Stocks

What are Top Investment Managers Holding in Their Portfolios?

The following is an complimentary excerpt from our Markets This Month dispatch from our premium newsletter called VC+. For more like this, get a VC+ annual membership for 25% off.

Analyzing the Funds of Five “Super Investors”

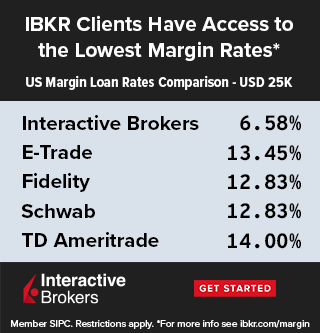

With the market usually taking a breather during the summer, it’s a great opportunity to analyze how top funds positioned their portfolios at the end of Q1 2023.

We selected five funds of various sizes, each one with a renowned investor at its helm that often has a unique outlook on the market and strategy towards building out their portfolio.

The differences in portfolio compositions underline the variety of investment strategies, showing how some of the top investors approach portfolio construction.

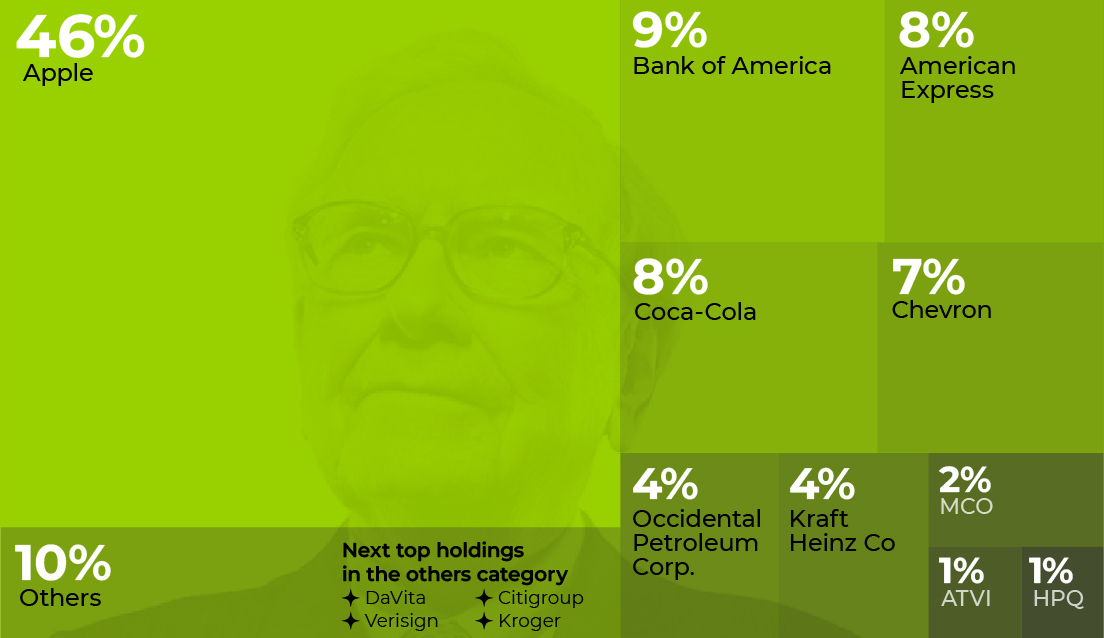

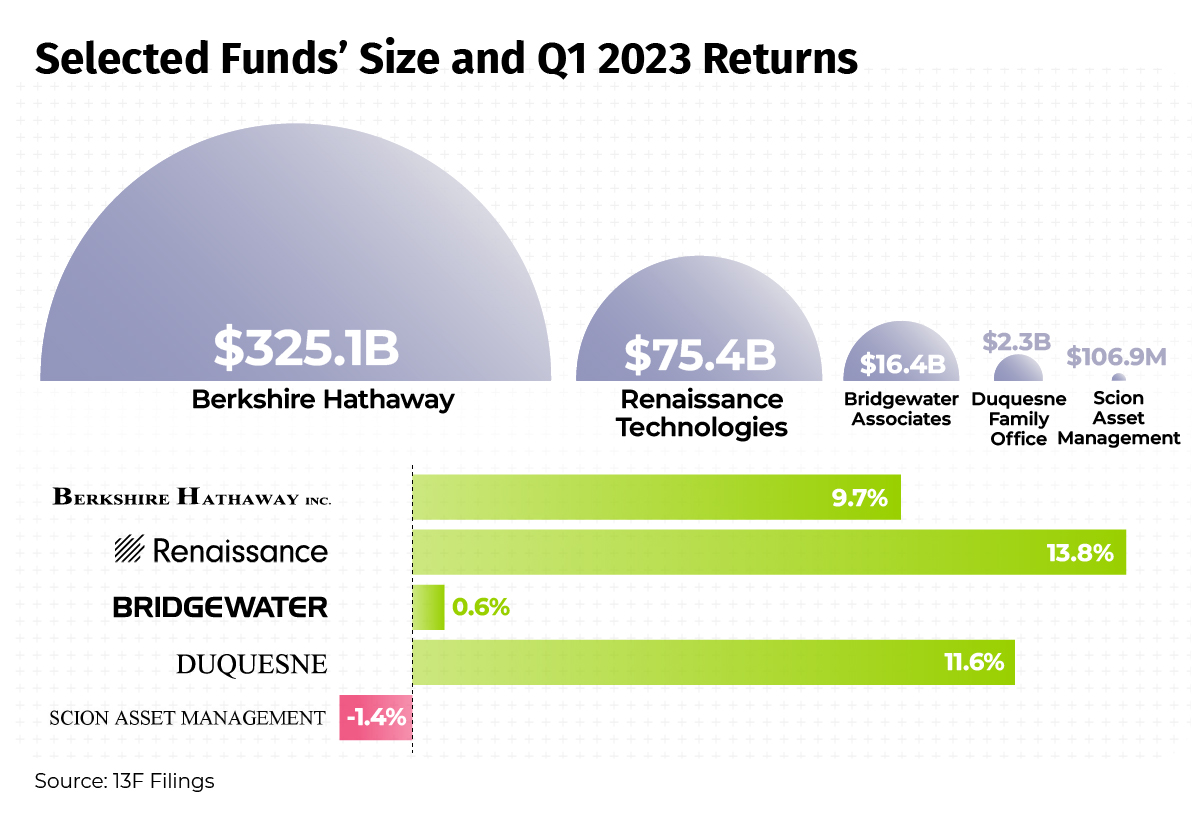

Berkshire Hathaway has one of the world’s best known and most successful portfolios, which has significantly outperformed the S&P 500 over the long term.

While the S&P 500 has returned 195% since 2013, Warren Buffett and Charlie Munger’s fund grew by 260% over the same time period.

Although Buffett is known for preaching diversification, almost half of Berkshire’s portfolio is all in the market’s most valuable company, Apple. The rest of the portfolio is fairly diversified with a mix of bank stocks, consumer staples like Coca-Cola and Kraft, along with oil and gas companies.

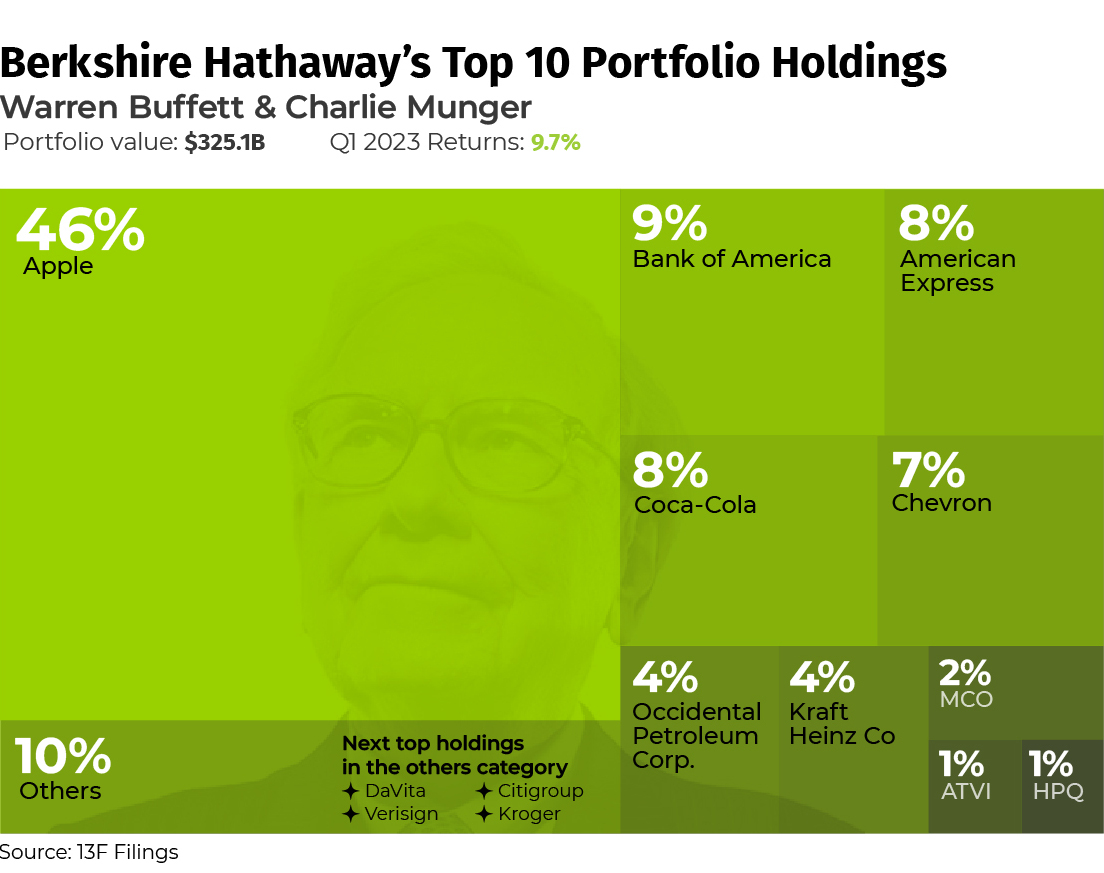

Jim Simons’ hedge fund, Renaissance Technologies, is best known for its groundbreaking use of complex mathematical models and algorithms which pioneered the practice of quantitative investing.

As a result, the hedge fund’s portfolio holdings showcase astounding diversification, with the fund’s largest holding being a 2% allocation to pharmaceutical giant Novo Nordisk.

The portfolio is split across more than 3,900 different positions, showcasing the fund’s strategy of squeezing out returns from a diverse collection of investments through its algorithm-driven, statistical arbitrage approach.

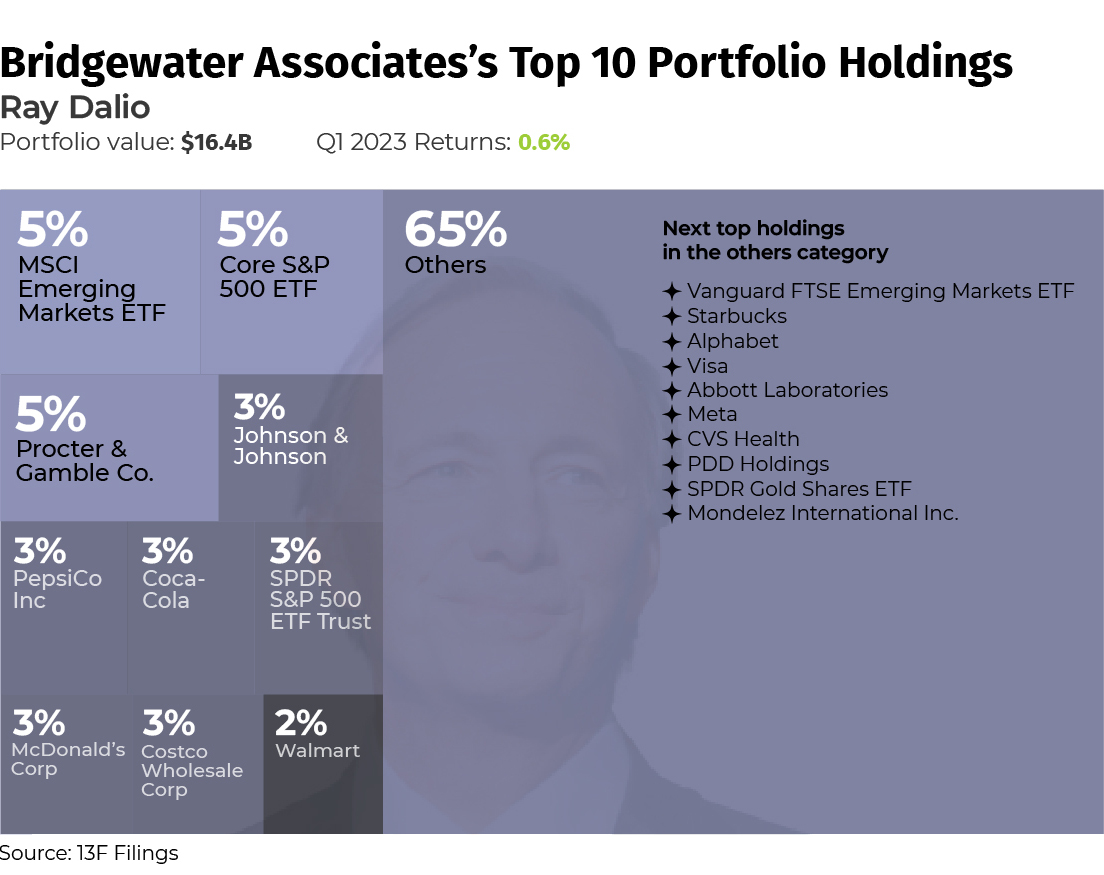

Ray Dalio’s Bridgewater Associates was one of the few hedge funds to predict and successfully navigate the 2008 financial crisis, largely thanks to its “all weather” strategy which looks to perform well in all economic environments through diversification and a risk-parity approach to asset allocation.

As a result, you see many parallels and “counterweights” in the fund’s holdings. Its largest holding of MSCI’s Emerging Markets ETF is balanced out by the Core S&P 500 ETF.

Bridgewater is also one of the few funds which holds shares in a gold ETF. While other funds we’ve looked at have investments in gold royalty companies or miners, which likely have strong balance sheets and businesses to support the investment, Dalio’s fund has preferred to invest directly in the precious metal.

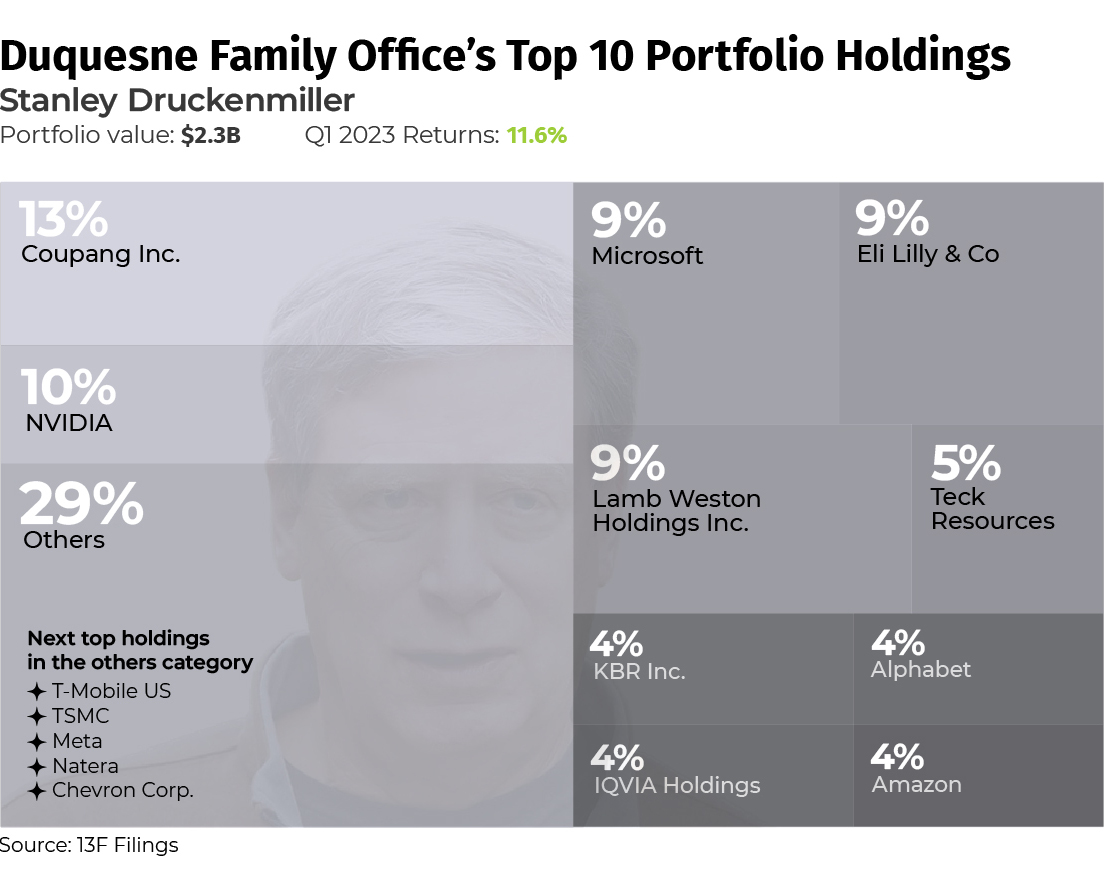

Stanley Druckenmiller is best known as having been a key strategist for George Soros’s Quantum Fund, along with his own consistent record of returns with Duquesne which average 30% annually.

