|---|---|---|

| Rochester, NY | 🇺🇸 United States | 2.5 |

| Cleveland, OH | 🇺🇸 United States | 2.7 |

| Oklahoma City, OK | 🇺🇸 United States | 2.7 |

| Buffalo, NY | 🇺🇸 United States | 2.8 |

| Cincinnati, OH-KY-IN | 🇺🇸 United States | 2.8 |

| Pittsburgh, PA | 🇺🇸 United States | 2.8 |

| St. Louis, MO-IL | 🇺🇸 United States | 2.8 |

| Hartford, CT | 🇺🇸 United States | 2.9 |

| Indianapolis. IN | 🇺🇸 United States | 2.9 |

| Tulsa, OK | 🇺🇸 United States | 3.0 |

Keep in mind, these figures are from Q3’2019. Considering the pandemic-induced suburban shuffle that’s been going on in some of America’s major housing markets, this list could look a bit different in Demographia’s next report.

>>Like this? Then you might like this article on The 10 Most Expensive Cities in the World

Where does this data come from?

Source: Demographia

Details: Affordability score is calculated by taking a city’s median housing price and dividing it by the median household income. Anything over 5.1 is considered severely unaffordable

Notes: Data includes 309 metropolitan markets across eight countries, including Australia, Canada, the U.K., and the U.S., as of the third quarter of 2019

UK Only

Charting the Rise of Cross-Border Money Transfers (2015-2023)

With over 280 million immigrants transferring billions of dollars annually, the remittance industry has become more valuable than ever.

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $447B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

United States3 weeks ago

United States3 weeks agoVisualized: The 100 Largest U.S. Banks by Consolidated Assets

-

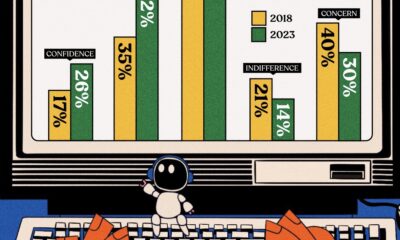

Automation1 week ago

Automation1 week agoCharted: Changing Sentiments Towards AI in the Workplace

-

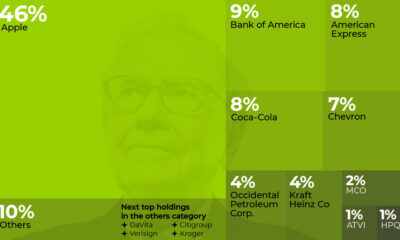

VC+3 weeks ago

VC+3 weeks agoWhat are Top Investment Managers Holding in Their Portfolios?

-

Markets1 week ago

Markets1 week agoThe 50 Best One-Year Returns on the S&P 500 (1980-2022)

-

United States3 weeks ago

United States3 weeks agoChart: U.S. Home Price Growth Over 50 Years

-

United States1 week ago

United States1 week agoMapped: The Most Dangerous Cities in the U.S.

-

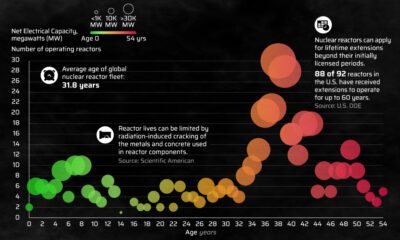

Energy3 weeks ago

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

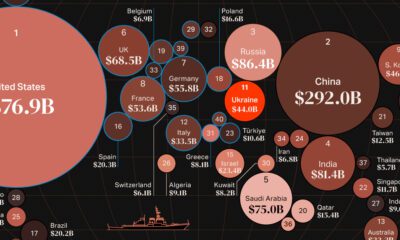

Countries7 days ago

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets