Datastream

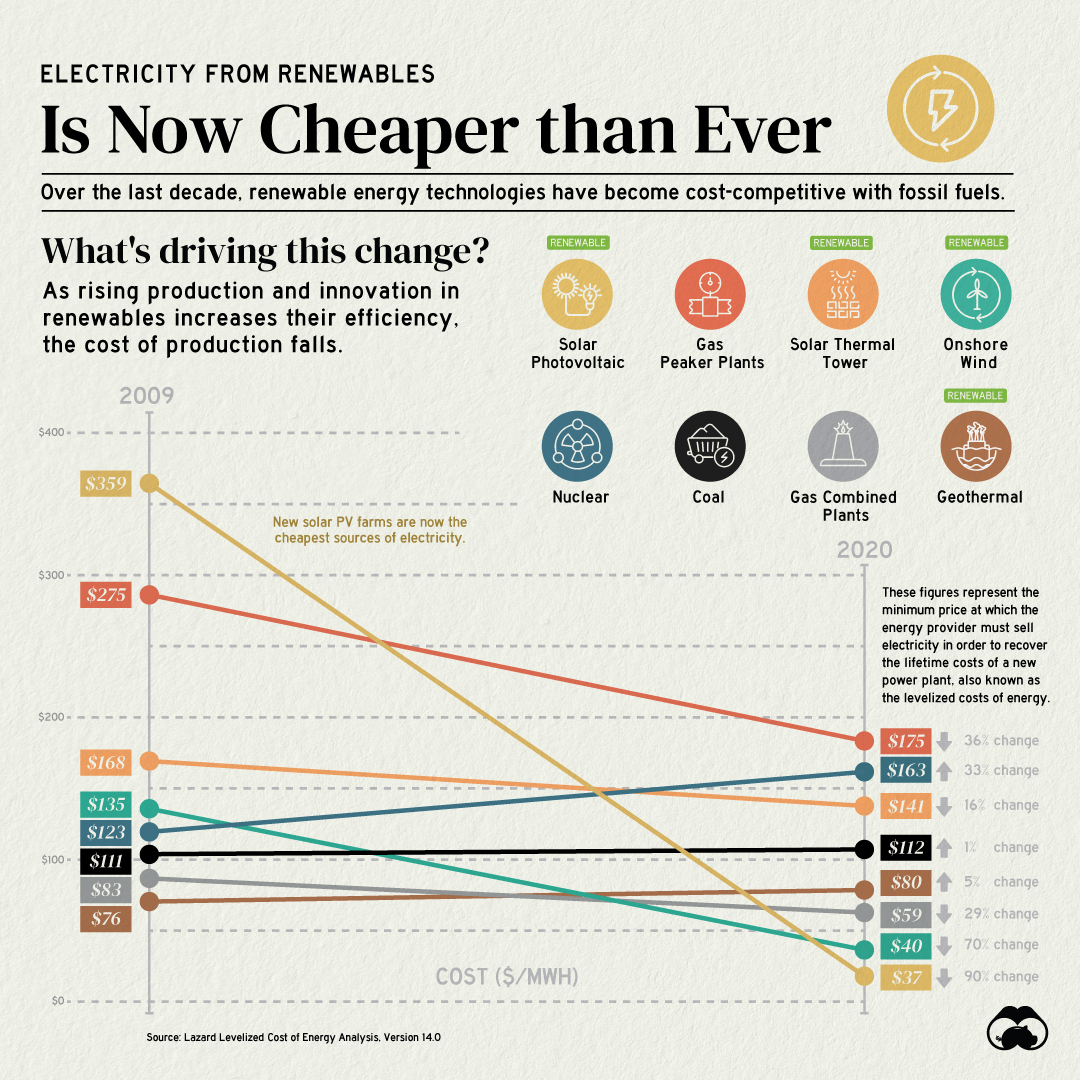

Electricity from Renewable Energy Sources is Now Cheaper than Ever

The Briefing

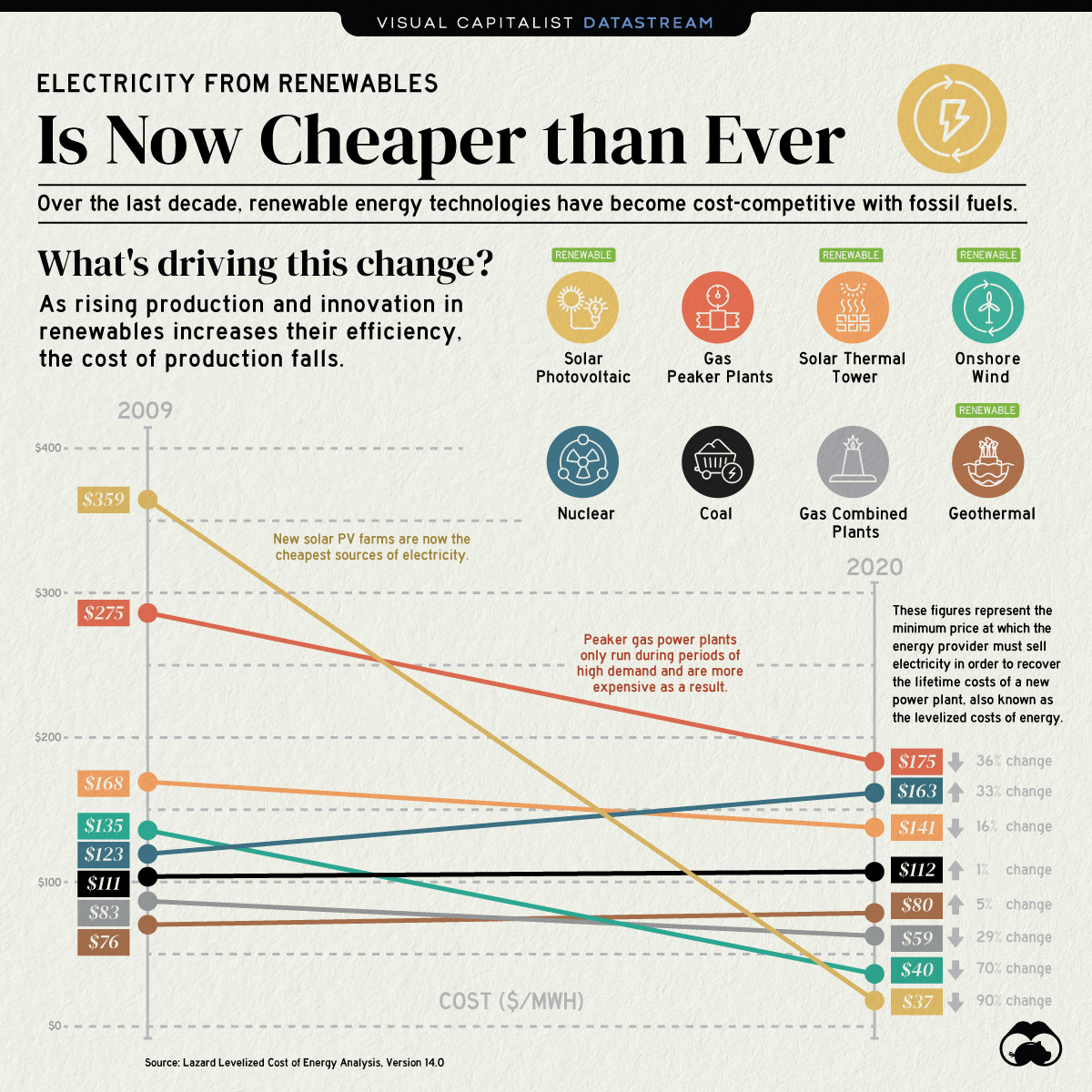

- Electricity from new solar photovoltaic (PV) plants and onshore wind farms is now cheaper than electricity from new coal-fired power plants

- The cost of electricity from solar PV plants has decreased by 90% since 2009

The Transition to Renewable Energy Sources

Renewable energy sources are at the center of the transition to a sustainable energy future and the fight against climate change.

Historically, renewables were expensive and lacked competitive pricing power relative to fossil fuels. However, this has changed notably over the last decade.

Renewables are the Cheapest Sources of New Electricity

Fossil fuel sources still account for the majority of global energy consumption, but renewables are not far off. The share of global electricity from renewables grew from 18% in 2009 to nearly 28% in 2020.

Renewable energy sources follow learning curves or Wright’s Law—they become cheaper by a constant percentage for every doubling of installed capacity. Therefore, the increasing adoption of clean energy has driven down the cost of electricity from new renewable power plants.

| Energy Source | Type | 2009 Cost ($/MWh) | 2020 Cost ($/MWh) | % Change in Cost |

|---|---|---|---|---|

| Solar Photovoltaic | Renewable | $359 | $37 | -90% |

| Onshore Wind | Renewable | $135 | $40 | -70% |

| Gas - Peaker Plants | Non-renewable | $275 | $175 | -36% |

| Gas - Combined Cycle Plants | Non-renewable | $83 | $59 | -29% |

| Solar thermal tower | Renewable | $168 | $141 | -16% |

| Coal | Non-renewable | $111 | $112 | +1% |

| Geothermal | Renewable | $76 | $80 | +5% |

| Nuclear | Non-renewable | $123 | $163 | +33% |

Solar PV and onshore wind power plants have seen the most notable cost decreases over the last decade. Furthermore, the price of electricity from gas-powered plants has declined mainly as a result of falling gas prices since their peak in 2008.

By contrast, the price of electricity from coal has stayed roughly the same with a 1% increase. Moreover, nuclear-powered electricity has become 33% more expensive due to increased regulations and the lack of new reactors.

When will Renewable Energy Sources Take Over?

Given the rate at which the cost of renewable energy is falling, it’s only a matter of time before renewables become the primary source of our electricity.

Several countries have committed to achieving net-zero carbon emissions by 2050, and as a result, renewable energy is projected to account for more than half of the world’s electricity generation by 2050.

Where does this data come from?

Source: Lazard Levelized Cost of Energy Analysis Version 14.0, Our World in Data

Details: Figures represent the mean levelized cost of energy per megawatt-hour. Lazard’s Levelized Cost of Energy report did not include data for hydropower. Therefore, hydropower is excluded from this article.

Datastream

Charting the Rise of Cross-Border Money Transfers (2015-2023)

With over 280 million immigrants transferring billions of dollars annually, the remittance industry has become more valuable than ever.

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $447B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

apps2 weeks ago

apps2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

Politics16 hours ago

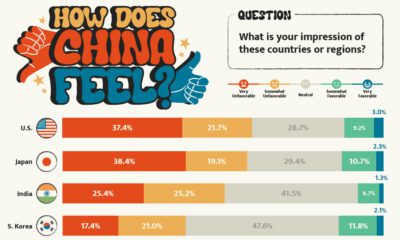

Politics16 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

Markets4 weeks ago

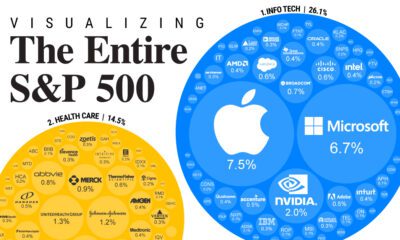

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index

-

Markets2 weeks ago

Markets2 weeks agoVisualizing 1 Billion Square Feet of Empty Office Space

-

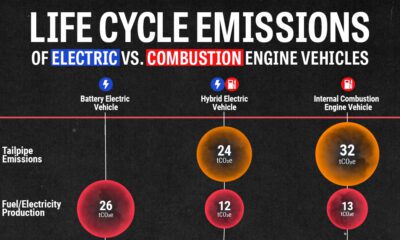

Environment4 weeks ago

Environment4 weeks agoLife Cycle Emissions: EVs vs. Combustion Engine Vehicles

-

Maps2 weeks ago

Maps2 weeks agoVintage Viz: The World’s Rivers and Lakes, Organized Neatly

-

Markets3 weeks ago

Markets3 weeks agoVisualized: The 100 Largest U.S. Banks by Consolidated Assets

-

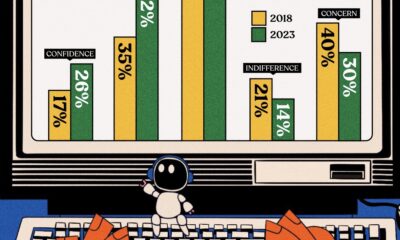

Automation1 week ago

Automation1 week agoCharted: Changing Sentiments Towards AI in the Workplace