Known for his macroeconomic approach to investing, Druckenmiller isn’t afraid to make unique and concentrated bets when he has high conviction.

Currently his highest conviction bet and largest holding in his portfolio is Coupang Inc., which is South Korea’s largest online marketplace. Along with Coupang, Druckenmiller positioned his fund to take advantage of this year’s AI boom, with significant holdings in companies like NVIDIA, Microsoft, and Alphabet.

The smallest of all five funds we looked at, Michael Burry’s Scion Asset Management might be one of the best known for its role in predicting the 2008 financial crisis early on.

The protagonist of the film, The Big Short, Michael Burry is best known for his aggressive short bets and overall value investing approach especially in distressed assets.

Scion Asset Management’s portfolio reflects this as a good portion of its holdings at the end of Q1 this year were in various bank stocks which had declined significantly throughout the month of March.

Burry’s biggest bets however are in Chinese ecommerce companies JD.com and Alibaba, indicating Burry’s belief in a consumer driven economic reopening for China this year.

|

Markets This Month by VC+

We hope you enjoyed this excerpt by Niccolo Conte from Markets This Month, which hits VC+ subscribers’ inboxes every month. Get 25% off an annual subscription to VC+ by clicking here. |

Markets

The 50 Best One-Year Returns on the S&P 500 (1980-2022)

The highest one-year return among the top S&P 500 stocks from 1980 to 2022 was a staggering 2,620%. Which stocks top the ranks?

The Top S&P 500 Stocks by Annual Returns

The average annual return of the S&P 500 was 10% from 1980-2022, excluding dividends. Of course, there are some companies that deliver much higher returns in any given year.

In this graphic using data from S&P Dow Jones Indices, we explore the top S&P 500 stocks with the best single year returns over the last four decades.

Ranking the Top S&P 500 Stocks

In order to find the top gainers, S&P took the top 10 best-performing stocks each year and then narrowed that list down to the top 50 overall. They ranked the top S&P 500 stocks by price returns, meaning that no dividends or stock distributions were included.

The best gains were clustered in a few select years, including the 1999 dot-com boom, the 2003 stock market rally, and the 2009 recovery from the Global Financial Crisis. None of the biggest gains happened in 2021 or 2022.

| Rank | Company | Sector | Return | Year |

|---|---|---|---|---|

| 1 | Qualcomm | Information Technology | 2620% | 1999 |

| 2 | Tesla | Consumer Discretionary | 743% | 2020 |

| 3 | DSC Communications | Communication Services | 468% | 1992 |

| 4 | Coleco Industries | Consumer Discretionary | 435% | 1982 |

| 5 | Avaya | Information Technology | 428% | 2003 |

| 6 | Chrysler | Consumer Discretionary | 426% | 1982 |

| 7 | XL Capital (Axa XL) | Financials | 395% | 2009 |

| 8 | Tenet Healthcare | Healthcare | 369% | 2009 |

| 9 | Dynegy | Utilities | 361% | 2000 |

| 10 | Advanced Micro Devices | Information Technology | 348% | 2009 |

| 11 | Sprint | Communication Services | 343% | 1999 |

| 12 | Ford | Consumer Discretionary | 337% | 2009 |

| 13 | NEXTEL Communications | Communication Services | 336% | 1999 |

| 14 | LSI Logic | Information Technology | 319% | 1999 |

| 15 | NVIDIA | Information Technology | 308% | 2001 |

| 16 | Nortel Networks | Communication Services | 304% | 1999 |

| 17 | Etsy | Consumer Discretionary | 302% | 2020 |

| 18 | Genworth Financial | Financials | 301% | 2009 |

| 19 | Micron Technology | Information Technology | 300% | 2009 |

| 20 | NetFlix | Communication Services | 298% | 2013 |

| 21 | Oracle | Information Technology | 290% | 1999 |

| 22 | Western Digital | Information Technology | 286% | 2009 |

| 23 | Network Appliance (NetApp) | Information Technology | 270% | 1999 |

| 24 | Data General | Information Technology | 267% | 1991 |

| 25 | Yahoo | Communication Services | 265% | 1999 |

| 26 | Williams Companies | Energy | 264% | 2003 |

| 27 | Novell | Information Technology | 264% | 1991 |

| 28 | Dynegy | Utilities | 263% | 2003 |

| 29 | Sun Microsystems | Information Technology | 262% | 1999 |

| 30 | PMC-Sierra | Information Technology | 262% | 2003 |

| 31 | Advanced Micro Devices | Information Technology | 259% | 1991 |

| 32 | Dell | Information Technology | 248% | 1998 |

| 33 | Global Marine | Energy | 247% | 1980 |

| 34 | Micron Technology | Information Technology | 243% | 2013 |

| 35 | Best Buy | Consumer Discretionary | 237% | 2013 |

| 36 | Reebok | Consumer Discretionary | 234% | 2000 |

| 37 | Freeport-McMoRan | Materials | 229% | 2009 |

| 38 | Biomet (Zimmer Biomet) | Healthcare | 226% | 1991 |

| 39 | NVIDIA | Information Technology | 224% | 2016 |

| 40 | Gap | Consumer Discretionary | 223% | 1991 |

| 41 | NetFlix | Communication Services | 219% | 2010 |

| 42 | Fleetwood Enterprises (Fleetwood RV) | Consumer Discretionary | 217% | 1982 |

| 43 | National Semiconductor | Information Technology | 217% | 1999 |

| 44 | Dell | Information Technology | 216% | 1997 |

| 45 | Tandy Corp (RadioShack) | Information Technology | 216% | 1980 |

| 46 | Novell | Information Technology | 215% | 2003 |

| 47 | Corning | Information Technology | 215% | 2003 |

| 48 | CB Richard Ellis (CBRE) | Real Estate | 214% | 2009 |

| 49 | AES Corp | Utilities | 213% | 2003 |

| 50 | Expedia | Consumer Discretionary | 212% | 2009 |

Qualcomm was by far the top-performer in any one calendar year window. The company had key patents for Code Division Multiple Access (CDMA) technology, which enabled fast wireless internet access and became the basis for 3G networks.

Its stock took off in 1999 as it shed less profitable business lines, resolved a patent dispute with competitor Ericsson, and joined the S&P 500 Index. At the time, CNN reported that one lucky investor who heard about Qualcomm from an investment-banker-turned-rabbi earned $17 million—roughly $30 million in today’s dollars.

The most recent stocks to make the rankings were both from 2020: well-known Tesla (#2) and lesser-known online marketplace Etsy (#17), which saw sales from independent creators surge during the early COVID-19 pandemic. The dollar value of items sold on Etsy more than doubled from $5.3 billion in 2019 to $10.3 billion in 2020, with mask sales accounting for 7% of the total.

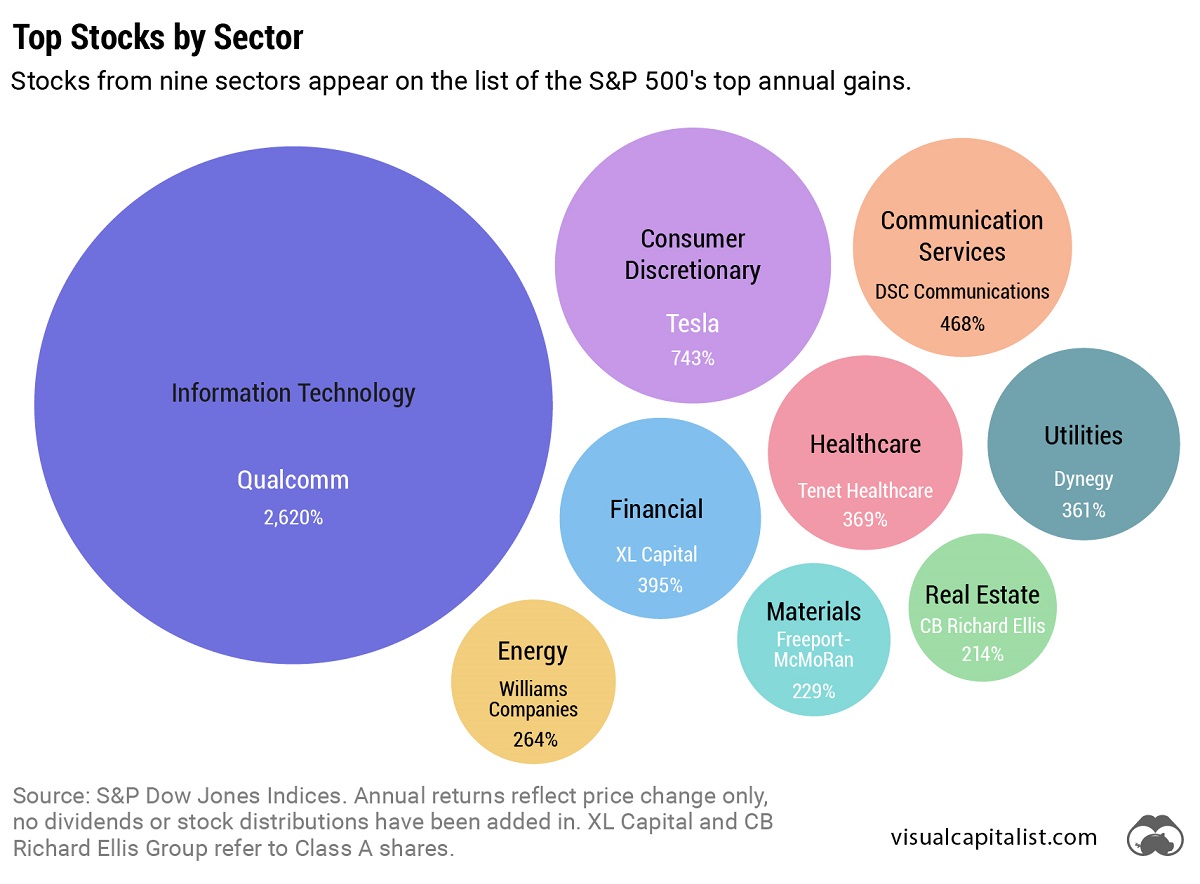

Biggest Gainers in Each Sector

While information technology stocks made up nearly half of the list, there is representation from nine of the 11 S&P 500 sectors. No companies from the Industrials or Consumer Staples sectors made it into the ranks of the top S&P 500 stocks by annual returns.

Below, we show the stock with the best annual return for each sector.

Tesla was the top-performing Consumer Discretionary stock on the list. After meeting the requirement of four consecutive quarters of positive earnings, it joined the S&P 500 Index on December 21, 2020. The company’s performance was boosted by the announcement that it would be included in the S&P 500, along with strong performance in China, and general EV buzz as environmental regulations tightened worldwide.

In the realm of Communication Services, DSC Communications saw a sizable return in 1992. The telecommunications equipment company had contracts with major companies such as Bell and Motorola. Alcatel-Lucent (then Alcatel), a French producer of mobile phones, purchased DSC Communications in 1998.

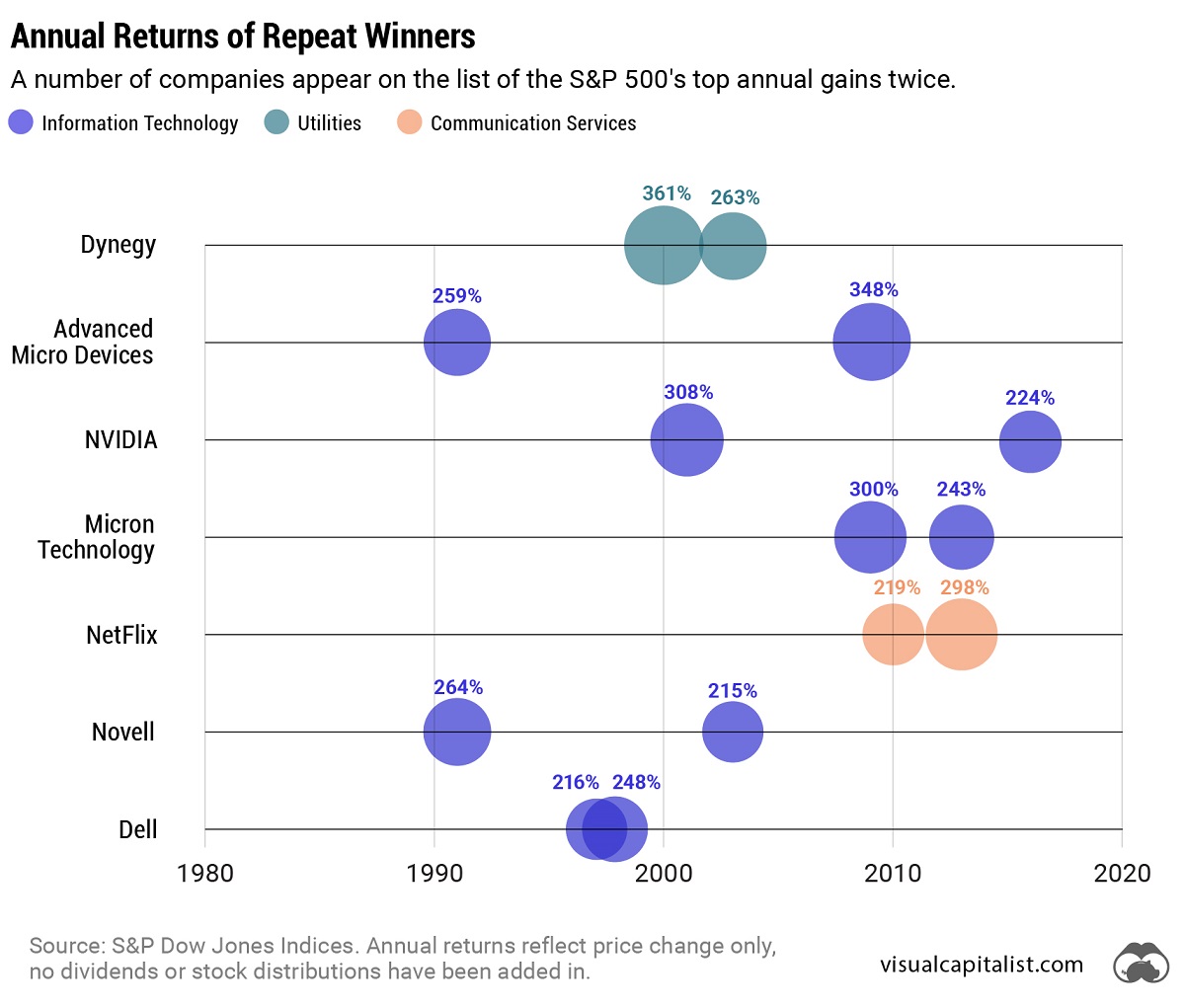

Serial Success Stories

It’s impressive to make the list of the top S&P 500 stocks by calendar returns once, but there are seven companies that have done it twice.

Some stocks saw their repeated outperformance close together, with Dell making the ranks back-to-back in 1997 and 1998.

On the other hand, a select few have more staying power. Computing giant NVIDIA topped the charts in 2001 and triumphed again 15 years later in 2016. And this year might be another win, as the company has recently reached a $1 trillion market capitalization and has the highest year-to-date return in the S&P 500 as of July 6, 2023.

-

Brands2 weeks ago

Brands2 weeks agoBrand Reputations: Ranking the Best and Worst in 2023

-

Environment5 days ago

Environment5 days agoHotter Than Ever: 2023 Sets New Global Temperature Records

-

Markets4 weeks ago

Markets4 weeks agoThe World’s Biggest Mutual Fund and ETF Providers

-

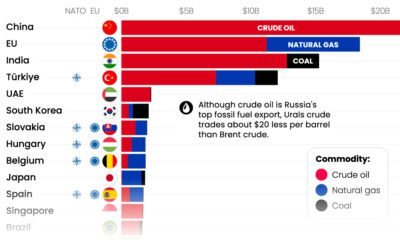

Energy2 weeks ago

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

VC+4 days ago

VC+4 days agoWhat’s New on VC+ in July

-

Datastream4 weeks ago

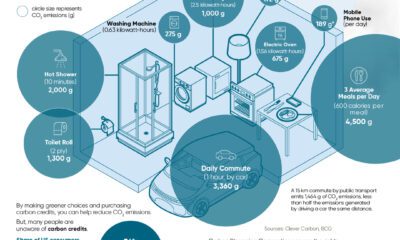

Datastream4 weeks agoCan You Calculate Your Daily Carbon Footprint?

-

apps2 weeks ago

apps2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

China13 hours ago

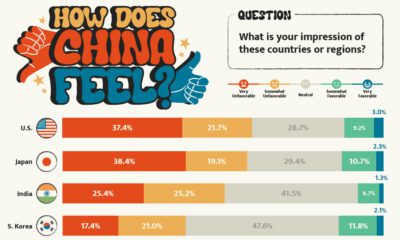

China13 hours agoHow Do Chinese Citizens Feel About Other Countries?